Welcome to our live blog coverage of earnings season!

This is the time of year when publicly traded companies report their financial results, giving investors and analysts a glimpse into their performance and future outlook. We'll bring you real-time updates, analysis, and commentary on the latest earnings reports from major companies across various sectors. Stay tuned as we break down the numbers, highlight surprises, and provide insights into what these results mean for the market.

-----------------------------------------------------------------------------------------------------------------------------------------------------

Summary

- Verizon revenue stays strong amid subscriber loss

- Tesla's revenue and income plummet

- RTX, Equifax, SAP see revenue rise

- Capital One's income grows

- Northdrop Grumman, Kimberly-Clark earnings crater

- Danaher's earnings beat estimates, though decline continues

_______________________________________________________________________________________

8:50 am (AEST):

Good morning! Harlan Ockey here to take you through today's earnings.

To kick things off in New York, Verizon (VZ) reported an increase in revenue, growing by 1.5% to US$33.5 billion.

Its earnings per share were US$1.15, rising from $1.09 year-over-year. Verizon's net income was $5.0 billion, up from $4.7 billion last year.

Wireless equipment revenue was US$5.4 billion last quarter, up by 0.7%, while wireless service revenue increased by 2.7% to $20.8 billion. The company's total broadband connections grew to more than 12.6 million at the end of the quarter, rising by 13.7%.

However, Verizon lost 289,000 wireless postpaid phone subscribers, above estimates of 197,000, and around 2.5 times Q1 2024's postpaid subscriber loss.

“We continue to drive our multi-year customer-first strategy, launching new programs such as our 3-year price lock and free phone guarantee for consumers and My Biz Plan for small and medium sized businesses, said CEO Hans Vestberg. ”With our high quality customer base, network superiority and position of financial strength, we have the momentum and flexibility to continue innovating to meet customer needs and invest for growth."

The company affirmed its 2025 guidance, which projects adjusted earnings per share growth of 0-3% and wireless service revenue growth of 2.0-2.8%.

9:15 am (AEST):

