Verizon Communications has lifted its profit outlook for the 2025 financial year (FY25) after reporting an 8.9% earnings increase for the second quarter (Q2).

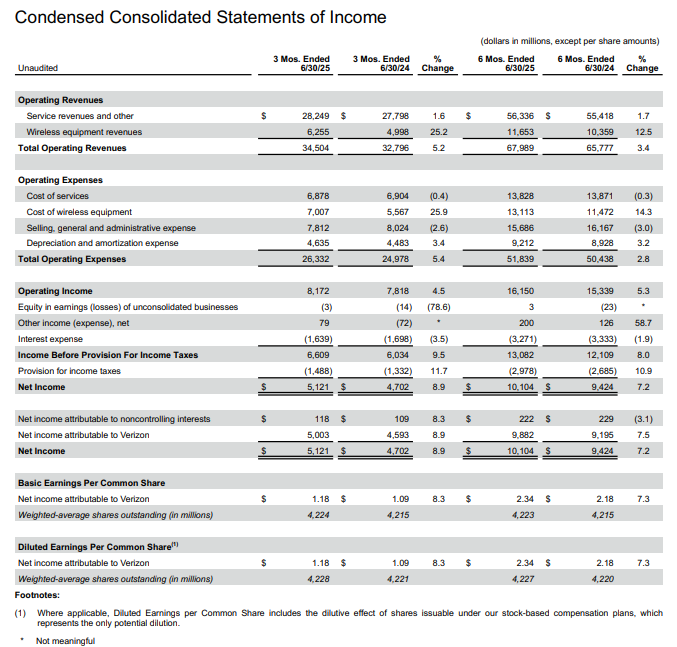

The American telecommunications company said net income was US$5.12 billion (A$7.87 billion) in the three months ended 30 June 2025 compared with $4.70 billion in the previous corresponding period (pcp).

Diluted earnings per share (EPS) rose 8.3% to $1.18 on operating revenue which grew 5.2% to $34.5 billion in Q2.

In the half year ended 30 June, net income rose 7.2% to $10.10 billion and diluted EPS grew 7.2% to $2.34 on revenue which increased 3.4% to $67.99 billion.

Cash flow from operations totalled $16.8 billion in the first-half, up from $16.6 billion in the pcp.

"Verizon's strong second-quarter financial performance reflects our high-quality, industry-leading customer base, our multiple growth paths, the success of our disciplined, segmented approach, and the inherent strength of our company,” Chairman and CEO Hans Vestberg said in a press release.

Verizon introduced customer retention promotions as it faces intense competition from AT&T (NYSE: T), T-Mobile (NASDAQ: TMUS), Comcast (NASDAQ: CMCSA) and Charter (NASDAQ: CHTR).

The company, which offers wireless, broadband and television services among others, said its strong performance and favourable tax reform gave it the confidence to update full-year guidance to:

- adjusted earnings before interest, tax, depreciation and amortisation (EBITDA) growth of 2.5%-to 3.5%

- adjusted EPS growth of 1-3%

- cash flow from operations of $37.0 billion to $39.0 billion, and

- free cash flow of $19.5 billion to $20.5 billion.

The result exceeded analyst forecasts for revenues and EPS.

Verizon (Nasdaq: VZ) shares closed $1.65 (4.04%) higher at $42.49, capitalising the company at $179.15 billion.

The company was founded in 1983 as Bell Atlantic, one of the original ‘Baby Bells’ formed after the break-up of AT&T (American Telephone and Telegraph) for anti-trust reasons.