Back on October 1st, I wrote about how infrastructure stocks would become the AI boom's real winners. While everyone obsessed over which chat model would come out on top, the smart money was following the picks-and-shovels plays - the chipmakers, data centres, power grids and the memory that makes AI actually work.

Sixteen days later, we can confirm something remarkable: global AI infrastructure spending has crossed US$1 trillion already for 2025. And we did it ahead of schedule, outpacing even the most bullish analyst predictions.

It's downright unprecedented. We've witnessed ~$500 billion in new deals and commitments for hard-asset tech since my October 1st piece alone.

A casual half a trillion dollars in barely two weeks of coordinated capital deployment across semiconductors, data centres and cloud infrastructure. It's bonkers.

The Manhattan Project cost $28 billion in today's dollars. The Apollo Program? $257 billion adjusted for inflation. We're operating at an entirely different scale.

Following the money: where the trillion went

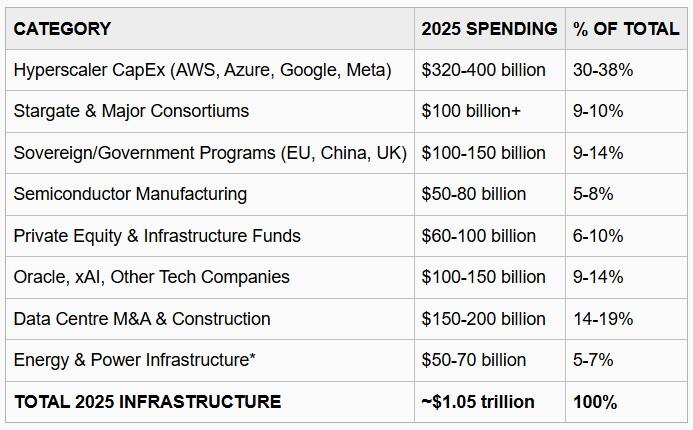

Here's what $1.05 trillion in AI infrastructure actually looks like when you break it down:

*Note: This represents only partial energy spending tracked in our analysis. Many analyst reports, including Gartner's $1.5 trillion figure, incorporate broader energy buildouts that we haven't fully captured, meaning actual total AI-related expenditure is likely higher.

Eye-whopping capex

The capital deployment hasn't been evenly distributed across this year at all. AI infrastructure spending during September and October (so far) this year has been extraordinary - accounting for roughly $820 billion in disclosed deals and commitments, or an eye-whopping 78% of the year's total infrastructure investment.

September mega-deals:

- Oracle-OpenAI: $300 billion (5-year, starting 2027)

- NVIDIA-OpenAI partnership: $100 billion announced (Sept 22)

- Microsoft-Nebius: $17.4 billion disclosed (Sept 8)

- NVIDIA-Intel strategic investment: $5 billion

- Multiple Stargate expansions

October blitz (Oct 1-17):

- Samsung/SK Hynix-OpenAI: $72 billion+ HBM supply commitment

- BlackRock-Aligned Data Centres: $40 billion acquisition

- xAI-NVIDIA chip lease: $20 billion

- NVIDIA-OpenAI UK initiative: $15 billion

- Broadcom-OpenAI custom chips: $10 billion

These two months alone represent the most concentrated capital deployment in technology infrastructure history.

Making hay while the sun shines

The equity markets have noticed. Since my October 1st article:

- SK Hynix: Hit 25-year highs, jumping nearly 10% on October 2nd alone

- Samsung Electronics: Reached highest levels since January 2021, up 3.5%

- KOSPI: Surged past 3,500 for the first time ever, closing at 3,549.21 (2.70% daily gain, ~48% YTD)

- Nebius: Soared 50% on Microsoft deal disclosure

- Aligned Data Centres: Valued at $40 billion (from $15 billion market cap earlier in year)

- NVIDIA: Added nearly $170 billion in market cap on partnership unveilings

- Oracle: Jumped 7% on Stargate news, continued climbing

Foreign investors poured $6.4 billion into Korean chipmakers in a single week. BlackRock's infrastructure play attracted sovereign wealth funds from Abu Dhabi, Kuwait, and Singapore. That's institutional money making long-term bets - not retail speculation.

Are we spending more than predicted?

Yes. Substantially.

Even the analyst community didn't see spending at this velocity coming. Just last month, Gartner forecast that worldwide AI expenditure (including software and services) would total $1.5 trillion in 2025. That seemed aggressive at the time.

UBS estimated $375 billion in AI infrastructure hardware alone for 2025. McKinsey projected $870 billion-$1.3 trillion annually, averaged through 2030 - implying we shouldn't hit a trillion until 2026 or 2027.