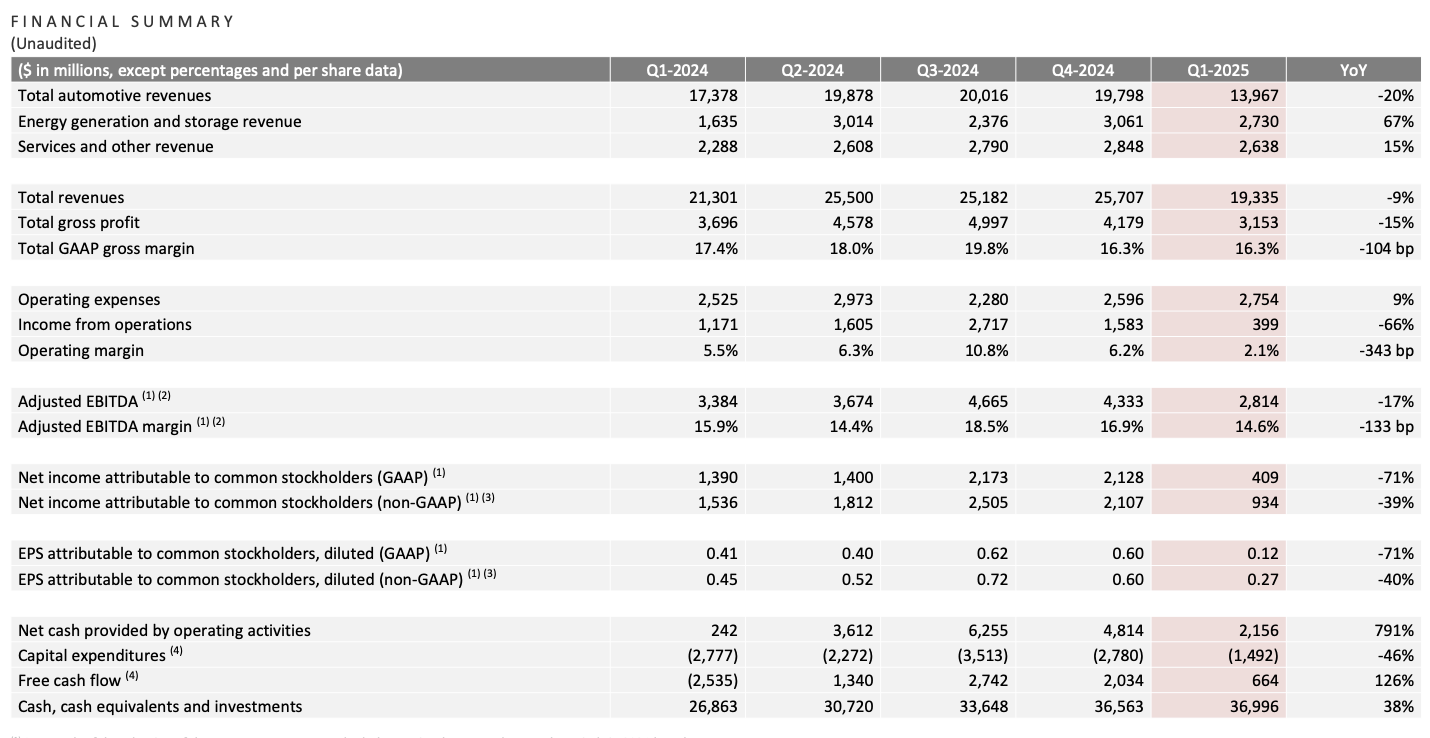

At the NASDAQ, Tesla (TSLA) has missed estimates on revenue and earnings per share, posting major slumps from the previous year.

Tesla's revenue was US$19.34 billion, below LSEG's projected $21.11 billion and down 9% year-over-year. Earnings per share were US$0.27, under estimates of $0.39 and a 40% drop from Q1 2024.

Its net income plummeted by 71% to just US$409 million.

Total automotive revenues fell by 20%, while revenue for its energy generation and other services rose by 67% and 15% year-over-year, respectively.

“Uncertainty in the automotive and energy markets continues to increase as rapidly evolving trade policy adversely impacts the global supply chain and cost structure of Tesla and our peers,” the company said. “This dynamic, along with changing political sentiment, could have a meaningful impact on demand for our products in the near-term.”

Tesla sales have declined significantly in 2025. This is partly due to CEO Elon Musk's close alliance with U.S. President Donald Trump, which has led to boycotts and protests worldwide.

The company said it would “revisit our 2025 guidance in our Q2 update”.

Garry West has the full story.

9:47 am (AEST):

Back at the NYSE, RTX (RTX) saw sales increase by 5% to US$20.3 billion.

Its adjusted earnings per share were US$1.14, up 10% year-over-year and beating Zacks estimates of $1.35.

“Organic growth was broad based and led by strength in commercial aftermarket, which was up 21 percent year-over-year driven by continued demand for our industry leading products and solutions,” said CEO Chris Calio.

"The current environment is clearly very dynamic, but our company is well positioned to perform operationally and our teams remain focused on executing on our commitments and delivering our robust backlog."

The company's adjusted net income grew by 11% to US$1.99 billion.

Collins Aerospace and Pratt & Whitney both saw major sales growth, at 8% and 14% respectively. Raytheon's sales dropped by 5%, which the company said was due to its divestiture from its cybersecurity arm last year.

RTX affirmed its full-year outlook, which expects adjusted sales of US$83-84 billion. However, this projection does not include the impact of the Trump administration's tariff plans. RTX has said that this could dent its 2025 profits by up to $850 million.

10:09 am (AEST):

Still at the NYSE, Capital One (COF) posted a decrease in revenue, but beat estimates on earnings per share.

The company's revenue fell by 2% year-over-year to US$10.0 billion. This is below Zacks estimates of $10.03 billion.

Its adjusted diluted earnings per share were US$4.06, however, surging past estimates of $3.66. Net income was $1.4 billion, an increase of 10%.

Capital One's net interest income increased by 7% to US$8.01 billion last quarter.

Last week, Capital One's acquisition of Discover Financial Services was approved by U.S. regulators, with the transaction set to close in May.

