Westpac has announced the sale of its RAMS mortgage portfolio and a 2% fall in full year net profit as a jump in expenses and lower margins offset the benefits of an increase in income.

The Big Four bank said it had sold its $21.4 billion RAMS mortgage portfolio to a consortium including Pepper Money (ASX: PPM), KKR and Pimco.

“This transaction will significantly streamline Westpac’s mortgage operations, reduce run costs across the business and provide further strategic flexibility,” Chief Executive Officer Anthony Miller said in a media release.

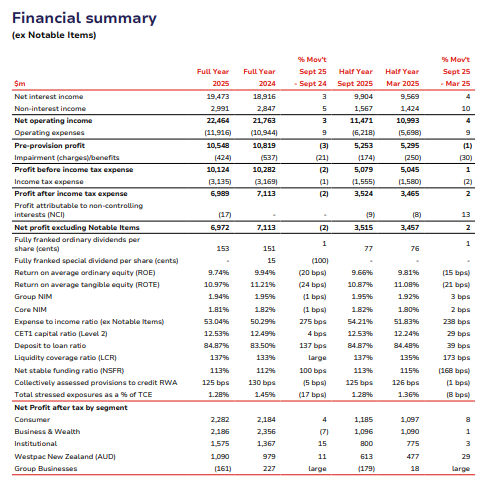

Net profit excluding notable items fell to A$6.972 billion (US$4.56 billion) in the year ending 30 June 2025 from $7.113 billion a year earlier.

Net operating income grew 3% to $22.464 billion as net interest income rose 3% and non-interest income increased by 5% in the 2025 financial year (FY25).

However, operating expenses jumped 9% to $11.916 billion due to technology and UNITE transformation program costs, higher software amortisation and salary and wage growth as more bankers were hired.

This excludes $273 million of restructuring costs.

“We remain focused on reducing our cost to income ratio over time,” Miller said in the media release.

Directors declared a fully franked final dividend of 77 cents to be paid on 19 December to shareholders registered on 7 November, compared with 76 cents a year earlier, making $1.53 for the full year, versus $1.51.

“This has been a solid year at Westpac and I’m pleased with the result we are delivering today,” he said.

He said the bank had managed margins in a competitive environment and its capital position was strong.

Miller was pleased with the 7% and 6% growth in deposits and loans, respectively, with deposits in the Consumer and Institutional divisions rising 10%, institutional lending growing 17% and business lending up 15%.

Westpac’s business lending origination platform BizEdge had reduced the average time to decision by 45% and had begun trialling Westpac One, a cloud-based digital platform that helps institutional customers manage their liquidity.

Net profit after tax beat the consensus analysts' estimate on Visible Alpha of A$6.83 billion.

At the time of writing, Westpac (ASX: WBC) shares were trading 83 cents (2.16%) higher at $39.58, capitalising the company at $135.04 billion.