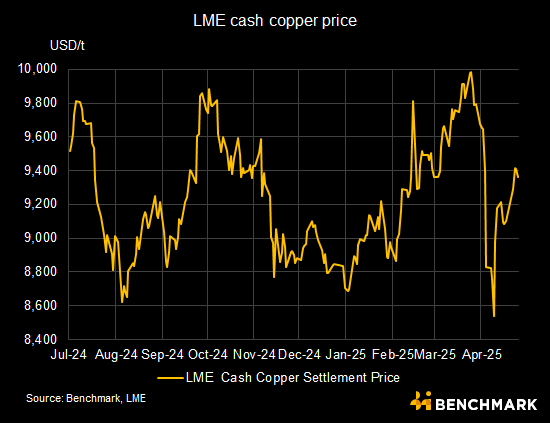

After a long time in the doldrums where the copper market was exploited by project developments outside of profitability, a resurgent copper price was music to miners' ears earlier this year...

…that is, until United States President Donald Trump decided to slap import tariffs on the commodity as part of what seems now more like a one-man crusade against China's rise to prominence as a superpower than collective governance.

Azzet’s Mission Critical is a weekly column, which lays out the ebbs and flows around critical minerals supply chains - from pricing, production, refinement and mergers & acquisitions, to manufacturing and consumer products.

Red metal's time to shine

Copper started strong in January, as optimism around policies aimed at revitalising China’s economy - including lower lending rates, debt issuance, and reduced payment thresholds for property purchases, drove demand.

Outside those markets, the global shift toward renewable energy, electric vehicles, and artificial intelligence is supporting copper’s long-term demand and giving mining companiesa reason to up investment and production levels.

Kicking off a flurry of investment and M&A deals, Canadian miner Teck Resources announced a US$3.9 billion investment to increase its copper production to 800,000 tonnes per annum (tpa) by 2030.

Teck aims to develop four near-term copper projects in Chile, Canada, Peru, and Mexico.

The company underwent a significant portfolio transformation in 2024, repositioning itself as a pure-play energy transition metals business focused on copper and zinc.

Peruvian copper output jumped 7% in January, led by Chinese-owned MMG's Las Bambas and Anglo American's Quellaveco. In Australia, Hillgrove Resources dramatically accelerated output from its underground Kanmantoo mine.

Things were looking optimistic and sentiments to a breakout in the copper price were fundamentally strong, until the red metal came under fire from the Trump administration as part of the ensuing U.S.-China trade war.

Find out more: Mission Critical: Copper under fire in US-China battle

Volatility crept in, and spot prices slumped once again.

Government funding boost

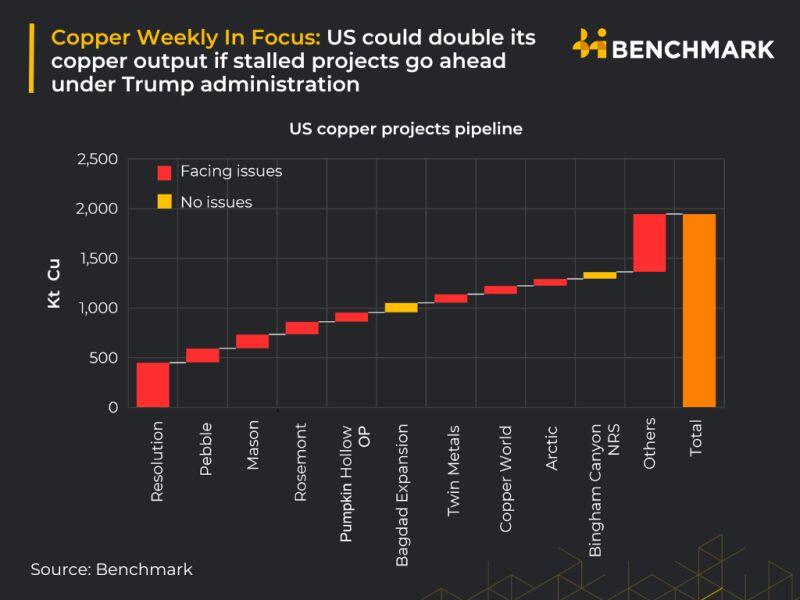

Perhaps as a countenance to copper price woes, the U.S. government is expediting permits for ten major critical mineral projects under the FAST-41 initiative to boost domestic supply chains and reduce reliance on foreign sources.

Mining developments that are set to take advantage include the Resolution copper play in Arizona - a JV between Rio Tinto and BHP (despite native American opposition) and Ivanhoe Electric's Santa Cruz copper project.

Find out more: Rio has high hopes for copper mine Resolution

The Trump administration plans to approve a land swap allowing Rio Tinto and BHP to develop the Resolution Copper mine in Arizona, despite Native American opposition over cultural and environmental concerns.

Ivanhoe Electric has potentially secured US$825 million in government financing for Santa Cruz - one of the largest copper deposits in the U.S. - as the nation looks to boost domestic copper supply.

Miners hit dirt worldwide

Bill Gates and Jeff Bezos-backed KoBold Metals is expanding into the Democratic Republic of Congo (DRC) to explore lithium, copper, and cobalt, aiming to boost US mineral supply chains and counter China’s dominance.

However, China’s Tengyuan is also eyeing the DRC, investing US$134.2 million to build a copper and cobalt plant that will churn out 30,000tpa of copper and 2,000tpa of cobalt.

Also snooping around central Africa, UK-based Vedanta Resources is planning a U.S. IPO for Konkola Copper Mines (KCM) in Zambia, aiming to raise an eye-whopping US$1 billion to fund an increase in the copper output to 300,000tpa.

Over in the copper-rich Americas, Panama’s President Mulino is exploring ways to reopen First Quantum’s Cobre Panama copper mine without congressional approval, balancing economic needs with past anti-mining protests and ongoing arbitration challenges.

Mulino has ruled out a new mining contract law with First Quantum for Cobre which has been shuttered since 2023 and is suggesting a potential partnership emphasising national ownership.

Peru's Antamina copper mine (427,000t Cu in concentrates in 2024), one of the country's largest, has begun gradually resuming operations following a fatal accident that resulted in the death of an employee.

Russia’s VEB bank is planning to invest US$13.4 billion in the Baimskaya copper mine, potentially boosting Russian copper production by 25%.

“Baimskaya, one of the world’s largest undeveloped copper projects, was discovered in the 1970s by Soviet geologists but has remained undeveloped due to the remote location and harsh climate of the Chukotka region," Benchmark Mineral Intelligence (BMI) said in its recent copper briefing.

“The project has resources of 2,500Mt at a grade of 0.31% Cu, and will require a large open-pit mine, moving significant volumes of material to remain profitable.

“The projected capex for the project is US$13.5 billion. With a planned production of around 350,000tpa, the average capex intensity would be US$38,000/t of installed capacity, reflecting the challenging environment and cost of building in the Arctic."

Taseko’s U.S.-based Florence copper project (projected to produce 38,000tpa of copper cathodes) is now 78% complete and on track for first production by year-end, with major drilling and construction milestones achieved.