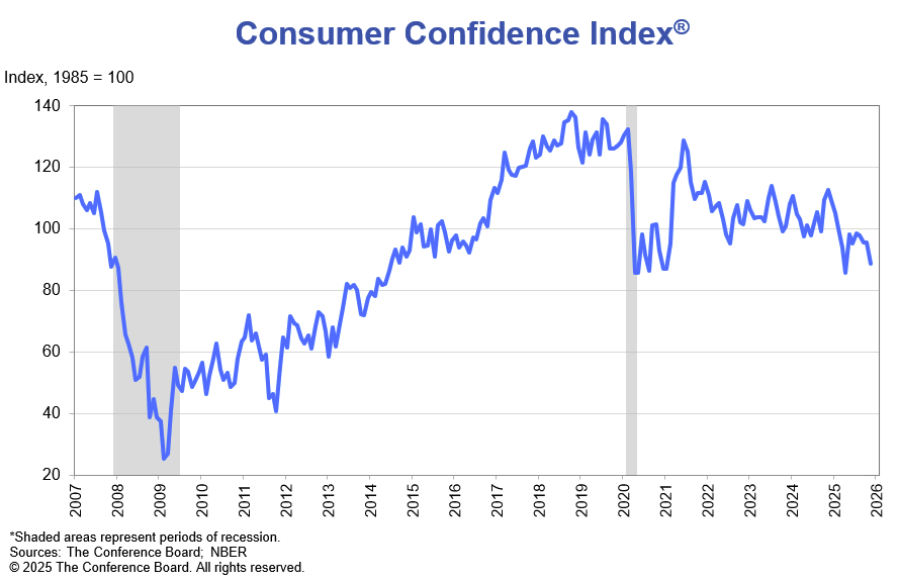

United States consumers have become more pessimistic about the current economy and their prospects for the future, according to a new Conference Board survey.

The board’s Consumer Confidence Index fell sharply by 6.8 points to 88.7 from 995.5 in October.

“Consumer confidence tumbled in November to its lowest level since April after moving sideways for several months,” The Conference Board chief economist, Dana Peterson, said.

The Expectations index saw a particularly steep drop of 8.6 points to 63.2. This index measures consumers' short-term outlook for income, business and labour market conditions.

The Expectations Index has tracked below 80 points for ten consecutive months, reaching the threshold that signals an incoming recession.

“Consumers were notably more pessimistic about business conditions six months from now,” Peterson said.

“Mid-2026 expectations for labour market conditions remained decidedly negative, and expectations for increased household incomes shrank dramatically, after six months of strongly positive readings.”

While confidence for consumers aged 35 or older is on a downward trend, confidence continues to improve among those under 35.

However, confidence within all income brackets fell after several months of increasing confidence for most groups.

Confidence also fell among all political parties, with the sharpest decrease found in independent voters.

Consumers were particularly pessimistic about business conditions and the labour market.

For business conditions, 27.7% expected them to worsen, up from 22.2% in October.

Despite negative views on the labour market, those who anticipated fewer jobs fell from 28.8% to 27.5%.

The present conditions index also dipped by 4.3 points to 126.9.

The amount for workers who said jobs were “plentiful” fell 6% from 28.6%.

This comes as the ADP reported that private companies shed an average of 13,500 jobs over the past four weeks.

Inflation expectations rose, with respondents expecting a 4.8% rate one year from now, well above the Fed’s 2% target.

Peterson noted that there was generally a more negative sentiment among consumers for November than in October.

“Consumers’ write-in responses pertaining to factors affecting the economy continued to be led by references to prices and inflation, tariffs and trade, and politics, with increased mentions of the federal government shutdown,” Peterson said.

“Mentions of the labour market eased somewhat but still stood out among all other frequent themes not already cited.”