Based on the quality of its £18.8 billion (A$38.7 billion) order book, up 120% in one year, it’s hardly surprising that Rolls-Royce (LSE: RR) – a brand synonymous with luxury and quality - has become the UK share market's best-performing stock over the past three years.

However, with so much upside already factored into the price, there are now mixed broker expectations on the ability of the maker of engines used in large Boeing and Airbus planes to go on climbing from here.

While the FTSE 100 stock’s 115% share price growth in the past 12 months is impressive enough, it has rocketed a mouthwatering 1,190% over five years.

Half-year results

The stock’s share price was given another significant kicker late July on revelations that strong demand for jet engines saw half-year profits rise 50%.

Underlying operating profits climbed to £1.7 billion on the back of underlying revenue of £9 billion, up from £8.1 billion in the same period last year.

At the half year, the free cash flow jumped to £1.58 billion.

While improved profitability was witnessed across all three of Rolls-Royce’s operating divisions, power systems – which produces high-speed engines, propulsion systems, and distributed energy systems - was the strongest division in the results, with revenues up 20% to £2.0 billion, while power generation orders rose 68%.

In the civil aerospace division, revenue saw a 17% rise to £4.8 billion, while the defence division experienced a sharp slowdown from 2024, with revenue only managing a 1% rise to £2.2 billion.

Based on this strong performance, Rolls-Royce raised its guidance for 2025, with operating profit now expected to be in the range of £3.1-3.2 billion, up around 12.5% from the previously guided £2.7-2.9 billion.

Rolls-Royce also raised its free cash flow guidance to £3.0-3.1 billion, compared with previous guidance of £2.7-2.9 billion.

Is Rolls-Royce overheating?

But while ongoing operational improvements have enabled the company to systematically outperform earnings expectations, what clearly unnerves some brokers is the perceived ‘toppiness’ in the share price, which virtually doubled valuations during 2025.

As a result, Rolls-Royce is now the fifth most valuable company on the London Stock Exchange -and vastly exceeds the wider index.

Following the group’s latest results, Citigroup raised its 12-month share price target to 1,440GBp.

Based on the Rolls-Royce share price today, (1,069GBp), that represents around a 35% potential capital gain. Based on these projections, an investment of £5,000 today could grow to £6,852 by this time next year.

Supply chain threats

In light of the company’s improving financial health and multi-year potential tailwinds within its energy-focused segments, Citigroup’s strong outlook appears justifiable.

However, not all institutional analysts agree.

While analysts at JP Morgan share similar bullish sentiment towards the company’s operational improvements, the broker’s price target of 1,040GBp suggests the share price is destined to tread water over the next 12 months.

Admittedly, with the company’s turnaround steadily moving towards completion, the level of execution risk is falling.

However, both Citigroup and JP Morgan analysts flag a persistent threat surrounding the company’s supply chains.

While Rolls-Royce has benefited from increased defence demand, the lion’s share of sales still originates from the commercial aerospace sector, which remains highly exposed to global developments and economic cycles.

