Anthropic has confirmed the expanded use of Google Cloud's tensor processing units in a deal worth tens of billions of dollars, the AI startup's largest compute commitment to date.

The arrangement grants Anthropic access to up to one million TPUs and will deliver well over a gigawatt of capacity in 2026.

Building a one-gigawatt data centre is no small matter, built with a price tag of about US$50 billion, with the bulk of that - around $35 billion - going toward chips.

"Anthropic and Google have a longstanding partnership and this latest expansion will help us continue to grow the compute we need to define the frontier of AI," Anthropic chief financial officer Krishna Rao said.

"Anthropic's choice to significantly expand its usage of TPUs reflects the strong price-performance and efficiency its teams have seen with TPUs for several years," Google Cloud CEO Thomas Kurian said.

"We are continuing to innovate and drive further efficiencies and increased capacity of our TPUs, building on our already mature AI accelerator portfolio, including our seventh generation TPU, Ironwood."

Playing both sides

Anthropic's multicloud architecture now spans Google's TPUs, Amazon's custom Trainium chips, and Nvidia's GPUs, with each platform assigned to specialised workloads across training, inference, and research.

The deal positions Google alongside competitor Amazon Web Services (AWS), which has invested $8 billion in Anthropic to-date and serves as its primary training partner.

Rothschild & Co Redburn analyst Alex Haissl estimated that Anthropic added one to two percentage points to AWS's growth in last year's fourth quarter and this year's first, with its contribution expected to exceed five points in the second half of 2025.

Wedbush's Scott Devitt also noted that once Claude becomes a default tool for enterprise developers, usage flows directly into AWS revenue, a dynamic he believes will drive the platform for years to come.

In January, Google agreed to a $1 billion investment in Anthropic, adding to its previous $2 billion and 10% equity stake.

The large language model business now serves more than 300,000 business customers, a 300-fold increase over the past two years.

Large accounts, each worth over $100,000 a year, have grown nearly sevenfold in the past year alone contributing to the company's $7 billion run rate, with Claude Code generating $500 million in its first two months.

Cloud market dynamics

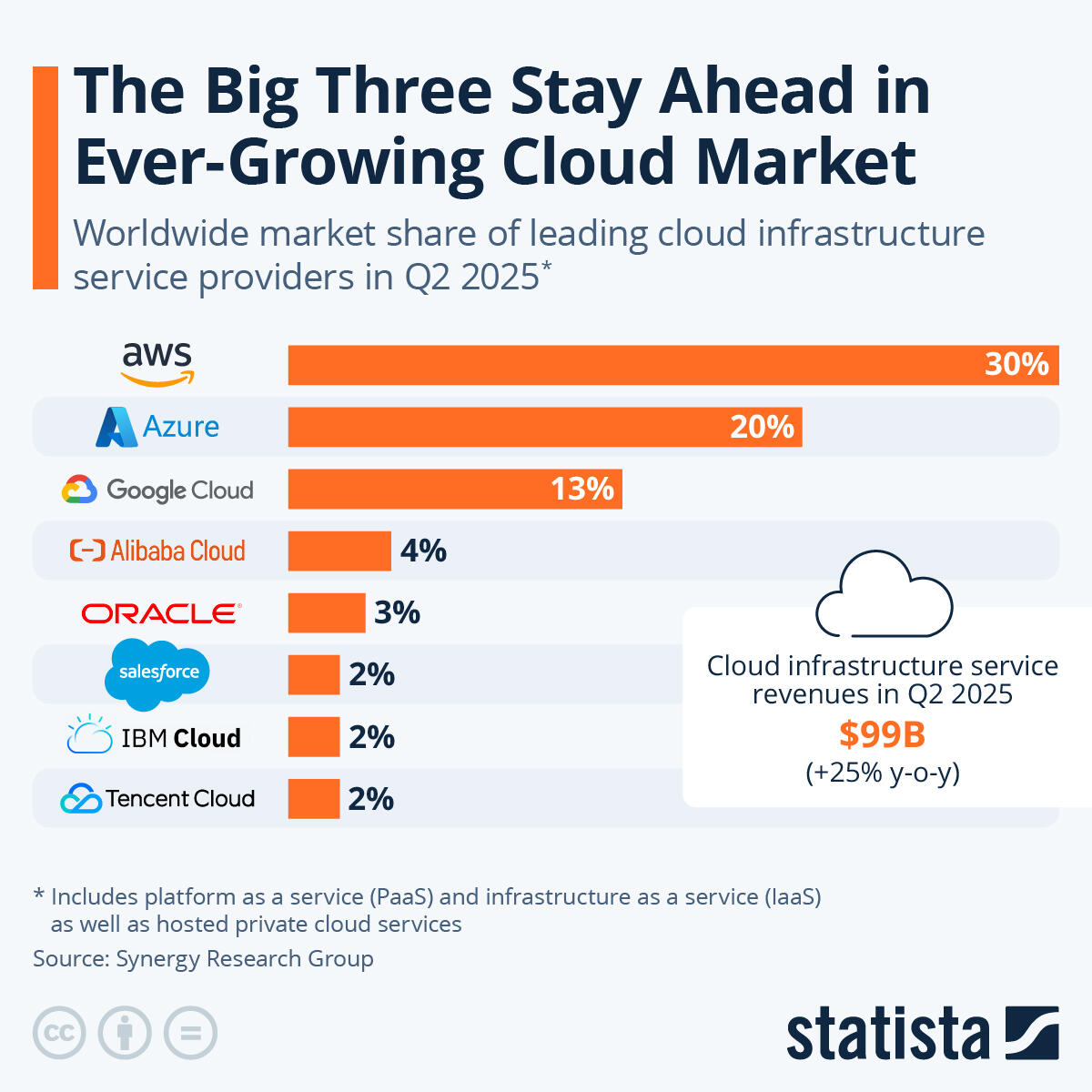

Cloud infrastructure is now a quarter-trillion-dollar market. This year, the Big 3+ China's Alibaba will clear about $259 billion in IaaS/PaaS revenue - up ~25% YoY.

AWS remains the revenue leader at ~$126.6 billion, but its growth rate of 17.5% is well below Azure and GC, both of which come in a the mid-high 30s.