Azzet’s Mission Critical is a weekly column that lays out the ebbs and flows around critical minerals supply chains - from pricing, production, refinement and mergers & acquisitions, to manufacturing and consumer products.

China's rare earths play underlying Trump's tariff war: Part 2

Well it’s taken less than a week for the Trump administration to retaliate to China’s rare earths restrictions and as we have come to know, the United States President doesn’t hold back when fired upon.

And Australia could well benefit from America cutting out Chinese supplies for critical minerals, including rare earths and uranium.

Missed Part 1?: Mission Critical: The gravity of China's rare earth bans

Wielding executive order powers once again, Trump has called for another Section 232 investigation, this time into critical minerals including rare earths - a known legal avenue for the President to implement tariffs on products coming into the United States.

The investigation will assess the existing supply, demand, pricing and use of critical minerals; and whether to recommend import restrictions, tariffs, domestic production incentives or other such policies.

Certain products have been annexed - the full list of exemptions are listed here.

Signed into law by former President John F. Kennedy, Section 232 of the Trade Expansion Act of 1962 authorises POTUS to adjust imports from other countries if the quantity or circumstances surrounding those imports are deemed to threaten national security.

This can be done through tariffs, or other means - and we all know what he's gunning for.

Section 232 has already been used to implement tariffs on steel, aluminium and the automotive industries, with timber, copper, pharmaceuticals and semiconductors under review.

Opportunity knocks

If imposed on China and other nations, Australia may be very well-positioned to take advantage of a raft of tariffs on critical minerals and associated products and fill a supply void.

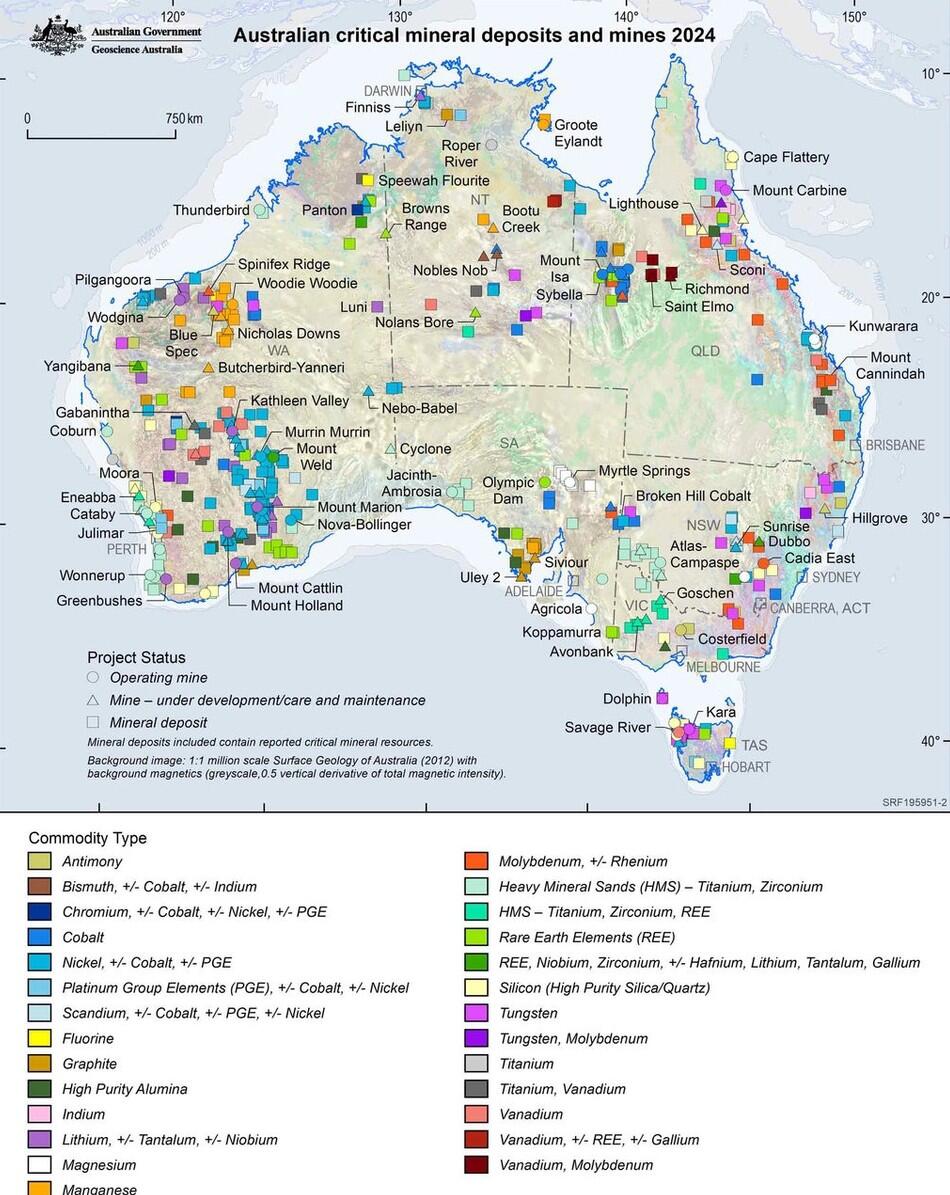

Australia has a plethora of identified and untapped strategic metals.

We're predominantly an exporter of these materials, if at all at the moment. However, that's changing, albeit at a snail's pace, and could accelerate with major investment in Australia's downstream capabilities.

Minerals Council of Australia CEO Tania Constable welcomed the investigation.

"Given Australia is a trusted supplier of critical minerals essential to U.S. industries, this investigation presents an opportunity for the nation to strengthen its position as a reliable supplier of these essential resources," Constable said.

"But we cannot afford to be complacent. Australia must negotiate a framework that delivers mutual benefit to both Australian producers and U.S. industries, while also continuing to forge and deepen strategic partnerships with other like-minded nations."

Federal Resources Minister Madeline King has called for Australia to establish a strategic reserve of critical minerals.

However, King did not name terbium and dysprosium, which are crucial for the defence sector and will now be subject to export controls by China.

King also did not mention that although Australia has terbium and dysprosium deposits, the nation does not currently produce these minerals.