Adobe reported strong revenue growth last quarter, as it invests in artificial intelligence and expands access to its products.

The company saw its total revenue reach a new record of US$5.71 billion, surpassing LSEG estimates of $5.66 billion, and rising from $5.18 billion year-over-year.

“Adobe’s success over the next decade will be driven by customer-focused innovation and new offerings for creators, marketing professionals, business professionals and consumers,” said Adobe CEO Shantanu Narayen.

“Adobe is well-positioned to capitalise on the acceleration of the creative economy driven by AI and we are reaffirming our FY2025 financial targets.”

Non-GAAP diluted earnings per share were US$5.08, above both estimates of $4.97 and Q1 2024’s $4.48.

Its operating cash flow also posted a new record high of US$2.48 billion. Operating income was $2.16 billion, up from the previous year’s $907 million.

Revenue for its Digital Media division, the company’s largest, grew to US$4.23 billion, compared with Q1 2024’s $3.82 billion.

The company’s Digital Experience division saw revenue rise to US$1.41 billion, up from $1.29 billion year-over-year. Revenue at its Publishing and Advertising division fell slightly to $70 million, compared with Q1 2024’s $80 million.

Its guidance includes revenue of US$5.77-5.82 billion in the next quarter, in line with estimates, and projects revenue of $23.3-23.55 billion across 2025.

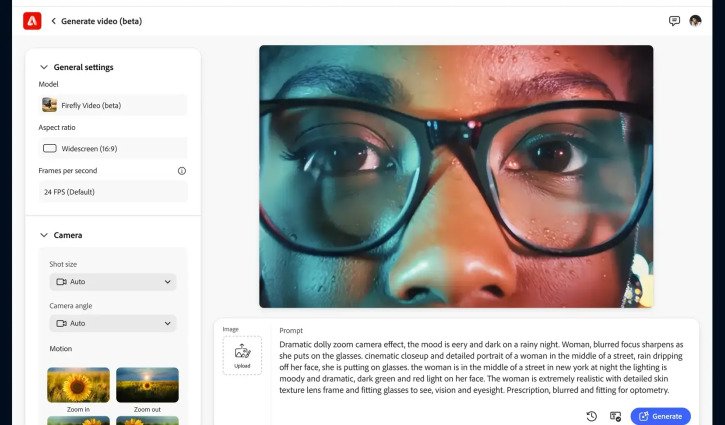

Adobe launched its Firefly Video artificial intelligence model last month, which can generate videos within the Firefly AI suite app. Firefly Video is “the only generative AI model that is IP-friendly and commercially safe,” according to the company.

It said today that it will partner with The Estée Lauder Companies, parent of brands like Estée Lauder, Clinique, and MAC, to integrate Firefly’s AI capabilities into their marketing campaigns.

The company also released a free Photoshop app for Apple devices in February. Adobe plans to bring the app to Android devices later this year.

Adobe’s (NASDAQ: ADBE) share price closed at US$438.60, up from its previous close at $433.66. However, shares fell by 4% in after-hours trading. The company’s market capitalisation is $190.75 billion.