“The combination of Capital One and Discover will create a leading consumer banking and payments platform with unique capabilities, modern technology, and powerful brands. It leverages Capital One’s technology transformation and digital capabilities across a significantly larger customer franchise. And it offers the potential to enhance competition and create significant value for merchants and customers,” said Capital One CEO Richard Fairbank.

Oliver Gray has the full story.

10:30 am (AEST):

Moving to the ASX, Azzet's Garry West has an update on the market's opening this morning.

Good news from the United States which buoyed share prices in New York have provided the conditions for a strong day on the Australian Securities Exchange (ASX) on Wednesday. ASX market participants can expect to see their trading screens lit up with green as futures trading indicate the market benchmark will open more than 1% higher than previous close as market participants digest overnight events in the United States.

Stock indices closed up on Wall Street, buoyed by hopes of an easing of U.S.-China trade tensions based on comments from Treasury Secretary Scott Bessent that he expected a de-escalation of U.S.-China trade tensions. He told journalists “no one thinks the current status quo is sustainable”.

After the market closed, stocks jumped further in extended trade after President Donald Trump said he had no plans to fire Federal Reserve Chair Jerome Powell, someone he has criticised harshly recently.

The major stock indices finished higher with the Dow Jones Industrial Average up 2.7%, the S&P 500 gaining 2.5% and the Nasdaq Composite rising 2.7%.

In Australia, at 9:30 am AEST (11:30 pm GMT Tuesday) the S&P/ASX 200 June share price index futures contract was 100 points (1.27%) higher than the previous settlement at 7,936.

Stocks in focus today will include Atlas Arteria, Insignia Financial, Paladin Energy and Woodside Energy, which are scheduled to provide quarterly updates, and Latitude Group, which holds its annual general meeting, according to CommSec.

11:20 am (AEST):

Staying at the ASX, Woodside Energy (WDS) has reported a 13% year-over-year rise in revenue in Q1 2025, reaching A$3.32 billion.

Its revenue declined by 5% from 2024's Q4, “primarily due to lower production and lower-oil linked prices”, the company said.

Woodside Energy produced 49.1 million barrels of oil equivalent, falling by 4% from Q4 2024 due to unplanned outages and weather issues. Its quarterly production was up 9% from Q1 2024, however.

“Significant progress was made on our major growth projects, all of which are proceeding to schedule and within budget," said CEO Meg O'Neill.

Its Beaumont New Ammonia Project is set to begin pre-commissioning activity in Q2, ahead of its opening in the second half of the year.

Woodside also agreed to sell a 40% stake in Louisiana LNG to Stonepeak this month.

11:40 am (AEST):

Chloe Jaenicke here, taking over the blog for a bit.

Moving onto the NYSE, Lockheed Martin (LMT) reported sales of US$18 billion for Q1 2025, compared to $17.2 billion in the same period last year.

The company also reported net earnings of $1.7 billion, or $7.28 per share and year-over-year growth of 4%.

According to Lockheed Martin chairman, president and CEO, Jim Taiclet, this reaffirms the company’s 2025 outlook.

"These solid first quarter results reinforce confidence in our ability to achieve the full year 2025 financial guidance we laid out in January, demonstrating the resilience and adaptability of Lockheed Martin's franchises amidst a highly dynamic geopolitical and technical environment,” he said.

11:48 am (AEST):

Staying on the NYSE, Northrop Grumman Corporation (NOC) stocks have plummeted, following a 7% sales decrease in the first quarter of 2025.

The company’s net earnings for Q1 2025 amounted to US$481 million compared to $944 million in the same quarter last year.

The loss can be attributed to higher manufacturing costs resulting in a change in process made by the company to enable an accelerated production ramp, as well as increases in the projected cost and quantity of general procurement materials.

“Global demand for our products remains strong, which is reflected in our record first quarter backlog, and we are making significant progress on our key programs,” Northrop Grumman chair, chief executive officer and president Kathy Warden said.

“The Northrop Grumman team remains committed to driving innovation to meet our customers’ priorities, expanding our market presence and optimising performance to deliver profitable, sustainable growth. Given this, we are reaffirming our sales and free cash flow guidance for the year.

12:06 pm (AEST):

Insurance company Chubb (NYSE: CB) reported first-quarter revenue of US$12.65 billion, falling short of the $12.94 billion consensus estimate.

