Westpac Banking Corp has announced a 14% increase net profit after (NPAT) for the third quarter of the 2025 financial year (FY25).

The Big Four bank said statutory NPAT was A$1.9 billion (US$1.2 billion) in the three months to 30 June 2025.

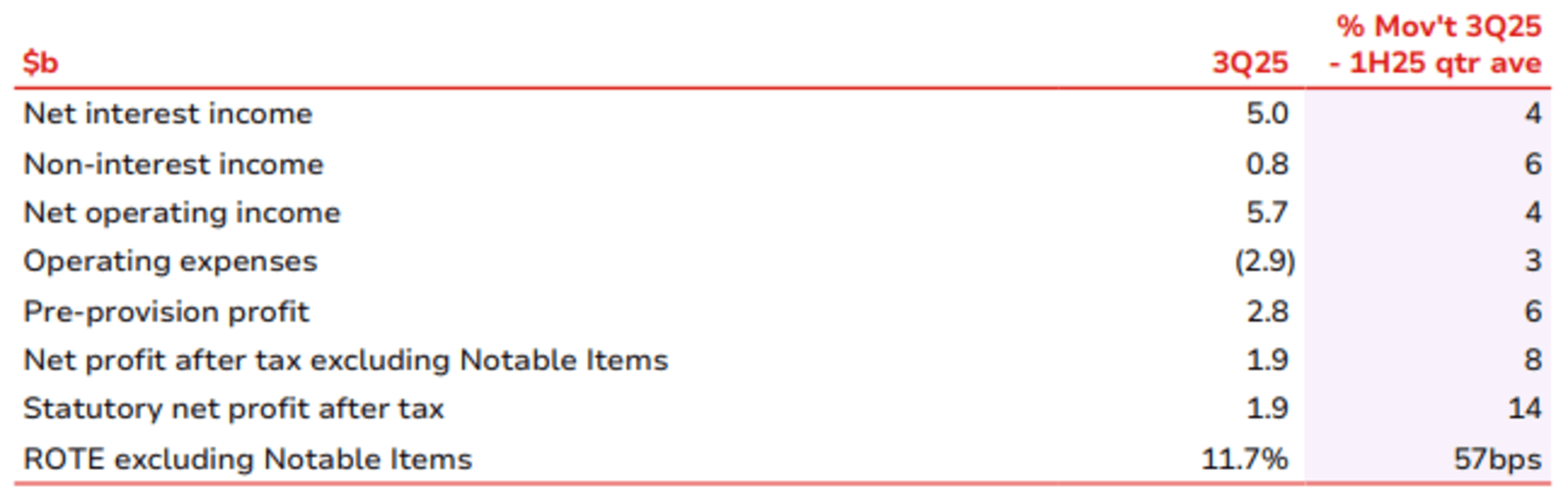

NPAT excluding notable items related to hedging rose 8% to $1.9 billion on net operating income which increased 4% to $5.7 billion.

Net interest income increased 4% to $5.0 billion, mostly due to the five basis point expansion of the net interest margin to 1.85%, and non-interest income gained 6% to $800 million, supported by stronger revenue from the Markets business.

The bank reported growth in Australian housing loans, excluding the RAMS business, of 1%, business loans of 5% and institutional loans of 2%.

Operating expenses rose 3% to $2.9 billion because of wage and salary growth, investment in bankers and the planned increase in the investment in the UNITE transformation initiative.

"This quarter we delivered a sound financial result, while executing on our strategy and priorities,” Chief Executive Officer Anthony Miller said in an ASX announcement.

“We grew strongly in business and institutional banking, while focusing on returns in Consumer and improving customer experience.”

The core net interest margin grew five basis points due to reductions in liquid and trading assets and increases in deposit and loan margins.

Treasury and Markets margins improved as a result of favourable interest rate positioning in a more volatile market environment.

Miller said the resilience of households and businesses, helped by lower interest rates and inflation, was reflected in lower levels of customer stress and should also underpin a recovery in private sector activity and support lending growth.

At the time of writing Westpac shares had risen $1.87 (5.52%) to $35.77, capitalising the bank at $120.74 billion, after ranging between $35.20 and $36.28.

Australia’s oldest bank, Westpac was established in 1817 as the Bank of New South Wales, a name it used until 1982 when it acquired the Commercial Bank of Australia.