There's a scene in every modern war film where the general asks: "What's our air superiority?" The answer used to involve fighter jets and missile systems - now it involves a US$200 drone bought on Alibaba carrying explosives into a fuel depot. Not kidding.

Australian defense-tech outfit DroneShield (ASX: DRO) has spent the last decade preparing for this moment, and investors have been paying attention.

The firm now has its AI-driven hardware in service across 70 countries, completing a transformation from garage startup to scaled defence contractor in 18 months.

Catalysts converge

DroneShield actually topped the ASX 200 in September with a 41% gain.

The Sydney-based counter-UAS manufacturer closed at A$5.68 on October 3, marking a 440% gain year-to-date and pushing market capitalisation to ~A$5 billion.

H1 revenue hit A$72.3 million, up 210% year-over-year, while second-quarter sales reached A$38.8 million - a whopping 480% jump from Q2 2024.

The financial beats were driven by three pivotal factors:

First, inclusion in the ASX 200 during quarterly rebalancing brought in index fund money that provided a valuation floor for the stock.

Second, the unveiling of expanded U.S. research and development operations showed the market company growth - as did hitting 4,000 units in the field worldwide.

Two new U.S. Department of Defense contracts worth A$7.9 million landed for handheld detection platforms, with more than half comprising AI-controlled RfPatrol units - body-worn devices that detect hostile drones through radio frequency signals.

"Passing 4,000 systems in service is an important milestone," DroneShield U.S. CEO Matt McCrann said.

“It underlines the performance and dependability of our solutions in the field.”

Company gross profit margins have grown from just 57.6% in 2018 to 71.7% in 2024.

Software-as-a-Service receipts grew 177% year-over-year to A$3.5 million in H1 2025, still only 5% of total top line.

The firm ploughs over A$50 million annually into research and development, a figure that exceeds the entire annual revenue of many ASX-listed defence contractors.

At the moment, DroneShield sits on A$203.8 million in cash and term deposits with zero debt, providing ample runway for further R&D spending.

David versus Goliath, except David has AI

The global counter-drone market is going gangbusters and expected to grow from US$3 billion this year to $9.3 billion by 2030 at a 25.14% CAGR.

Growth was fueled when the Pentagon redirected $50 billion to counter-unmanned aerial systems programs through a shift in threat assessment.

Yet competition in the sector splits into two camps that rarely see eye to eye.

Established defence contractors like Raytheon Technologies (NYSE: RTX), Lockheed Martin (NYSE: LMT), and Northrop Grumman (NYSE: NOC) bring electronic warfare devices, jamming systems, and directed-energy weapons integrated with existing radar networks.

They've got the relationships, the security clearances, and the patience to navigate the established procurement systems.

Then there are the specialists betting the farm on a single technology vertical.

Venture-backed Anduril Industries locked in a $106 million U.S. Department of Defense deal in 2020 for its SkyDome platform and raised $2.5 billion in June 2025 to scale autonomous systems production.

Anduril's WISP platform processes petabyte-scale sensor feeds to maintain 360-degree awareness across 3-10 miles with autonomous intercept decisions, representing the kind of Silicon Valley approach that makes traditional defence contractors nervous.

Dedrone was acquired by Axon (NASDAQ: AXON) in 2024 and now partners with NATO forces for AI-powered drone detection at military installations.

Israel Aerospace Industries (TASE: IAI) and Rafael Advanced Defense Systems round out the specialist category, with Rafael securing a $60 million European NATO win in January 2025.

DroneShield differentiates from them with in-house manufacturing, battle-tested hardware in Ukraine and an army of 300 software and hardware engineers focused on AI development out of the company's 400+ employees.

Last month, DroneShield unveiled expanded U.S. R&D operations, with more than 30% of new roles going to software development and AI capabilities.

"As we continue to scale our operations globally, this expansion in the U.S. plays a crucial role in enhancing our ability to innovate and deliver advanced solutions for the evolving defense industrial base right here in the U.S.," McCrann said.

And yet the expansion continues closer to home too.

This week, DroneShield announced a $13 million investment over three years to establish an R&D facility in Adelaide, creating 20 high-skilled engineering roles focused on radiofrequency electronics and electronic warfare.

The facility will be led by Jeff Wojtiuk, a former Lockheed Martin Australia defence engineering leader with over two decades of experience in RF design and complex systems integration.