Net income and core income came to $1.33 billion and $1.49 billion for the quarter, respectively, compared to 2.14 billion and 2.16 billion last year. According to the company, unfavourable currency movements impacted core operating income by $36 million.

“Our income and premium revenue this quarter were impacted by foreign exchange due to a strong dollar, which has since weakened considerably,” Chubb chairman and CEO Evan Greenberg said.

“Premiums were also impacted by two one-time items in our North America business: reinstatement premiums related to the wildfires in personal insurance, and larger-than-usual, one-off structured transactions written last year in our Major Accounts division.”

12:23 pm (AEST):

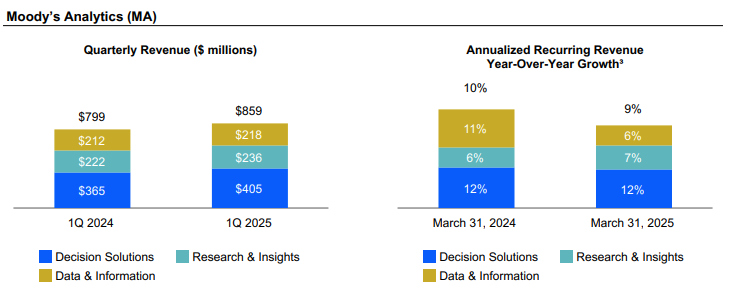

Moody’s (NYSE: MCO) reported an 8% year-on-year revenue increase to US$1.9 billion.

The growth includes an 11% growth in Decision Solutions, 6% increase in Research and Insights and a 3% growth in Data & Information.

The company also reported earnings of $3.83 per share, beating the Zacks Consensus Estimate of $3.56 per share and beating last year's $3.37 per share.

Moody’s chief financial officer, Noémie Heuland, said the company will be considering updating and widening its full-year guidance range based on market volatility.

We now expect to deliver Adjusted Diluted EPS1 between $13.25 to $14.002, representing 9% year-over-year growth at the mid-point.” Heuland said.

“We believe our financial strength allows us to continue investing to meet the needs of our customers to help drive durable growth.”

12:55 pm (AEST):

Thanks Chloe! Harlan Ockey back with you now.

At the NYSE, Equifax (EFX) saw its revenue grow by 4% last quarter to US$1.44 billion, above the midpoint of its February guidance.

The company's revenue rose across sectors, with its U.S. Mortgage revenue increasing by 7% and Workforce Solutions up by 3%. Internationally, its Q1 revenue rose by 7% on a local currency basis.

Equifax's diluted earnings per share were US$1.06, compared with $1.00 in Q1 2024. Its net income was $133.1 million, up 7%.

“We are maintaining our full-year 2025 Guidance midpoint expectation for local currency revenue growth of 6% and adjusted EPS of $7.45 per share. Despite our very strong, above guidance first quarter results, we are maintaining our full-year 2025 Guidance due to the significant uncertainty in the global macroeconomic environment and direction of U.S. inflation and interest rates,” the company said.

Equifax also said that it would repurchase up to US$3 billion of its common stock.

1:26 pm (AEST):

Over at the NASDAQ, Intuitive (ISRG) beat earnings per share estimates for the fourth consecutive quarter. The company's earnings per diluted share were US$1.81, above Zacks estimates of $1.71 and Q1 2024's $1.50.

Intuitive also beat revenue estimates, reporting a year-over-year increase of 19% to US$2.25 billion.

Its da Vinci robotic surgical system posted a 17% rise in procedures, while its installed base grew by 15% to 10,189 systems.

The company's full-year 2025 outlook projects da Vinci procedures will grow by 15-17%, with its non-GAAP gross profit margin representing 65-66.5% of revenue. In 2024, its gross profit margin was 69.1% of revenue, though Intuitive estimates U.S. tariffs could impact this by 1.7%.

"As we look ahead, we remain focused on enabling our customers to deliver on their goals: better patient outcomes, improved patient and care team experiences, lower total cost to treat, and increased access to care," said CEO Gary Guthart.

2:00 pm (AEST):

Returning to the NYSE, Kimberly-Clark (KMB) reported a drop in both its net sales and earnings per share. The company said this was driven by currency pressures and divestitures.

