Coca-Cola reported lower-than-expected quarterly revenues for the first time in five years.

For the fourth quarter of 2025, the food and beverage company reported revenue growth of 2% to US$11.82 billion, but fell short of Wall Street’s $12.03 billion expectations.

.

Despite this, demand for its drinks in North America and Latin America is beginning to show improvements.

Its volume in North America increased 1% and 2% in Latin America.

However, when excluding transaction gains and other one-time items, Coke earned 58 cents per share, surpassing expectations of 56 cents per share.

The company also reported net income attributable to shareholders of $2.27 billion, or 53 cents per share, up from last year’s $2.2 billion or 51 cents per share.

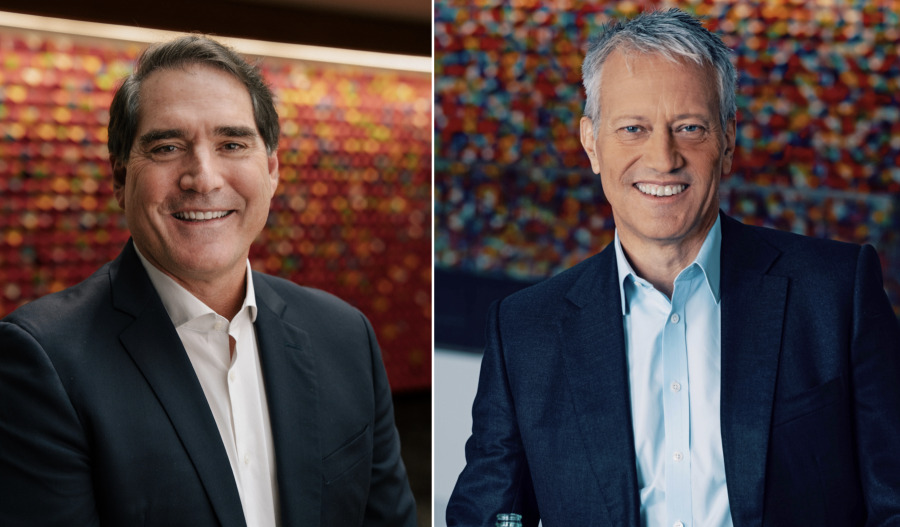

Coke chairman and CEO, James Quincy, said the company’s performance in 2025 created strong momentum for 2026.

“Looking ahead, we will focus on executing our strategy even better and positioning our system for long-term success,” he said.

For the full year 2026, the company expects to deliver organic revenue growth of 4% to 5%

Similar to rival PepsiCo, demand for Coke’s drinks has declined due to budget-conscious shoppers trying to save more on their grocery bills and dining out less frequently.

However, its water, sports and tea division outperformed the rest of its portfolio, with this segment growing 3%, thanks to higher demand for brands like Smartwater and Bodyarmor.

Coke's soft drink business reported flat volume, with its namesake rising 1% in the quarter while Coke Zero reported a volume increase of 13%.

Coke’s juice, value-added dairy and plant-based beverages division reported that volume fell 3%.

This earnings report will also be Quincey’s last as CEO before Chief Operating Officer Henrique Braun takes over the top role on 31 March.

On the earnings call, Braun said he wanted to improve Coke’s speed when taking new products to market, better integrate its marketing so that customers can actually buy its drinks and continue efforts to digitise every step of its system.

“Our system needs to focus on being a little bit better and sharper everywhere to drive transformation and impact,” Braun said.

At the time of writing, Coca-Cola (NYSE: KO) shares fell 1.49% to $76.81. Its market cap is $330.41 billion.