United States President Donald Trump's 8 July announcement of a 50% tariff on copper imports beginning 1 August sent prices surging 13% in one day, up to a record high of US$5.69 per pound (lb), marking the largest single-day copper price increase since 1968. Imagine what happens when the reality of tariffs on the red metal sinks in next week, with demand to remain constant and even grow over the next two decades.

The U.S. administration's unprecedented trade policy threatens to fragment global markets, with U.S. consumers potentially paying around $15,000 per tonne (t) for copper while the rest of the world pays around $10,000/t once the tariffs take effect.

It's a watershed moment for global copper markets, creating immediate price distortions that could reshape supply chains across industries.

The most active copper futures on the COMEX fell by nearly 3% to $5.613/lb, a sharp pullback following a record-setting rise last week that saw prices approach the $6/lb level, demonstrating extreme volatility as traders position themselves ahead of the deadline.

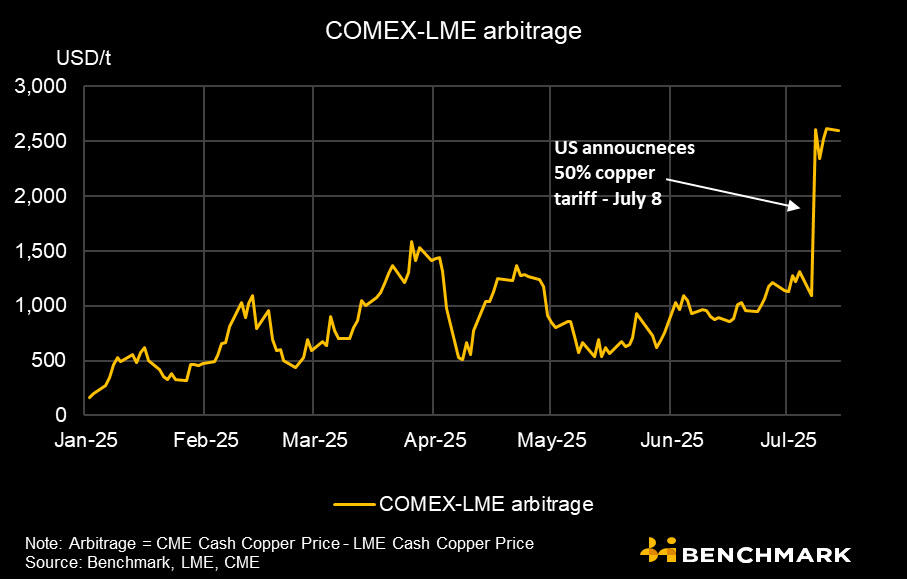

Arbitrage opportunities

The tariff's most immediate impact has been the creation of massive price discrepancies between U.S. and global markets.

The U.S. copper price premium over the global benchmark soared 138% on Tuesday to a record high, currently sitting at ~30% of the LME value but potentially surging to 50% post-implementation.

This price fragmentation has triggered extraordinary pre-emptive stockpiling.

Morgan Stanley estimates 400,000 tons, or roughly six months' worth of "extra" copper was front-loaded and delivered to the US in the early months of 2025.

Global traders have accelerated shipments through unconventional routes, including Hawaii for faster customs clearance, creating short-term supply chain disruptions.

The arbitrage opportunities, however, come with significant risks.

London-based Benchmark Mineral Intelligence warns that the current stockpile build-up provides only temporary market buffering, with longer-term supply constraints inevitable given America's structural copper deficit.

Industrial sectors brace

The tariff's impact extends far beyond commodity markets into critical industrial sectors such as construction, which faces immediate pressure with housing costs set to escalate significantly.

"Tariffs on copper, lumber, steel, aluminum and other materials or products that go into building a home needlessly raise housing costs," National Association of Home Builders Buddy Hughes says.

EV manufacturers face particularly acute challenges, given that EVs contain up to 64kg of copper versus conventional vehicles.

This copper intensity threatens to undermine the economics of electric vehicle adoption precisely when the industry seeks to scale production.

The technology sector confronts dual pressures from both increased material costs and accelerated infrastructure demands.

Data centres supporting AI expansion require substantial copper quantities for cooling systems and electrical infrastructure, while 5G network deployment depends heavily on copper-intensive components.

Winners and losers

Chile, the world's largest copper exporter, faces the most significant immediate impact as two-thirds of US copper imports originate from Chile and Canada.

Exports to the U.S. could face a complete redirection to Asian markets, potentially straining China's already dominant position in global copper refining.

China itself emerges as a potential beneficiary, despite its own production capacity metrics.

The country's control of roughly 50% of global smelting and refining capacity positions it to absorb redirected red metal supplies at potentially discounted prices, further entrenching its market dominance.

Canada faces a complex situation given its USMCA trade agreement status, yet early reports suggest possible country-specific exemptions - though no official clarification has emerged.

Any Canadian exemption would create additional competitive pressures on Chilean and Peruvian exporters, while potentially undermining the tariff's domestic production objectives.

America's production to remain constrained

Despite the tariff's stated goal of boosting U.S. production, structural constraints limit immediate supply responses.

Current domestic refineries operate at approximately 55% capacity, well below the 80% target established by previous Section 232 actions on steel and aluminium.

Major domestic producers including Freeport-McMoRan and Rio Tinto may benefit from higher local prices, but face significant operational challenges.

Declining ore grades at ageing mines and logistical constraints in transporting concentrates limit expansion potential.

It takes almost 32 years, on average, from the discovery of mineable copper in the US to production, according to S&P Global Market Intelligence.

The copper scrap recycling industry represents the most immediate domestic supply response opportunity.

Recycling operations could see dramatically improved economics as manufacturers seek tariff-free alternatives to imports, potentially driving significant capacity expansion in the secondary copper market.

Inflation pressures

Consumer impacts extend across numerous product categories.

Ryan Young, senior economist at the Competitive Enterprise Institute, says copper is an integral component of electrical wiring and plumbing, as well being used as a heat conductor in radiators and household appliances.

The resulting price increases could exacerbate existing inflation pressures across the broader economy.

Household appliance manufacturers face immediate margin pressure, with refrigerators, air conditioners, and washing machines all containing substantial copper components.

The electronics industry confronts challenges with smartphones, computers, and consumer electronics, where copper's superior conductivity makes substitution difficult.

Home renovation and construction costs could see substantial increases.

Electrical systems, plumbing installations, and HVAC systems all require significant copper quantities, potentially adding thousands of dollars to renovation projects and new home construction.

Volatility

Analysts predict sustained market volatility through 2025 and beyond.

"There's a reality that has to be dealt with, and the price of copper with a 50% tariff is not going to mean copper production in the U.S. goes through the roof tomorrow," JP Morgan Chase said in a note.

The disconnect between policy implementation timelines and production reality suggests extended price premiums in U.S. markets.

The Fed's monetary policy decisions reap added complexity too, given copper's inflation implications.

Higher copper costs could cascade through supply chains, influencing central bank policy responses and broader economic growth trajectories.

Global copper consumption forecasts indicate demand from clean energy sectors growing at 10.7% annually through 2030, with EVs alone growing at 14.3%.

To boot, meeting electrification goals may require 115% more copper mined over the next 30 years than in all previous history, making supply disruptions particularly problematic for climate transition objectives.

Happy August.