Due to robust demand from investors seeking higher income, the strong annual net bond issuance by non-financial corporations experienced over 2025 is expected to persist into 2026.

However, Australian bond investors are actively rotating into shorter-dated securities as of February 2026, due to a significant divergence in interest rate outlooks between Australia and the United States.

While Australia’s central bank is looking decidedly more hawkish on rates, in the U.S., the Fed is widely expected to continue easing, with some forecasts projecting a neutral target of 3.00% to 3.25%.

Global investors sidestep US debt woes

Unsurprisingly, with Australian 10-year yields now around 65 basis points higher than U.S. Treasuries - the widest premium in three years - global investors are seeking "Australian duration" as an alternative to U.S. debt woes.

Fund managers are rotating out of longer-dated Tier 2 (T2) bank bonds - due to inadequate spread compensation – in favour of shorter-dated 2030s that offer comparable spreads with less duration risk.

While the market is currently pricing in one to two additional RBA rate hikes for 2026 - which has pushed short-term yields higher - longer-term yields also remain sensitive to global inflation and U.S. factory data.

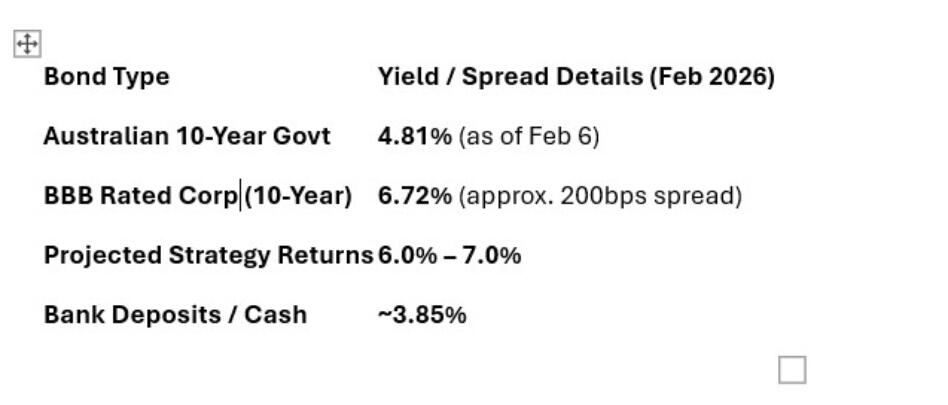

The Australian corporate bond market in February 2026 is characterised by robust issuance and high yields, driven by the RBA’s cash rate rising to 3.85% on 3 February.

Front end of the curve

It’s understood that strategic duration is being rebuilt at a lean 1.7 years, specifically skewed toward the front end (shorter-term) of the curve to limit drawdowns from potential further hikes in May 2026.

While High yields (e.g., 4.8% on 10-year bonds) are continuing to attract some buyers, the consensus remains defensive, especially with the RBA warning that inflation may remain above target for an extended period.

Investment-grade corporate bonds continue to modestly outperform government bonds as credit spreads have levelled out.

While corporate bond spreads remain near historic lows, yields of 6%–7% are being projected for higher-income strategies, significantly outperforming cash.

The last few days have been busy in the primary market with foreign entities issuing A$-denominated debt (Kangaroo bonds) continuing to turbocharge the market, contributing around 27% of recent new issuance.

Noteworthy recent corporate action includes:

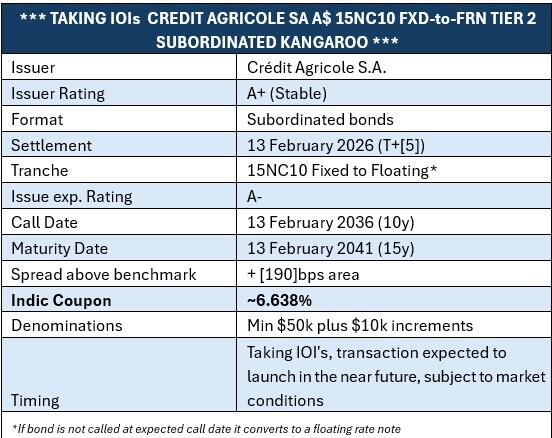

French bank, Credit Agricole, is seeking expressions of interest for a new multi-tranche transaction which could launch as soon as tomorrow.

Like Westpac, this is also a financial institution, albeit a non-Australian one. Initial guidance on Credit Agricole’s 10 year callable bond is ~6.6%.

The issue will have an A- rating, the same as that of Westpac, yet the return is likely to end up 0.5% higher.

At face value, opportunities to pick up that additional return purely due to lack of name recognition always look relatively attractive.

Westpac is taking indications of interest (IOI) for a senior and/or Tier 2, 15-year, non-call 10 deal with price guidance of 75 basis points over swap and 145 basis points over semi-quarterly swap, respectively.

ING Bank Australia (A/A3/A) is taking IOI for a senior unsecured deal, across multiple tranches with a 2.75-year and /or five-year, fixed and/ or floating. Price guidance is 70 basis points over swap and 83 basis points over swap.

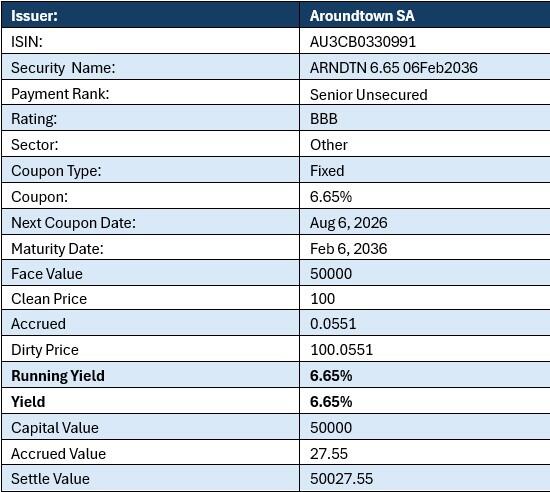

Aroundtown: For those looking to diversify away from the sector altogether, the German property giant Aroundtown launched a new 10-year bond, offering a coupon of 6.65% and a BBB rating.

Aroundtown is another European issuer that offers investors a yield premium above its Australian peers.

The bond is senior unsecured, unlike most of the financial issuance, which is largely subordinated. This means that it sits higher in the capital structure and has a legal maturity of 10 years, not a call date.

Having issued in the A$ market before, Aroundtown is one of the largest landlords in Germany, investing in office, hotel, retail, logistics and residential property.

Pick up this bond at a price of 100 is better than what investors were getting it on launch day, resulting in the yield to maturity equivalent to that of the coupon, being 6.65%.

Aroundtown priced a dual tranche $600 million kangaroo deal:

- $300 million in a five-year fixed-rate tranche with a 6% coupon

- $300 million in a 10-year fixed-rate tranche with a 6.65% coupon

AusNet ((BBB+/Baa1) priced a $1.1 billion 30NC10 hybrid in a dual tranche deal:

- A $450 million floating rate tranche priced at 177 basis points over 3-month BBSW

- A $650 million fixed-to-floating

- g rate tranche (the lowest in the capital structure) with a 6.49% coupon.

Avanti Finance (BB/Pos) has mandated Ord Minnett to arrange a series of investor meetings. Subject to market conditions, an A$ transaction may follow.

Watercare Services Limited (Aa3) has mandated banks for a potential 5.5-year or 10-year FXD senior secured transaction.

This article does not constitute financial or product advice. You should consider independent advice before making financial decisions.