Then there's Dell'Oro Group's most recent forecast.

“We project that data center infrastructure spending could surpass $1 trillion annually within five years,” Dell'Oro senior research director Baron Fung said.

"While AI spending has yet to meet desired returns and efficiency improvements, long-term growth remains assured, driven by hyperscalers' multi-year capex cycles and government initiatives such as the $500 billion Stargate Project."

That was a 2029 projection… we've hit it in 2025.

International Data Corporation (IDC) was more conservative, forecasting that AI infrastructure spending would reach $223 billion by 2028.

"IDC expects AI adoption to continue growing at a remarkable pace as hyperscalers, CSPs, private companies, and governments around the world are increasingly prioritizing AI." VP Lidice Fernandez said.

We've quintupled that 2028 forecast in 2025.

Spending this year has hit $1.05 trillion in infrastructure alone - and that's a conservative count that excludes significant energy buildouts that other analysts include. Add in AI software, services, and full power generation facilities, and we're easily approaching or exceeding $1.5 trillion total.

The fourth quarter still has 2.5 months remaining. If deals continue at even half the October pace, we'll finish 2025 at $1.2-1.3 trillion in infrastructure - 20-30% above the high end of most projections.

It's all connected

Watch how the pieces fit together. The biggest companies in the Western world are building a unified AI ecosystem:

- NVIDIA is simultaneously backing OpenAI ($100 billion), xAI ($2 billion), and Intel ($5 billion)

- OpenAI is partnering with NVIDIA, AMD, Broadcom, Samsung, SK Hynix, Oracle, Microsoft, and CoreWeave

- Microsoft is funding OpenAI, Nebius, CoreWeave, and the AI Infrastructure Partnership

- BlackRock created AIP with MGX, Microsoft, NVIDIA, and xAI as co-investors

- Oracle is building Stargate with SoftBank and OpenAI while providing capacity to both

- Sovereign wealth funds (MGX, Qatar, Saudi PIF) are deploying capital across the entire stack

NVIDIA invests in customers who buy NVIDIA chips. OpenAI trades equity stakes for chip supply. Cloud providers lease capacity to each other. Customer, supplier, investor, partner - the lines have dissolved into a single organism.

And don't forget the likes of Amazon, AMD, Meta, Google, Tesla, Anthropic, banks and other sovereign wealth funds, to name a few.

Think defence industrial base, not tech sector competition. A handful of prime contractors, mutually dependent, financed by the same pools, building toward a common goal…

It's an AI arms race

Because that's exactly what we're watching unfold.

The United States, backed by allied money from the UAE, Japan, South Korea, and Europe, is building 10+ gigawatts of AI computing capacity by 2026. That's enough to power 7.5 million homes - dedicated entirely to training and running AI models.

China, meanwhile, isn't sitting idle. The National Integrated Circuit Industry Investment Fund III injected ¥344 billion (US$47 billion) into domestic chip production.

Alibaba secured nearly 23,000 domestically-produced AI chips for a $390 million facility, and the Chinese government launched an $8.2 billion AI venture fund in April.

China's total visible AI infrastructure expenditure for 2025 appears significantly lower than that of Western levels, but that, of course, should be taken with a grain of salt.

Bottlenecks of note include semiconductor export restrictions and ASML's monopoly on extreme ultraviolet lithography machines, which are creating constraints that compound quarterly.

For its part, China is restricting exports of the critical minerals crucial to the manufacturing of these products. Whether Western deployment velocity is able to continue to accelerate while Chinese procurement capacity hits structural limits remains to be seen, but the divergence is widening for now.

What this means going forward

Three observations worth noting:

- First, the "AI bubble" concerns look misplaced. We're talking fabrication plants, data centres, power generation, and chip production. Long-cycle, hard-asset investments with 5-10 year payback periods. The money is committed, not speculative.

- Second, national AI capability has become infrastructure policy. Trump's emergency declarations for Stargate, the EU's €200 billion InvestAI program, and China's Big Fund III - governments are treating AI buildouts with the same strategic priority they once gave railways, highways, and telecommunications.

- Third, the constraint has shifted. Money and chips are flowing - what's scarce is electricity. Those X-energy SMR partnerships, Microsoft's Three Mile Island restart, the natural gas plant expansions - that's where the next wave is likely to flow.

The trillion-dollar question has been answered. Now we're asking: how far beyond a trillion will we go?

Cameron Drummond is a senior business journalist covering tech, AI and capital markets at Azzet.