Revenues soar

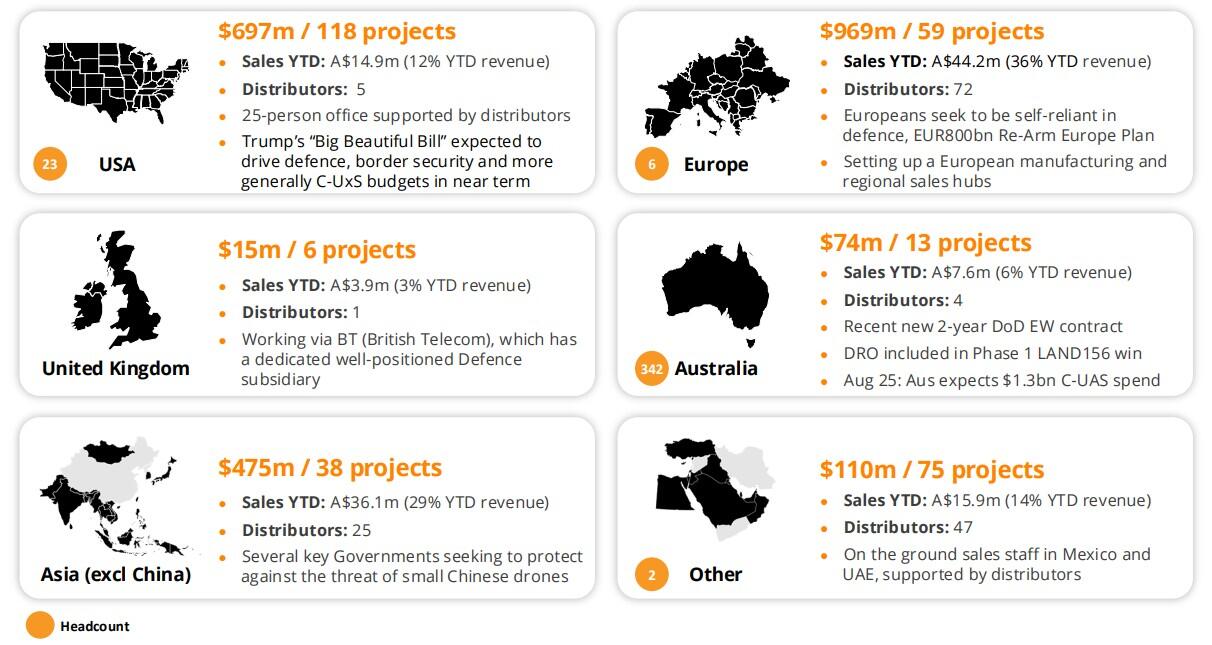

DroneShield reported A$176.3 million in locked revenue as of July 2025, while the sales pipeline totals A$2.34 billion - up 112% from the first half of 2024 - spanning 284 projects scheduled for 2025-2026 delivery.

CEO Oleg Vornik said DroneShield's recent performance “reflects the strength of our product portfolio, the agility of our operations, and the rapidly growing market for counter-drone solutions”.

As of the end of August, the company's sales pipeline exceeded A$2.34 billion and encompassed 13 deals exceeding A$30 million each, with Europe accounting for A$1 billion across 56 projects, the U.S. contributing A$684 million across 100 projects, and Asia adding A$437 million across 33 projects.

The standout deal landed in June, when the firm won a record A$61.6 million European military order through a local reseller - an order that surpassed DroneShield's total 2024 top line and covers handheld detectors and jamming devices for Q3 2025 delivery.

Europe builds another wall

Russian drone incursions into Polish, Estonian, and Romanian airspace prompted European Commission President Ursula von der Leyen to unveil plans in September 2025 for a counter-drone defence network along the EU's eastern borders.

The initiative - called the Eastern Flank Watch - will integrate detection, tracking, and interception capabilities across member states, creating coordinated procurement that favours companies with proven, scalable technology.

NATO defence spending is projected to increase from 2% to 5% of GDP by 2035, while European defence expenditure is forecast to grow from $1.5 trillion to $2.8 trillion over the same period.

These aren't aspirational targets but budget commitments driven by the reality that NATO's eastern flank faces persistent aerial threats that traditional air defence platforms weren't designed to counter.

“Shooting down drones costing thousands of dollars with missiles priced at millions creates a losing proposition,” NATO Secretary General Mark Rutte said.

The Russia-Ukraine conflict showcased to the world drone effectiveness in modern warfare and has rapidly forced a rethink of Western defence establishments and procurement priorities that favour exquisite hardware over mass-producible solutions.

DroneShield plans to establish European manufacturing facilities and expand U.S. operations in 2025-2026, targeting capacity growth from A$500 million to A$2.4 billion per annum by the end of 2026.

Thus, Europe is essentially building a Maginot Line for the drone age, except this one might actually work.

Australia's largest defence tech stock

DroneShield trades at roughly a 70x enterprise value-to-revenue multiple based on its hefty A$5 billion market cap and A$72.3 million half-year sales run rate.

The multiple bakes in performance, expansion and market share gains against competitors with deeper pockets and longer runways.

The firm's performance over the next 18 months hinges on converting pipeline to revenue without major contract losses, maintaining margins as competition intensifies and customers gain negotiating leverage, and pulling off international expansion without operational stumbles.