DroneShield (ASX: DRO) is one of the top performing ASX stocks right now, posting record sales and a more than doubling of its United States workforce in a massive R&D push that has sent shares up almost 8% to $3.55 during trade today.

The Australian counter-drone specialist is adding a second Virginia facility in the U.S. and dedicating >30% of new roles to software development and AI capabilities.

With global military spending surging past US$900 billion and drone threats making headlines from Ukraine to the South China Sea, DroneShield's timing is spot on.

"Expanding our U.S. technology team strengthens our ability to support critical programs and deliver advanced solutions with greater speed and precision," said DroneShield CTO Angus Bean.

Orders in…

The drone tech leader just surpassed the 4,000 systems sold worldwide milestone with a fresh US$7.9 million order from the Department of Defense.

Q3 2025 sales are already sitting at a whopping US$77 million - more than the firm's previous record quarters combined.

The stock has rocketed 212% over the past year, earning DroneShield a spot in the S&P/ASX 200 index earlier this month and a market cap pushing over $1.5 billion.

With shares trading at over 18 times forward sales, investors are paying a premium to join in on its upwards momentum - not surprising for a company showing record growth.

“As our customers seek to step up from their early small-scale evaluation purchases into full-scale procurement, we are seeing rapidly rising customer demand," DroneShield CEO Oleg Vornick said.

“Counterdrone is still at its nascency with our customers requiring very significant additional purchases to progress to the required levels of counterdrone defence.”

Growth in the billions

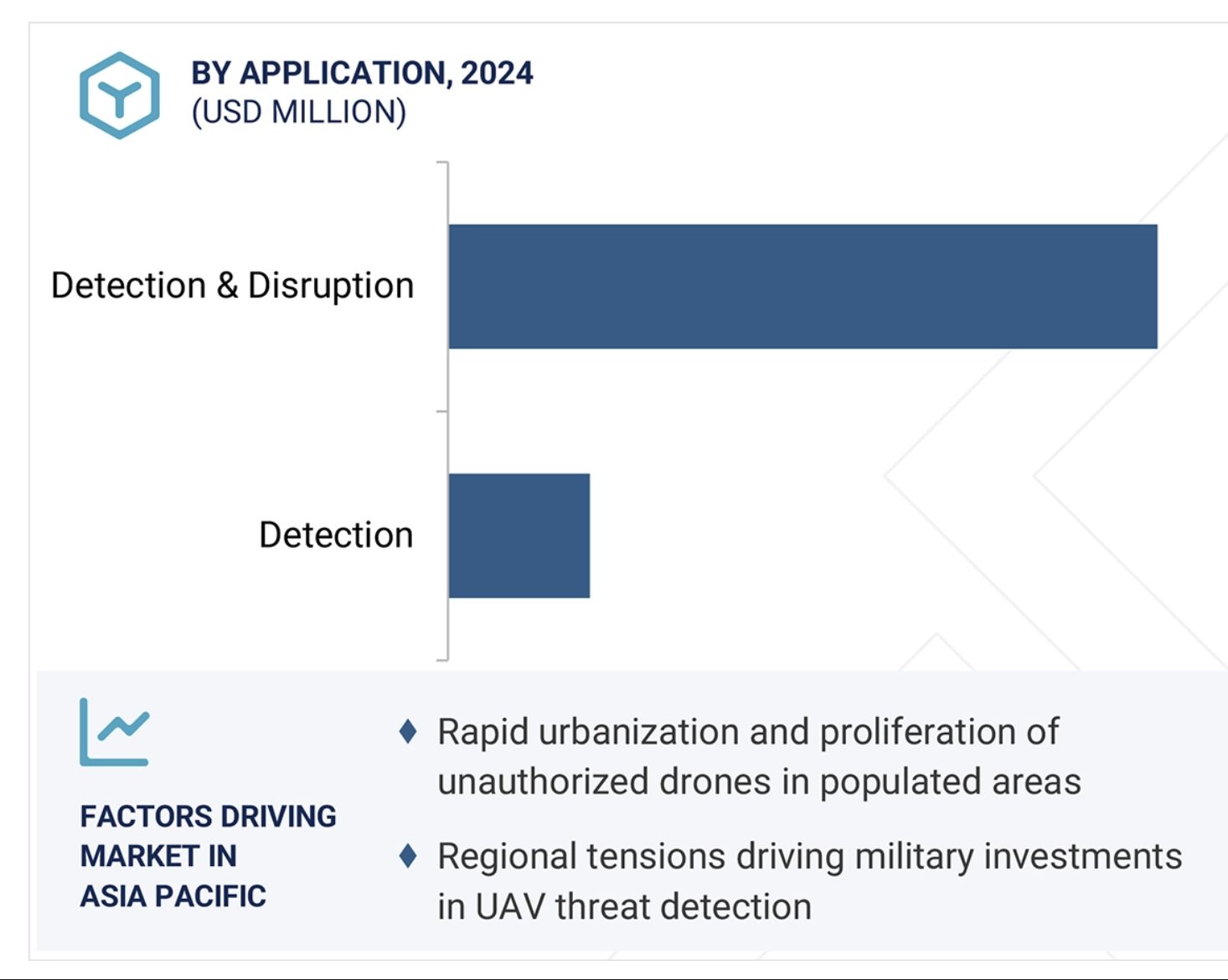

DroneShield's U.S. push is targeting America's military industrial base in a global anti-drone market projected to grow from US$4.48 billion to $14.51 billion by 2030 - at a CAGR of 26.5%

It already supplies the American military with handheld drone jammers, AI-powered detection platforms, and integrated counter-drone solutions - as well as other government customers.

The ASX junior's portfolio includes everything from handheld "DroneGuns" that safely disable hostile drones, to sophisticated detection arrays that integrate multiple sensors.

Over 30% of the current buildout focuses on software development that's targeting recurring income streams.

Its SaaS-based AI software updates provide quarterly firmware releases through secure portals, encouraging sticky customer relationships.

Global buildout

The push follows recent facility investments in Australia and Europe, positioning DroneShield as a truly global player in counter-drone technology.

With manufacturing capacity set to scale from US$500 million to US$2.4 billion annually, the business is preparing for explosive gains.

The counter-drone space is driven by everything from border security to critical infrastructure protection.

Recent contracts span Asia (US$32 million) and Europe (US$61 million), backed by a steady flow of U.S. and Australian activity.

With risk on, trading at 18X earnings has its execution risks.

High-momentum military stocks can see 10-20% pullbacks when quarterly results disappoint or geopolitical tensions ease.

Competition is heating up as traditional military contractors wake up to the drone threat as the outfit burns through cash on R&D and facility scaling with its US$192 million warchest.