Technology giant Tesla has reported a 71% plunge in net income to US$409 million (A$639 million) for the first quarter (Q1) of the 2025 financial year and warned it would revisit guidance due to the impact of uncertainty on demand for its products.

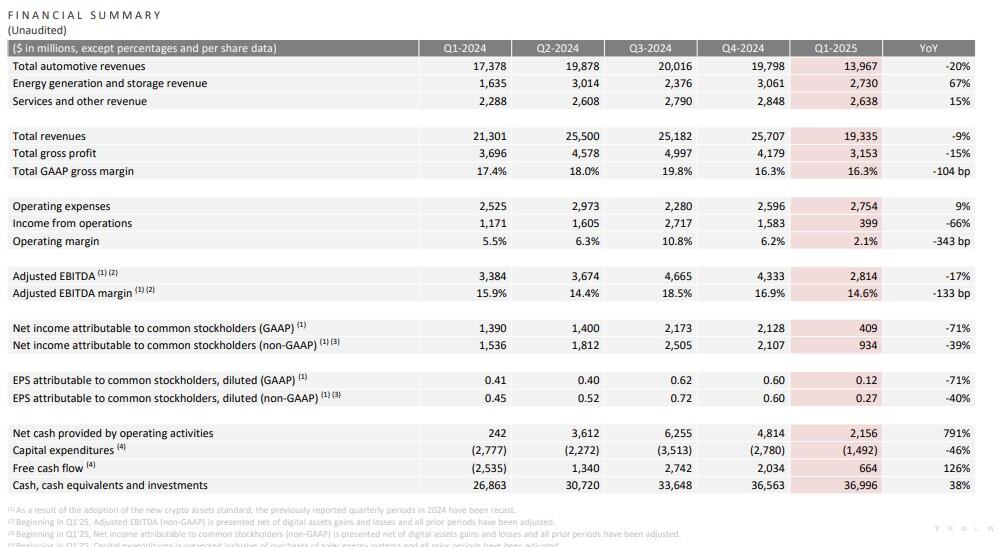

The electric vehicle (EV) maker and clean energy company said earnings per share (EPS) fell 40% to 27 cents and operating margin shrank to 2.1% from 5.5% on revenue which declined 9% to $19.335 billion in the first three months of the year.

Tesla, run by the world’s wealthiest person Elon Musk, attributed the fall in earnings to lower vehicle deliveries and selling prices and an increase in operating expenses driven by artificial intelligence and other research and development projects.

This was partially offset by a decrease in selling, general and administrative expenses, growth in energy generation and storage gross profit, lower Cybertruck production ramp costs, lower vehicle costs and higher regulatory credit revenue.

Tesla said uncertainty in the automotive and energy markets continued to increase as rapidly evolving trade policy adversely affected the global supply chain and its cost structure and that of its peers.

“This dynamic, along with changing political sentiment, could have a meaningful impact on demand for our products in the near-term,” the company said in an update.

The CEO of Tesla and with a net worth of $342 billion, Musk is also a key adviser to United States President Donald Trump, and his role in overseeing a massive government cost-cutting program has created brand damage for the EV and solar energy company.

Referring to “near-term profitability hurdles”, Tesla said its low-cost manufacturing base provided advantages in delivering the best products at the right price to customers, but “we will revisit our 2025 guidance in our Q2 update".

Although Q1 revenue and EPS fell short of forecasts of $21.45 billion and 43 cents, respectively, the share price rose as some analysts had expected an even worse outcome.

Tesla (NASDAQ: TSLA) shares finished $10.47 (4.6%) higher at $237.97 on Tuesday, giving it a market capitalisation of $745.67 billion, and they continued rising in after-hours trading to $250.99 at the time of writing.