China has added to the latest round of global trade tensions by announcing new export restrictions that will impose tighter export controls on seven critical rare earth (RE) elements.

Given that China produces around 90% of the world's rare earths, and around 98% of the world’s medium and heavy rare earths, this latest round of controls is expected to have far-reaching supply chain implications for global technology sectors, including defence, renewable energy and high-end electronics.

The specific rare earths affected by the new restrictions — samarium, gadolinium, terbium, dysprosium, lutetium, scandium and yttrium — are instrumental in producing everything from electric vehicles (EVs) and smartphones to military systems like fighter jets, missiles and satellites.

In recent years China has been accused of weaponising its global predominance over critical materials and recently implemented similar restrictions on minerals like gallium, germanium and graphite — all of which are critical to high-tech and defense applications.

While China’s recent export restrictions fall short of imposing an outright ban, shipments used in both civilian and military applications will now be subject to even greater scrutiny.

Looking beyond China

Given that there are few alternatives to sourcing rare earth materials, China’s latest round of controls has left global manufacturers searching for supply chain solutions independent of China.

Beyond China, the only heavy rare earth element operations globally include Myanmar and Laos, the Serra Verde mine in Brazil, which exports Mixed Rare Earth Carbonate (MREC) to south-east Asia for processing within the Chinese supply chain.

With only one rare earth mine the U.S. depends on imports for 80% of its supply administration.

U.S. President Donald Trump recently announced an ‘Executive Order’ aimed at increasing U.S. domestic production of critical minerals, including rare earths.

As a result, the U.S. has already expressed interest in securing rare earths and critical minerals from jurisdictions like Ukraine and Greenland.

The U.S. has also been in talks with the Democratic Republic of Congo (DRC) over a future minerals agreement.

Similar measures in Europe saw the European Union (EU) recently publish a list of ‘Strategic Projects’ to ensure European extraction, processing and recycling of strategic raw materials meets 10%, 40% and 25% of EU demand by 2030, respectively.

“There can be no defence industry without rare earths, which are used in our radars, sonars and targeting systems - and for which… we are 100% dependent on refined Chinese materials,” EU industry commissioner Stephane Sejourne recently noted.

Ionic Rare Earths

Meantime, China’s latest move to restrict rare earth exports is attracting renewed attention to ASX-listed rare earth miner Ionic (ASX: IXR), with the small-cap’s share price up around 16% in early afternoon trading.

The miner’s Makuutu Heavy Rare Earths Project in Uganda is said to be among the most advanced ionic adsorption clay (IAC) projects globally, which offers an advanced, shovel-ready alternative (to China) with high heavy rare earth content.

“The opportunity for Makuutu is shown by the fact that more than 95% of the world’s supply of heavy REOs is from declining IAC reserves in southern China and Myanmar,” said Ionic’s managing director Tim Harrison.

The miner is also advancing financing discussions with members of the Mineral Security Partnership (MSP) - a multinational initiative launched in June 2022, aimed at securing and diversifying global supply chains for critical minerals - and potential offtake partners to accelerate its development.

Added to the MSP in 2023, Makuutu is now considered as a globally strategic resource with low capital intensity and potential to underpin long-term supply chains for Western economies.

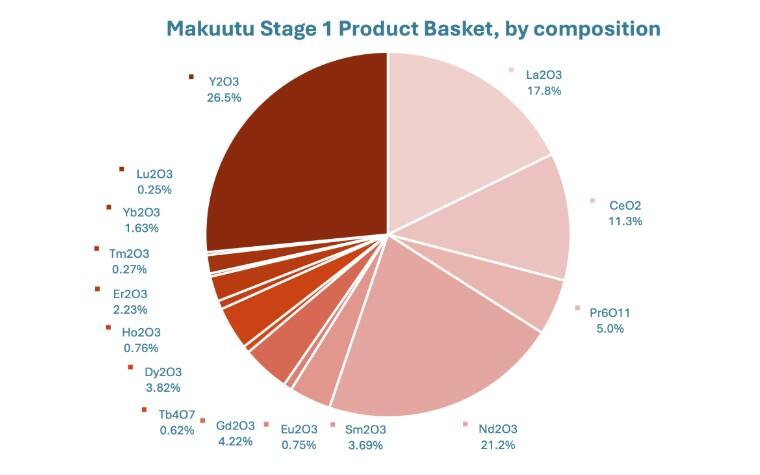

Makuutu’s metallurgical refine and concentrate (MREC) featured a rare earth basket with approximately 45% medium and heavy rare earths — one of the highest concentrations identified to date.

“We have been actively progressing in talks with MSP members and with the current focus on securing ex-China supply we see an enormous opportunity to find the right project partners for development of this key asset,” says Harrison.

Overall, the Makuutu MREC product basket announced in Ionics’s Definitive Feasibility Study released in March 2023 demonstrated a basket rich in medium and heavy REOs.

Notably able to offset the elements targeted in the control's restrictions.

Ionic Rare Earths’ market cap is $36 million; the share price is down 58% in one year, flat year-to-date and up around 16% today.