The Australian sharemarket is somewhat overvalued because dividend yields are below average, according to Morningstar.

The yield on companies in the ASX 200 index was about 3.1% at the end of August 2025, which was more than one standard deviation below its 10-year historical average of 4.4%, the investment research firm said.

“Yields are less attractive than normal, which supports our view that the Australian stock market is somewhat overvalued,” Morningstar analyst Shaun Ler wrote in the firm's inaugural dividend outlook report for the third quarter of 2025.

The stocks it covered were 6% overvalued on average based on the equal-weighted average price/fair value estimate at 21 September 2025, and 20% overvalued if using a market capitalisation weighted average.

But Morningstar believed the potential for dividend growth was good with distributions set to increase across many sectors in 2026-2027, and yields in some sectors remained attractive.

Falling interest rates were likely to dampen yields, increasing the appeal of equities compared with bonds, but shares appeared to reflect this, and further yield improvement would depend on stronger earnings.

Morningstar expected 64% of the companies it covered to raise distributions in the 2026 financial year and 78% in fiscal 2027, with seven of the market’s 11 sectors forecast to offer higher yields than average: energy (5.5% yield), utilities (5.3%), real estate (4.8%), and financial services (4.7%).

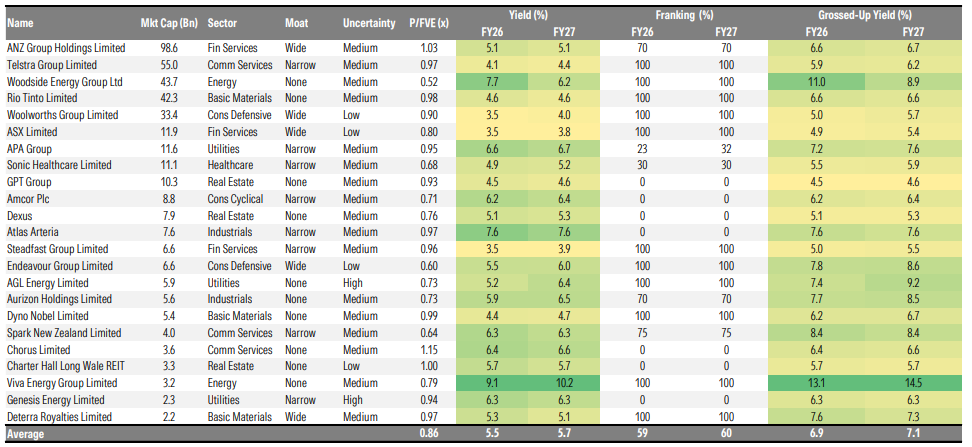

The firm identified 23 companies as its ‘picks’, delivering an average yield of 5.6% for FY26-27, with almost 40% yielding 6.0% or more on average.

“Dividend yields are likely to remain subdued unless earnings growth can compensate for the lower interest rate environment,” Ler wrote.

“Investors should focus on sectors and companies with strong earnings prospects and stable payout ratios to capture yield opportunities.”