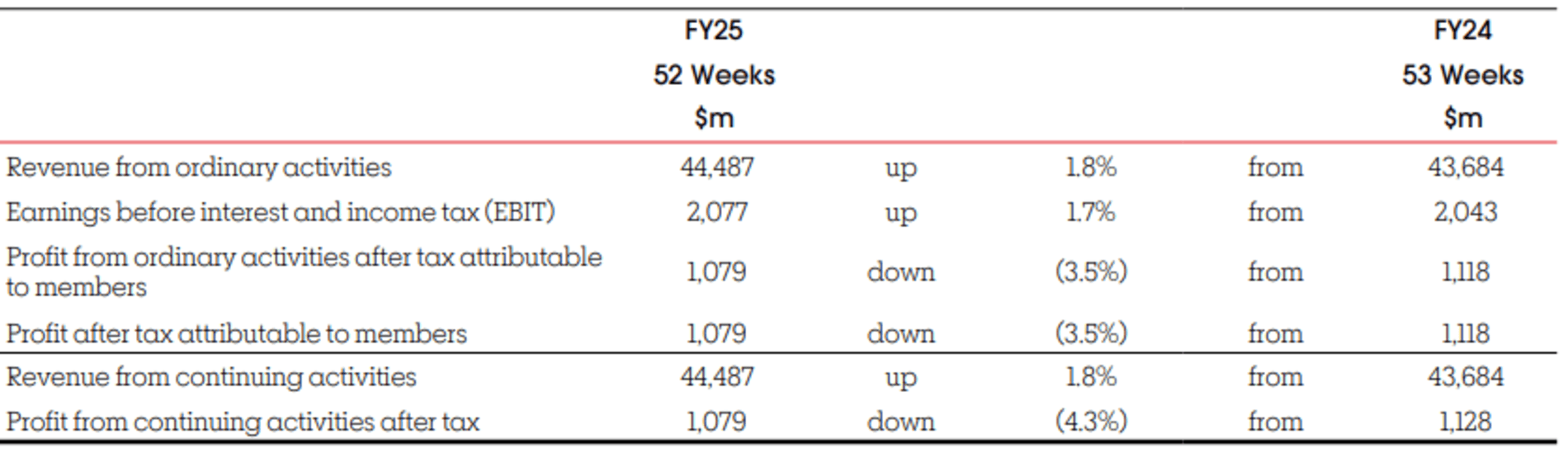

Australia’s second-largest retailer Coles has rung up a 3.5% fall in profit for the 2025 financial year (FY25) because the prior reporting period had an extra week.

Net profit fell to A$1.079 billion (US$699 million) in the 52 weeks to 29 June 2025 from $1.118 billion in FY24 on revenue from ordinary activities, which grew 1.8% to $44.487 billion, or 3.6% if the 53rd week in FY24 is removed.

Normalised underlying profit from continuing operations, excluding significant items and removing the impact of the additional week, grew 3.1% to $1.181 billion.

Underlying group earnings before interest, tax, depreciation and amortisation (EBITDA) and EBIT increased by 10.7% and 6.8% respectively, excluding project implementation, dual running and transition costs and non-recurring expenses.

Normalised growth was 4.3% from supermarkets, or 5.7% if tobacco sales are excluded, and 1.1% from liquor.

Coles reported 24.4% growth in ecommerce sales from supermarkets and 7.2% from liquor.

Directors declared an unchanged and fully franked final dividend of 32.0 cents per share to be paid on 22 September 2025 to shareholders registered on 8 September 2025, lifting the full year payment to 69 cents from 68 cents.

“In FY25 we maintained a consistent focus on our strategic priorities. We were clear that value, quality and availability remained important to our customers,” CEO Leah Weckert said in an ASX announcement.

Turning to the outlook, Coles said supermarket sales revenue increased by 4.9% (7.0% ex-tobacco) in the first eight weeks of FY26, supported by continued strength in volumes as it continued to invest in customer value and experience.

But strong growth in sales has been partially offset by a further decline in tobacco as a result of the impact of new tobacco legislation and growth in the illicit market.

Coles shares (ASX: COL) opened 7% higher at $22.17 on Tuesday, capitalising the company at $27.97 billion.

The company, which operates about 1,900 supermarkets and liquor stores in Australia, was floated on the ASX in 2018 at $12.75 per share after being demerged from Wesfarmers (ASX: WES), which acquired it in 2007.