China has reportedly banned technology companies like Alibaba and ByteDance from purchasing Nvidia’s chips, as China aims to support domestic chip production amid United States export controls.

The country’s Cyberspace Administration told China’s major technology companies to cancel their orders and halt testing of Nvidia’s RTX Pro 6000D chip, per the Financial Times.

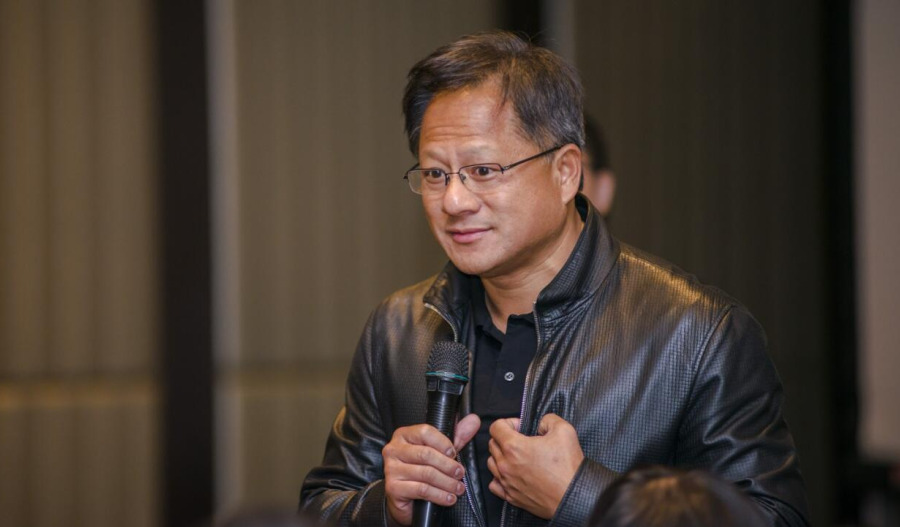

“We probably contributed more to the China market than most countries have. And I’m disappointed with what I see,” said Nvidia CEO Jensen Huang. “But they have larger agendas to work out between China and the United States, and I’m understanding of that.”

Nvidia will “continue to be supportive of the Chinese government and Chinese companies as they wish, and we’re of course going to continue to support the U.S. government as they all sort through these geopolitical policies,” said Huang.

Nvidia’s RTX Pro 6000D and H20 chips were designed for the Chinese market, meeting United States export controls on high-powered chips to China.

A ban on exporting the H20 to China was lifted in July, with Nvidia agreeing to pay 15% of its Chinese revenue to the U.S. government. The RTX Pro 6000D was unveiled that month.

While Chinese regulators have discouraged China-based companies from buying H20 chips in recent months due to worries that U.S. entities could control the chips remotely, companies like Alibaba had ordered Nvidia chips to train their artificial intelligence models.

China’s domestic chipmaking industry has seen a surge in development since the U.S.’ export controls were introduced. Chinese regulators have reportedly decided that China-made chips from companies like Cambricon and Huawei are now comparable in ability to Nvidia’s semiconductors.

The Chinese government also ruled this week that Nvidia broke anti-monopoly laws, saying it violated the terms of China’s conditional approval of its 2020 purchase of chip designer Mellanox Technologies.

Nvidia’s (NASDAQ: NVDA) share price closed at US$170.29, down from its previous close at $174.88. Its market capitalisation is $4.14 trillion.

Related content