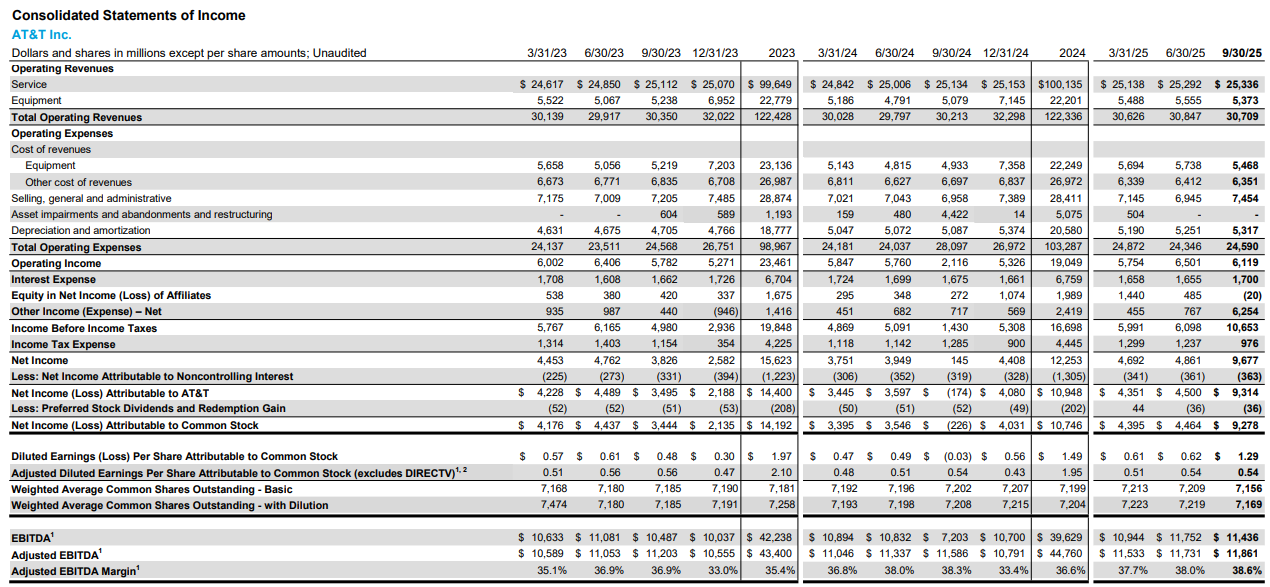

Telecommunications giant AT&T maintained its full year financial guidance after announcing a flat adjusted operating profit for the third quarter of the 2025 financial year (Q3 FY25).

The American company said net income in the three months ended 30 September was $9.7 billion, which included a $5.5 billion gain on the sale of its remaining DIRECTV investment, versus $0.1 billion in the previous corresponding period (pcp), which included a $4.4 billion non-cash goodwill impairment.

When adjusted for certain items, adjusted operating income rose 1.5% to $6.6 billion on revenue, which edged up by 1.6% to $30.7 billion as higher Mobility, Consumer Wireline and Mexico income was partially offset by a decline in Business Wireline income.

AT&T said diluted earnings per share (EPS) were $1.29 versus a three-cent loss in the pcp, but when adjusted for the gain on the 70% DIRECTV sale, legal settlement costs and other items, they were consistent with the pcp at 54 cents.

The Dallas-based company said the strong third-quarter results demonstrated continued customer demand for its wireless and fibre offerings and positioned it to deliver on its full-year consolidated financial outlook.

The company reiterated its FY25, FY26 and FY27 financial guidance, including adjusted EPS at the higher end of the $1.97 to $2.07 range for the current year, and adjusted EPS accelerating to double-digit percentage growth in 2027.

“We have the key building blocks in place to give our customers the best connectivity experience in the industry and we’re winning the race to lead in convergence,” Chairman and CEO John Stankey said in an earnings release.

“We continue to add highly-profitable customers that are choosing AT&T for all their connectivity needs on the country’s fastest and largest wireless and fibre networks.

“It’s clear our differentiated investment-led strategy is working, and we remain on track to achieve all of our 2025 consolidated financial guidance.”

Q3 is an important quarter for U.S. wireless carriers as competition around Apple's annual iPhone launch peaks.

Adjusted EPS was broadly in line with, but revenue was just short of, forecasts, according to LSEG data.

AT&T shares (NYSE: T) closed 50 cents (1.92%) lower at $25.55 on Wednesday (Thursday AEDT), capitalising the company $183.3 billion.

Founded in 1885 as part of the Bell Telephone Company, AT&T (American Telephone and Telegraph) had a monopoly on U.S. telephone services for much of the 20th century before being broken up into regional companies in 1984 to encourage competition.

The current AT&T was formerly known as SBC Communications, one of the regional companies formed from the breakup, which bought the old AT&T in 2005 and adopted the name.