Broadcom has bested estimates for earnings per share and revenue driven by its artificial intelligence products, and forecast continued growth.

The company’s diluted earnings per share last quarter were US$1.58, up $0.48 year-over-year and above LSEG estimates of $1.56. Its revenue was $15.00 billion, rising 20% and passing estimates of $14.99 billion.

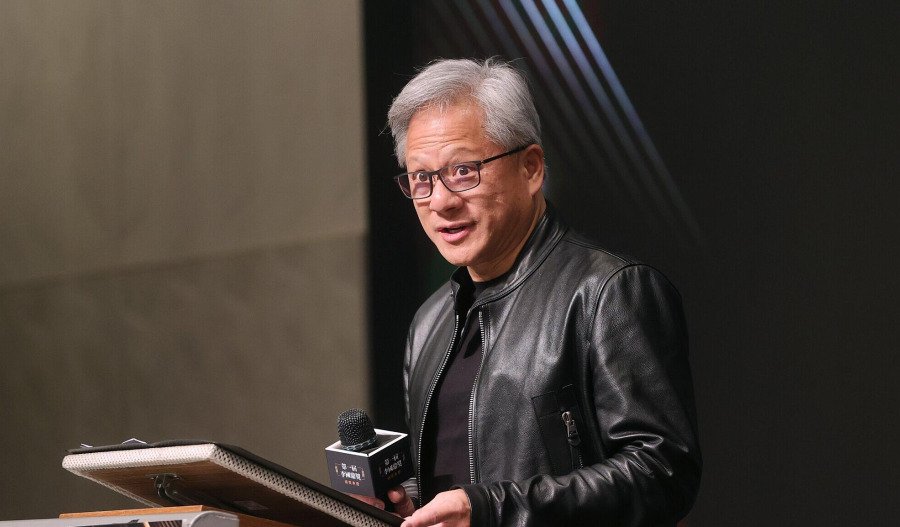

“Broadcom achieved record second quarter revenue on continued momentum in AI semiconductor solutions and VMware. Q2 AI revenue grew 46% year-over-year to over $4.4 billion driven by robust demand for AI networking," said Broadcom CEO Hock Tan.

“We expect growth in AI semiconductor revenue to accelerate to $5.1 billion in Q3, delivering 10 consecutive quarters of growth, as our hyperscale partners continue to invest.”

GAAP net income was US$4.965, increasing by 134% year-over-year. Adjusted ETBIDA was $10.00 billion, rising by $1.96 billion.

Its semiconductor solutions segment posted the highest revenue last quarter, up 17% to US$8.41 billion. Infrastructure software’s revenue grew by 25% to $6.60 billion.

The company’s third quarter guidance expects revenue of around US$15.8 billion. While some average estimates were $15.7 billion, some projections were up to $1 billion higher.

Broadcom also said this week that it would begin shipping its Tomahawk 6 Ethernet switch series, which includes more than double the bandwidth of other Ethernet switches on the market.

Broadcom’s (NASDAQ: AVGO) share price closed at US$259.93, before falling to $249.98 in after-hours trading following the earnings release. Its market capitalisation is $1.22 trillion.