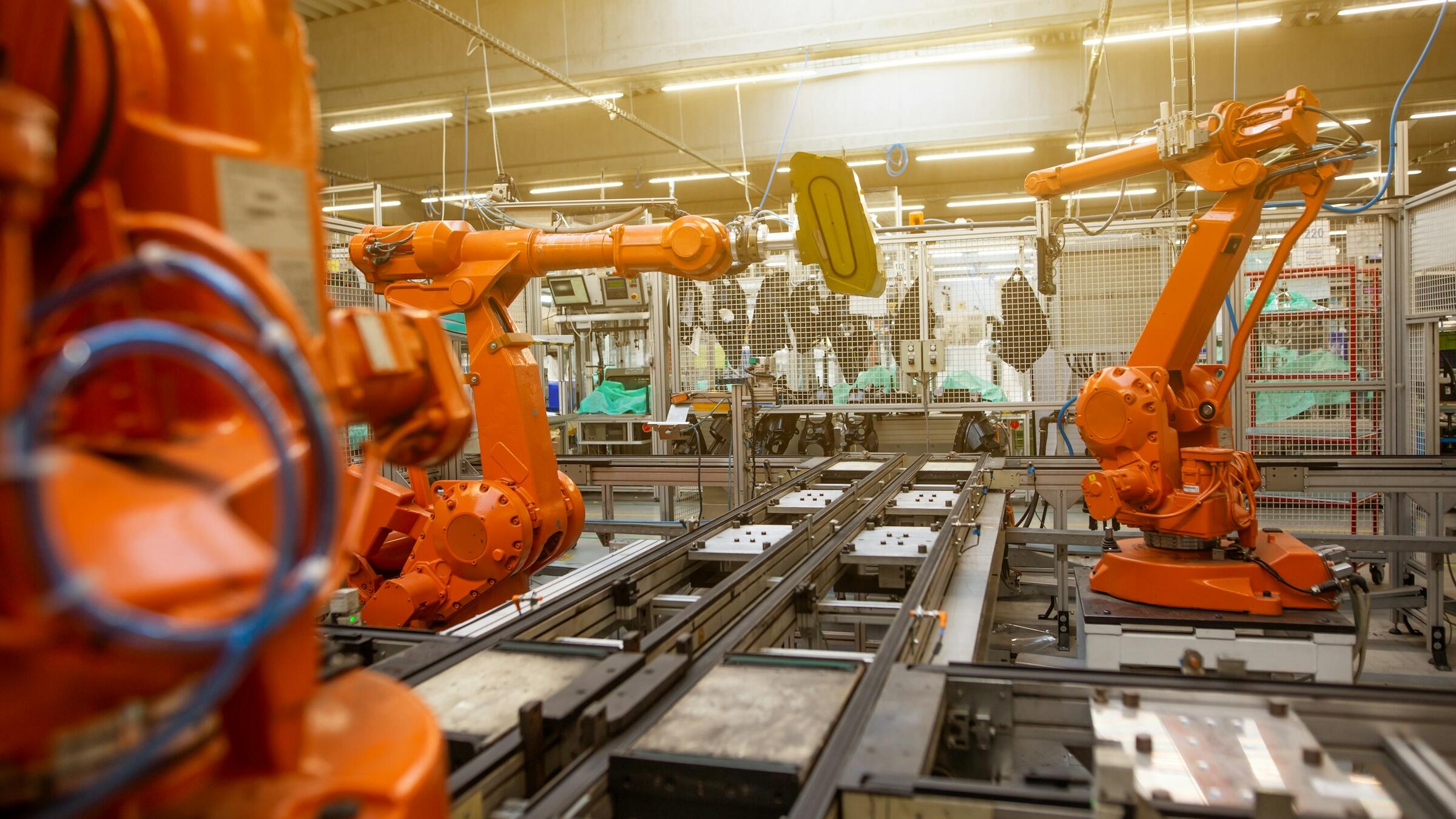

China’s factory growth in October missed market forecasts, according to a private survey.

The RatingDog China Manufacturing Purchasing Managers’ Index dropped from 51.2 in September to 50.6 in October, missing analysts' expectations of 50.9 in a Reuters poll.

RatingDog founder Yao Yu said signals a slowdown in the pace of manufacturing expansion, and marketing concerns about weakening exports have persisted.

“On the demand side, heightened trade uncertainty in October caused new export orders to fall sharply into contraction territory, dragging down the new orders reading,” Yu said.

“On the production side, uncertainty in the external environment also dampened output growth.

“Although production-related sub-indices declined month-on-month, they all remained in expansion territory.

“Purchasing activity growth slowed significantly.”

New export orders also fell at the quickest rate since May, with survey respondents attributing this to “rising trade uncertainty”.

However, new jobs were increasing slightly, with the rate of job creation being the fastest in over two years, with Chinese manufacturers reporting that they hired additional workers to cope with the existing workload.

The private survey showed the index staying above the 50-benchmark, which separates growth from contraction; however, an official survey released last Friday showed manufacturing experienced its worst contraction in six months, falling to 49.0.

Private surveys, previously conducted by Caxin and S&P Global, tend to paint a better picture than official polls due to focusing on more export-oriented manufacturers.

With an extension of the U.S.-China trade truce and expected recovery in export orders, the manufacturing PMI is set to improve in the coming months, according to managing director and head of Asia macro research at OCBC Bank, Dongming Xie.

While in South Korea, President Donald Trump and Xi Jingping committed to a truce regarding automotive chips, critical minerals and more.