While additional Tier 1 bank hybrids are being phased out by 2032, investors have been piling into corporate hybrids with their ears pinned back. Possibly by default, corporate hybrids have been arguably the hottest A$ credit market in 2025, with the universe having reached A$10 billion across over 20 individual instruments since the start of its renaissance in late 2024.

Demand appears to be showing no signs of slowing down with the market’s latest transaction, Ampol’s (ALD) 30NC8, attracting a $3.39 billion orderbook (~6.8x coverage).

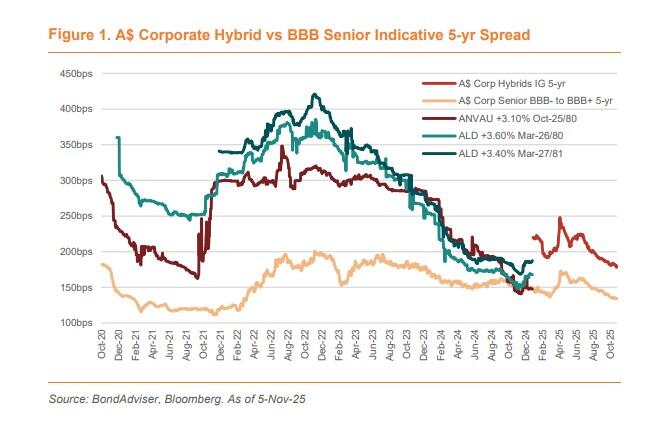

However, it has by no means been all smooth sailing throughout this period, with A$ corporate hybrid spreads unwinding 40-60bps (to ~250bps on average) in response to the Trump Administration’s “Liberation Day” in April 2025.

It’s also worth noting spreads at even wider levels historically with ALD and Ausnet (ANV) instruments trading in excess of 300bps for most of the 2022/23 period.

ANV’s existing +2.25% Nov-30/55 (5 years ttc) is currently priced at +175bps, which compares to its now called +3.10% Oct25/80, which reached +169bps in Sep-21 (4-years ttc).

This is despite ANV's subordinated debt being rated one notch higher at the time.

A$ corporate hybrids appear to be trading at the implied post-COVID tights, but the jury’s out on whether A$ corporate hybrid spreads can defy mean reversion - move back to their long-term average - and grind tighter from here.

While wider spreads typically indicate higher perceived risk and economic uncertainty, narrower spreads suggest stability.

According to independent investment research company BondAdviser, this is unlikely with senior/sub ratios currently sitting at between 1.5-1.7x for A$ corporate hybrids; already tight from a global perspective, with recent EUR corporate hybrids pricing closer to 2.5x.

With the 5-year marker for Big Four A$ Tier 2 having reached +125bps – with the A$ Tier 2 senior/sub ratio remaining at 1.8x – BondAdviser suspects senior corporate spreads will have to move first/or in tandem, to support tighter corporate hybrid valuations.

“However, with A$ senior corporate spreads already sitting at pre-COVID (2019) levels, there is not much juice to squeeze,” noted BondAdviser.

“For the avoidance of doubt, we are generally comfortable with the fundamental credit profiles of the underlying issuers.”

However, given that corporate subordinated debt is a high-beta part of the capital structure, BondAdviser reminds investors that it can be volatile in less favourable market conditions.

Given that demand has seen the A$ corporate hybrid curve completely flatten and invert in some instances (MELAIR/TRGRID) - on both a spread and yield basis – BondAdviser prefers sub 5-year paper.

In combination with the success of ALD’s recent transaction, the bond market researcher believes long-dated hybrid funding is looking highly attractive for issuers.

“This was akin to the A$ Tier 2 market earlier this year and saw >$5bn of long-dated issuance from the Big Five in quick succession,” BondAdviser noted.

“We view long-dated corporate hybrids as vulnerable in this context.”

Issuance update

Airservices Australia (AAA) is taking IOIs for a 12-year senior unsecured FXD transaction. IPG has been set at SQ ASW +120-125bps area.

Australia and New Zealand Bank Limited (AA-/Aa2/AA-) priced a $2.90 billion 3-year short transaction across two tranches: a $650 million FXD and a $2.25 billion FRN at 3mBBSW/SQ ASW +61bps (4.25% coupon for FXD).

The final orderbook was in excess of $4.54 billion (FRN: $3.39 billion; FXD: $1.15 billion), and IPG was 3mBBSW/SQ ASW +67bps area.

Bank of Queensland (A-/Baa1/A-) is taking IOIs for a 3-year senior unsecured FXD and/or FRN transaction. IPG has been set at 3mBBSW/SQ ASW +82bps area.

Goodman Australia Industrial Partnership (A-/A3) priced a $500 million 6-year senior unsecured FXD transaction at SQ ASW +100bps (4.904% coupon).

The final orderbook was in excess of $1.9 billion, and IPG was SQ ASW +115bps area.

Shinhan Bank (A+/Aa3/A) has mandated banks for a potential 5-year senior unsecured benchmark FRN.

National Australia Bank (AA-/Aa2/AA-) priced a $1.75 billion 10NC5 tier 2 transaction across two tranches: a $650 million FXD-to-FRN and a $1.15 billion FRN at AQ ASW/ 3mBBSW +130bps (5.0824% coupon for FXD).

The final orderbook size was in excess of $2.49 billion (FRN: $1.61 billion; FXD: $880mn), and IPG was 3mBBSW / SQ ASW +140-145bps area.

NSW Electricity Networks (Transgrid) (BBB/Baa2) has mandated banks for a potential 30NC5.25 and/or a 30NC10 FXD-to-FRN subordinated securities transaction.

SBS Bank (BBB) has mandated banks for a potential 3-year senior unsecured FRN transaction.

Victoria Power Networks (A-) priced a $100 million tap to its existing April 2032 green notes at 3mBBSW +107bps. The total outstanding amount is $400 million.

Westpac Bank (AA-/Aa2/AA-) priced a $3.0 billion 5-yr senior unsecured transaction across two tranches: a $2.0 billion FRN and a $1.0 billion FXD at 3mBBSW/ SQ ASW +73bps (4.50% coupon for FXD), along with a $1.0 billion 20-yr FXD Tier 2 transaction as SQ ASW +160bps (6.135% coupon).

The final orderbook was in excess of $6.6 billion for the 5-year tranche (FRN: $4.21 billion; FXD: $2.39 billion) and $3.84 billion for the Tier 2.

IPG was SQ ASW +80bps for the 5-yr and +175bps area for the tier 2.