Azzet’s Mission Critical is a weekly column that lays out the ebbs and flows around critical minerals supply chains - from pricing, production, refinement and mergers & acquisitions, to manufacturing and consumer products.

China's rare earths play underlying Trump's tariff war: Part 1

Flying under the radar as part of the ensuing and now global trade war that is currently being waged is China’s retaliatory restrictions on critical minerals to the United States and its allies.

In its latest salvo, China has imposed export restrictions on seven more rare earth elements (REE) as part of escalating economic warfare between the two superpowers.

They include the light rare earths (LREE) scandium and yttrium, and the heavy rare earths (HREE) of samarium, gadolinium, terbium, dysprosium and lutetium.

The move follows on from similar export bans on gallium, germanium, and antimony to the U.S. entirely, including bans on the technology to process and refine the materials - intellectual property that China is much more advanced in.

Businesses and governments in the West and right across the value chain are now increasingly worried about securing materials in the near future.

That’s because REEs – comprised of 17 critical metals – are indispensable components in military defense systems, consumer electronics and renewable energy technologies, to name a few.

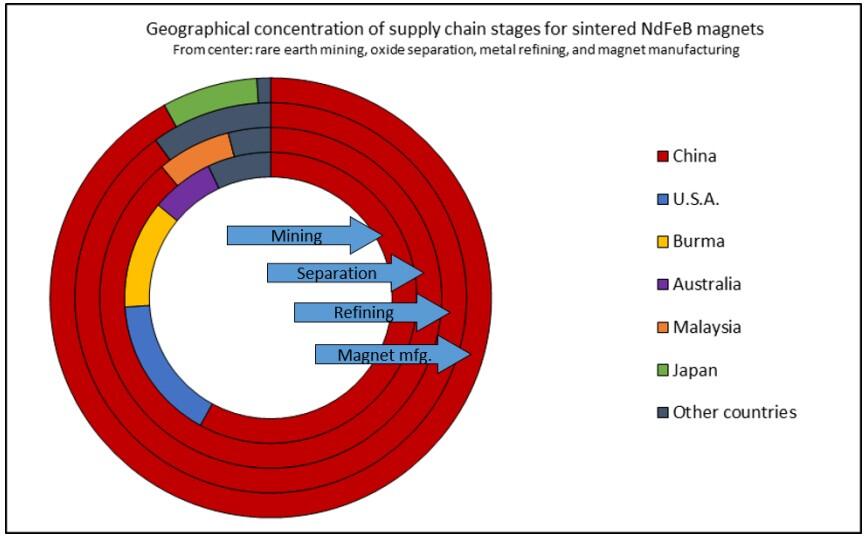

The gravitas of these measures combined should not be overlooked, considering China has hegemonic control over the whole supply chain of these critical minerals, from production to end product - exemplified by this U.S. Department of Energy example of sintered neodymium-based magnetics supply chains:

Chinese squeeze

Despite more than a decade of sustained efforts by Western countries and companies to loosen China’s grip, Beijing by far remains the top player in REE mining, processing and refining.

China became a major producer of rare earths in the 1980s after ramping up research and development funding for mining and processing.

In the 1980s, the USA was the dominant market leader in global production of rare earths.

Fast forward to 1987, Chinese Communist Party (CCP) leader Deng Xiaoping - the architect of modern China - made a shrewd prediction:

“The Middle East has oil, China has rare earths”

Long before the West, China understood that REEs and other critical minerals would be intrinsic to 21st-century manufacturing.

REEs such as neodymium, praseodymium, dyprosium and terbium, as well as tech metals such as gallium, germanium, graphite and antimony, would be key raw materials in the value chain and equate to trillions of dollars worth of GDP.

It’s now weaponised its hegemony over these metals.

Retaliatory restrictions

The world experienced a wake-up call about the consequences of China withholding REE supply to Japan in 2010 in retaliation for a boating collision, which sent prices through the roof.

Shipments of REEs to G7 members and Australia from 2010 to 2019 were restricted, brewing as part of the trade war we see today that is shaking global markets.

Australia too had restrictions placed upon it, being subject to ‘economic coercion’ by China, where import duties were placed on them together with other trade items such as barley, wine and meat at the time.

China had to scrap its export quotas for rare earths after losing a World Trade Organisation (WTO) case brought by the U.S. and other trading partners that alarmed global technology producers.

To circumvent the ruling, the Chinese Communist Party (CCP) switched to production quotas and stricter environmental rules to control supply.

Under the new guidelines, rare earths will require an export licence, but the amount sold abroad will no longer be covered by a quota.

China’s limits, imposed in 2009, have since prompted concern about supplies for global technology producers. They have led to efforts to reopen or develop new mines in the U.S. and elsewhere, and by Japan and other countries to recycle rare earths.

Stay tuned next week for Part 2 of Mission Critical's: China's rare earths play underlying Trump's tariff war