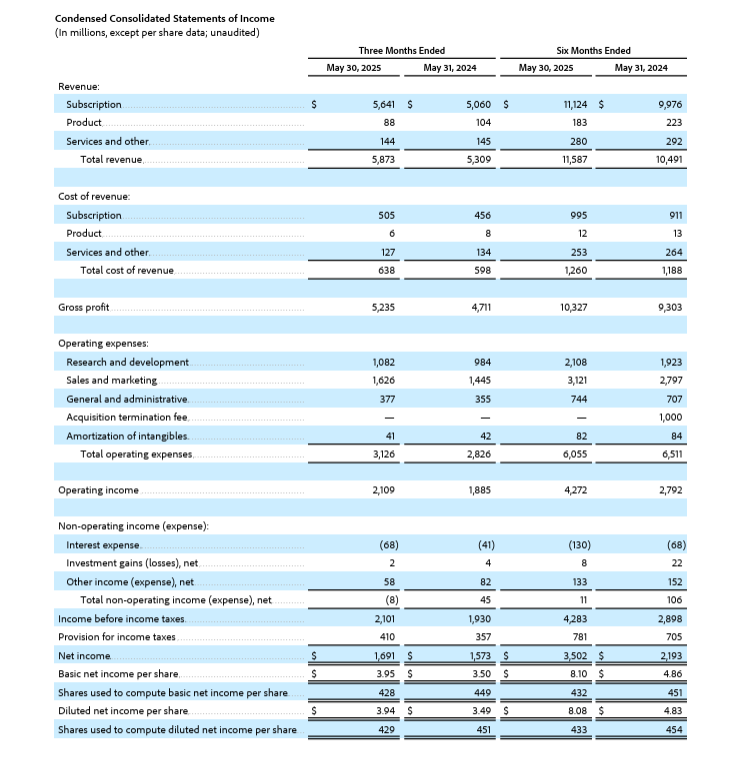

American computer software company Adobe has delivered a record-breaking Q2 FY25, reporting $5.87 billion in revenue, an 11% year-over-year increase, and an all-time high for a single quarter.

The San Jose, California-based company’s AI-driven innovation and strong customer engagement have fuelled this growth, prompting Adobe to raise its full-year revenue and EPS targets.

Digital Media led the charge, generating $4.35 billion, up 11% from last year.

Meanwhile, the Digital Experience segment contributed $1.46 billion, marking a 10% increase.

Adobe’s Annualised Recurring Revenue (ARR) for Digital Media hit $18.09 billion, reflecting 12.1% growth.

Adobe’s subscription revenue surged across all customer groups.

The Business Professionals and Consumers Group saw 15% growth, reaching $1.60 billion, while the Creative Marketing Professionals Group climbed 10% to $4.02 billion.

With an adjusted EPS of $5.06, the company beat expectations of $4.97.

These gains underscore Adobe’s expanding influence in both the professional and creative markets.

Looking ahead, Adobe has raised its FY25 revenue target to $23.50 billion–$23.60 billion. This is with GAAP EPS projected at $16.30–$16.50 and non-GAAP EPS projected at $20.50–$20.70.

The company’s Q3 revenue target is $5.875 billion–$5.925 billion.

Adobe remains bullish on its AI-powered strategy, but acknowledges risks and uncertainties tied to future performance.

Investors will watch closely as Adobe continues its aggressive push for AI-driven growth.

“Our strategy to deliver ground-breaking innovation for Business Professionals and Consumers, and Creative and Marketing Professionals is delighting customers and we are pleased to raise Adobe’s FY25 revenue target,” said Shantanu Narayen, chair and CEO, Adobe.

“Adobe’s AI innovation is transforming industries, enabling individuals and enterprises to achieve unprecedented levels of creativity.”

“As a result of us driving strong performance in the first half of the year, we are pleased to raise Adobe’s FY25 total revenue and EPS targets,” said Dan Durn, executive vice president and CFO, Adobe.

“We continue to invest in AI innovation across our customer groups to enhance value realisation and expand the universe of customers we serve.”

Adobe Inc (NASDAQ: ADBE) shares were at $410.91, down $2.77 (0.67%) in after-hours trading, after closing at $413.68. Its market cap is around $176.31 billion.

*All financials are in US dollars.

Related content