Financial technology company Block missed estimates on revenue and earnings per share last quarter, but sent shares up after raising its gross profit guidance.

Revenue was US$6.05 billion, dropping from $6.16 billion year-over-year and below LSEG estimates of $6.31 billion. Adjusted diluted earnings per share were $0.62, above the $0.47 seen one year ago but under estimates of $0.69.

“We had a strong second quarter. Square GPV grew 10% year over year and Cash App gross profit grew 16% year over year, accelerating as we exited Q2,” wrote Block CEO Jack Dorsey.

“Our focus on products that can drive network expansion is already paying off as we started rolling out Pools on Cash App in July, just four months after kicking off development work. Our shipping velocity has accelerated and I’m confident in our ability to sustain strong growth at scale.”

Adjusted net income was US$385 million, up from $301 million, while operating income increased from $307 million to $484 million. Gross profit rose by 14% to $2.54 billion.

While transaction and subscription-based revenue increased year-over-year, Bitcoin and hardware revenue declined.

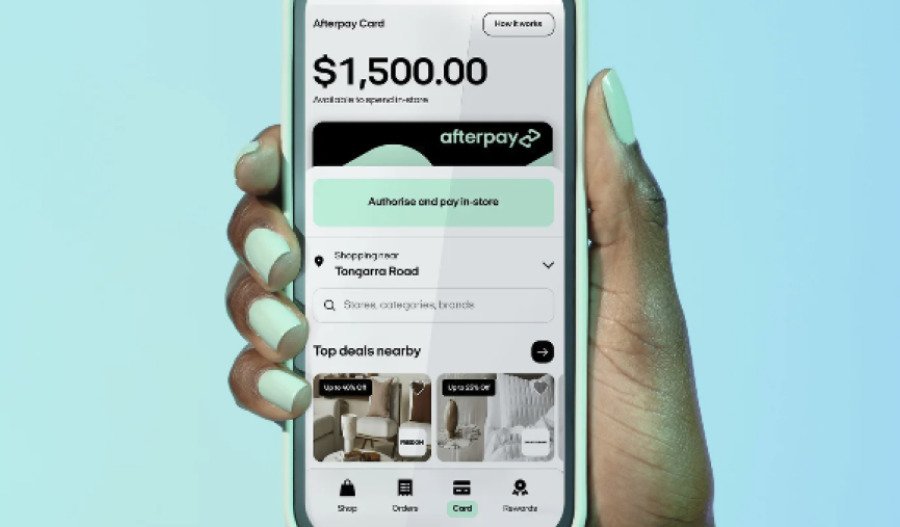

Square’s gross profit was up 11% year-over-year to US$1.03 billion, with gross payment volume rising 10% to $64.24 billion. Cash App’s gross profit grew by 16% to $1.50 billion.

Block began rolling out its Square Handheld payment processor internationally last quarter after launching in the United States in May. Cash App released its Pools group payment feature in July.

The company has raised its full-year outlook to project US$10.17 billion in gross profit. Its Q1 forecast expected gross profit of $9.96 billion.

Block estimated its gross profit next quarter would be US$2.60 billion.

Block’s (NYSE: XYZ) share price closed at US$76.85, but jumped to $86.77 in extended trading before settling at $81.15. Its market capitalisation is $46.30 billion.