Its net sales declined by 6% year-over-year to US$4.8 billion, while organic sales fell by 1.6%.

Diluted earnings per share were US$1.70, falling from $1.91 one year ago.

In North America, the company's net sales fell by 3.9%, partly due to the sale of its personal protective equipment business last year. Its International Personal Care division saw net sales drop by 8.9%, while its International Family Care & Professional segment's net sales were down 7.7%.

“Despite the evolving external landscape, our first quarter was consistent with our full-year plan,” said CEO Mike Hsu. “At the same time, the current environment will now mean greater costs across our global supply chain versus our expectations at the beginning of the year. However, we remain confident in our ability to offset these costs over time and unlock our long-term potential."

Kimberly-Clark has cut its full-year 2025 outlook due to the estimated impact of these higher supply chain costs. Its adjusted earnings per share and adjusted operating income are now projected to be flat to positive on a constant-currency basis. Both metrics were previously expected to see single-digit percentage growth.

2:49 pm (AEST):

Again at the NYSE, Danaher (DHR) beat estimates on revenue and earnings per share, though these metrics continued to decline.

The company saw revenue fall by 1% year-over-year to US$5.74 billion, above Zacks estimates of $5.56 billion.

Revenue from its Life Sciences and Diagnostics divisions dropped by 3.5% and 3.1% respectively, but similarly beat estimates. Its Biotechnology segment was the only division to post an increase in revenue, rising by 6% to US$1.61 billion.

Adjusted earnings per share were US$1.88, surpassing estimates of $1.62. This is a decline from Q1 2024's $1.92, however.

“Revenue, earnings, and cash flow exceeded our expectations in the first quarter–highlighted by continued momentum in bioprocessing and better-than-expected respiratory demand in our molecular diagnostics business,” said CEO Rainer Blair.

"While the macro backdrop has become more dynamic since the start of the year, it's in times like these that Danaher's positioning and capabilities truly stand out. We believe that the combination of our team's DBS-driven execution, resilient portfolio and strong balance sheet will continue to differentiate Danaher in 2025 and beyond."

Danaher's share price closed at US$192.07, up from its previous close at US$184.96.

3:24 pm (AEST):

Still at the NYSE, Elevance Health (ELV) reported major increases in earnings per share and individual membership.

Its adjusted diluted earnings per share were US$11.97, above Zacks estimates of $11.21. This is a 10.5% increase over Q1 2024.

Individual membership grew by 10.6% year-over-year to 1.42 million. Medicare memberships also rose by 5.9%. However, Employer Group Risk-based, Medicaid, and Federal Employee Program memberships all declined. Total medical memberships increased by 0.2% to 45.8 million.

Operating revenue was US$48.8 billion, up 15.4% year-over-year. Total revenues were $48.9 billion, rising by 14.8%, while premiums grew by 14.5% to $40.9 billion.

“In the first quarter, we made measurable progress reimagining the healthcare experience with personalised support, real-time digital solutions, and a whole-health model that improves outcomes and reduces cost,” said CEO Gail Boudreaux.

The company reaffirmed its full-year 2025 guidance, which projects adjusted diluted earnings per share of US$34.15 to $34.85.

3:48 pm (AEST):