SMR nuclear technology

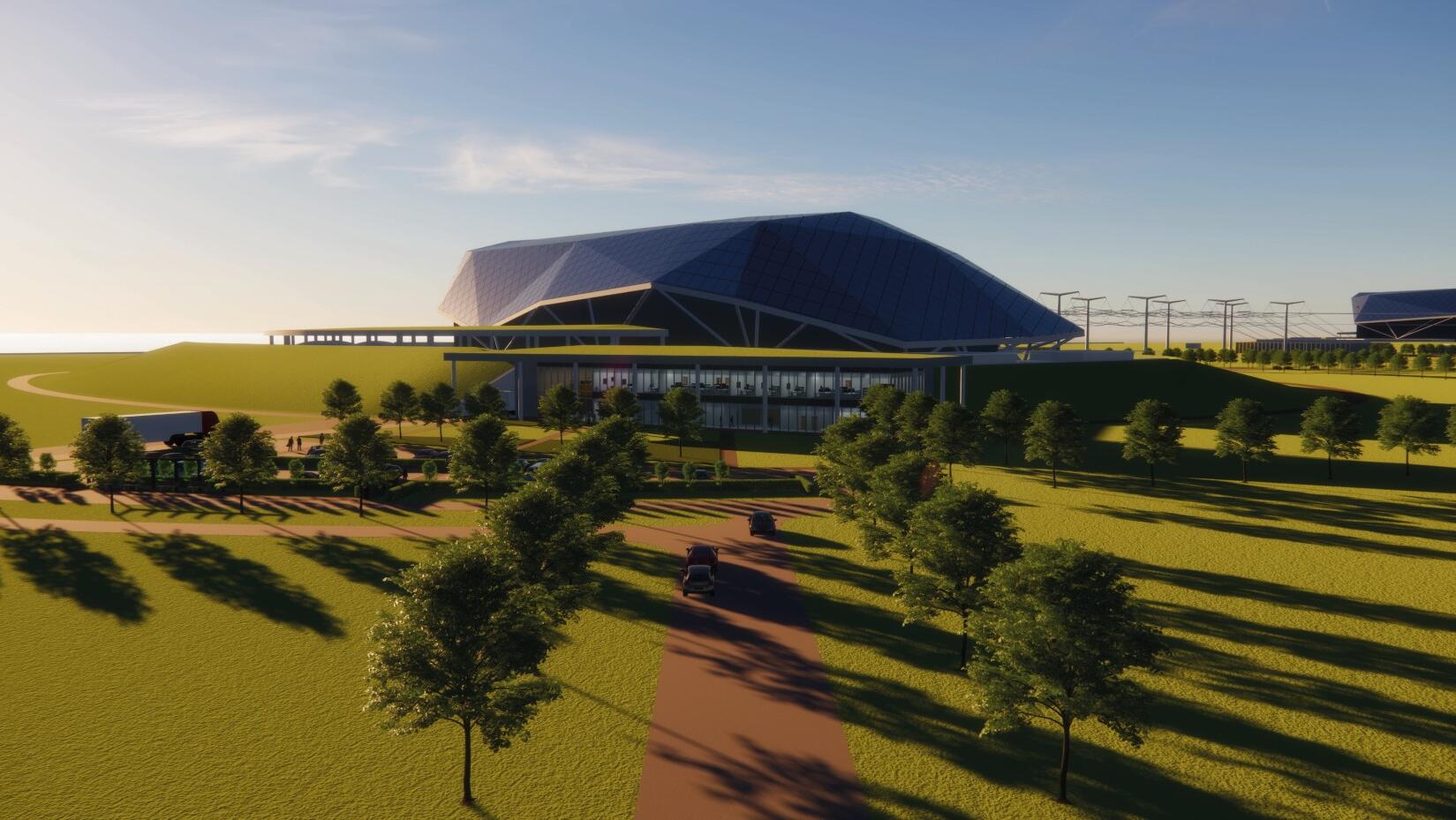

Meanwhile, much of Rolls-Royce’s long-term potential centres around its small modular reactor (SMR) nuclear technology.

The company’s CEO Tufan Erginbilgic, recently told the market that the nuclear business has a chance of making it the biggest company in the UK as the world will need 400 SMRs by 2050, with each costing around £3 billion.

“There is no private company in the world with the nuclear capability we have. If we are not market leader globally, we did something wrong,” he said.

However, there’s no shortage of competitors looking to capitalise on the accelerating demand for affordable nuclear energy.

Without a clearly defined sustainable competitive advantage in this space, the company is exposed to peers potentially stealing market share while also undercutting its pricing power.

Overall, Rolls-Royce appears to be a vastly improved business with exciting future upside.

Back to reality time?

However, the share price may already reflect the expected long-term gains, while also glossing over some underlying operational complexities and competitive dynamics – over which management has little control.

Rolls-Royce has a market cap of £90 billion, making it one of the largest companies in the FTSE 100 index.

Given that the forward-looking P/E ratio of 34 times looks high. it’s understandable why some analysts want to see greater evidence of it growing into that multiple.

Despite the recent heady gains in the Rolls-Royce share price, bullishness in that recent momentum appears to be waning.

This may explain why projections from 16 analysts peg the average 12-month price target for Rolls-Royce at 1,135GBp, which equates to potential upside of 6.19%.

These are hardly giddy prospects for investors entering the stock at current levels, especially given lingering downside risk.

The lowest price target of the range is down at a measly 240BGp, which would mean a 77% crash from the current Rolls-Royce share price: possible, yet highly unlikely.

By comparison, one institutional analyst has placed the five-year share price forecast at 2,389GBp.

That’s around 116% higher than current levels, translating into a market-beating compounded annual return of 17.3% between now and 2030.

This article does not constitute financial or product advice. You should consider independent advice before making financial decisions.