New research points to a widening productivity gap between smaller companies and their larger counterparts when it comes to the deployment of Artificial Intelligence (AI), with the latter effectively scaling the technology to cut costs tied to human workers using it.

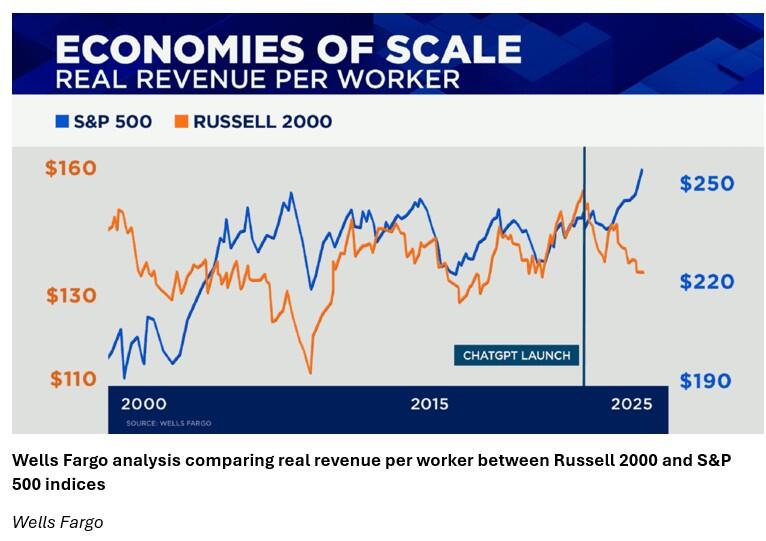

According to Wells Fargo analysis, large-cap companies have witnessed steady AI-related productivity gains since the release of OpenAI’s ChatGPT model in 2022 in terms of their real revenue per worker.

However, over the same period, the firm found that small-cap names have witnessed a decline in productivity.

″While productivity for the S&P 500 has soared 5.5% since ChatGPT, it’s down 12.3% for the Russell 2000,” Wells Fargo equity strategist Ohsung Kwon wrote in a recent note to clients.

“We see other examples of diverging trends in consumer, industrial, and financial markets.”

|

Nowhere is that divergence in the productivity stakes more evident than in the performance of the S&P 500 versus the Russell 2000 small-cap index.

While the broad market index is up 74% since ChatGPT’s 2022 launch, the Russell is up only 39%.

Breakthrough advancements in AI this year have seen the biggest U.S. corporations like Amazon use the technology in ways to eliminate human roles, improve their productivity and supply chain efficiency.

While layoffs this year have been on the rise, a recently published World Economic Forum survey found that around 40% of companies globally expect to replace workers over the next five years with AI-automated tasks.

While some major companies, including Target, Amazon, Meta, Starbucks, Oracle, Microsoft and UPS, have already announced major cuts to their total headcount in an attempt to streamline operations and growth strategy as reasons for cuts, many directly attribute staff cuts to the deployment of AI.

It’s understood that e-commerce giant Amazon - a leader in robot deployment across its facilities - is on track to replace more than half a million jobs with robots, in an attempt to save around 30 cents on each item Amazon selects, packs and delivers to customers.

Based on Morgan Stanley’s analysis, Amazon’s robotics efforts can save the company between US$2 billion and US$4 billion by 2027.

While AI investments have seen Klarna shrink its workforce by about 40%, in May, CrowdStrike announced cuts to 5% of the company’s global workforce, citing AI efficiencies.

IBM’s CEO expects 30% of non-customer-facing roles to be cut by 2028 and told The Wall Street Journal earlier this year that AI chatbots have replaced 200 HR employees, freeing up investments to hire more people in sales and programming.

Palo Alto Networks, Walmart and McDonald’s are also amongst other companies leveraging AI to improve margins.

Meanwhile, an Intuit QuickBooks Small Business Insights survey of 5,000 small businesses in the U.S., Canada, the UK, and Australia in September shows that 68% of businesses have integrated AI into their daily operations, with around two-thirds reporting an increase in productivity.