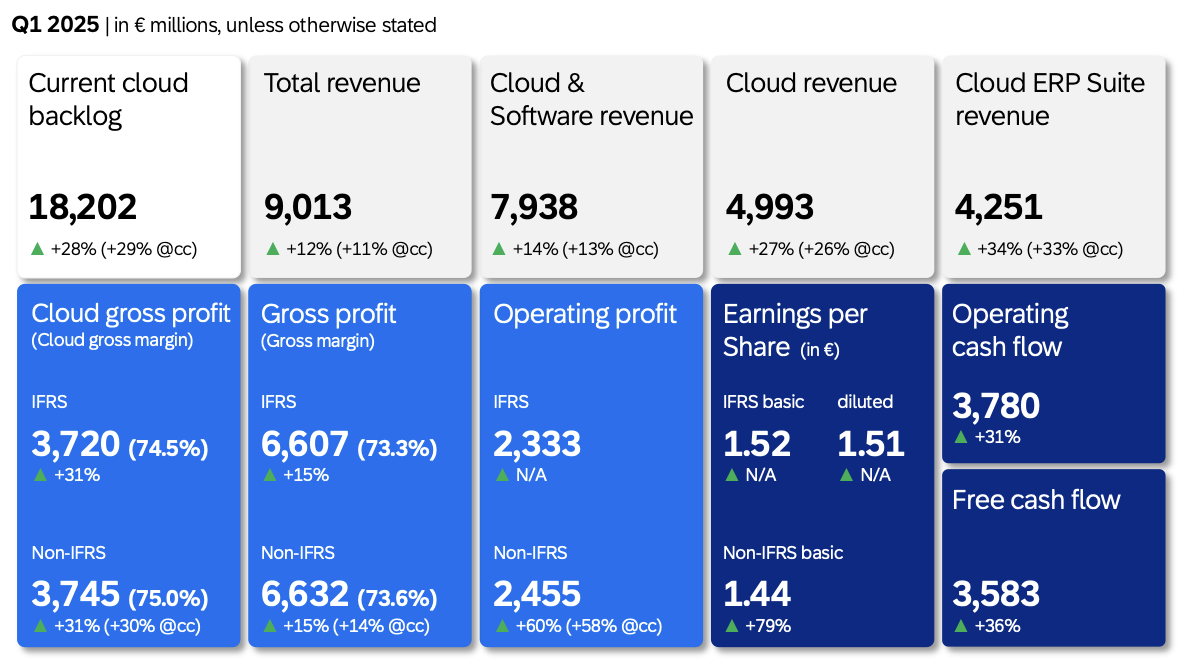

Turning to Frankfurt, SAP (SAP) saw its total revenue increase by 12% to EU€9.01 billion.

Its adjusted earnings per share were EU€1.44, above Q1 2025's €0.81 and mean estimates of €1.30.

The company's cloud revenue rose by 27% to reach EU€4.99 billion, while its current cloud backlog grew by 28% to €18.2 billion.

Its total cloud and software revenue was €7.94 billion, up 14%. SAP's software license revenue declined by 10% to €180 million.

SAP's free cash flow was EU€3.58 billion, rising by 36% year-over-year.

“Q1 marks a solid start to the year in a highly volatile environment, with strong total revenue growth and outstanding operating profit expansion. These results are a testament to our cost discipline and focused execution. While we’re encouraged by this momentum, we remain mindful of the broader environment and are approaching the rest of the year with vigilance, continuing to safeguard both profit and cash flow,” said CFO Dominik Asam.

The company also said its restructuring program, first announced in January 2024, was completed as planned last quarter. Around EU€300 million was paid out under this program in Q1, with another €400 million to be paid later in the year.

SAP's full-year 2025 guidance projects EU€21.6-21.9 billion in cloud revenue, and €33.1-33.6 billion in combined cloud and software revenue. Current cloud backlog growth is likely to slow this year, the company said.

4:22 pm (AEST):

At Mexico City's BMV, Banorte (GFNORTEO) reported that its net interest income rose by 4% year-over-year to MX$95.4 billion (US$4.86 billion, A$7.6 billion).

Net income was up by 8%, reaching MX$15.3 billion. This is above LSEG estimates of $15.04 billion.

The company's assets under management grew by 14% year-over-year to MX$4.72 trillion. The majority of these assets were stage 1 loans, which saw a similar increase of 14%. Stage 2 loans were up by 8%.

Banorte's earnings per share were MX$5.44, up 10% year-over-year.

Its Banco Mercantil del Norte subsidiary saw the highest net income last quarter, up 7% to MX$11 billion.

Bineo, Banorte's financial technology subsidiary, posted a net loss of MX$289 million, a 54% slump. Banorte CEO Marco Ramirez said this week that it would either sell Bineo's banking license for around US$100 million, or merge it into Banorte's main operations.

Banorte also said last week that it would acquire full ownership of Targetas del Futuro, which owns RappiCard's credit card services, for US$50 million. Established in a joint venture with Colombian company Rappi in 2021, RappiCard issued 1.1 million credit cards last year.

Banorte projects 10% loan book growth across 2025.

That's all from me today; thank you for joining us this earnings season!