A nuclear renaissance is unfolding right before our eyes, and the sector has a boom in energy-hungry artificial intelligence to thank for it.

Intrinsic to the functioning of AI, data centres consumed roughly 415 terawatt-hours globally in 2024 - about 1.5% of total electricity demand - a figure the International Energy Agency projects will more than double to 945 TWh by 2030 and roughly equivalent to Japan's entire electricity consumption.

That's becausae AI queries use almost ten times more power than a standard search, and with hyperscalers racing to expand capacity, that demand isn't slowing anytime soon.

Solar and wind can't deliver baseload reliability at that scale, leaving nuclear as the only carbon-free option capable of meeting the demand - and the uranium market is now caught between that surging appetite and a supply chain that hasn't kept pace.

Spot prices hit US$83.18 per pound in September - the highest mark of 2025 - while the World Nuclear Association forecasts reactor requirements will climb from 68,920 metric tonnes this year to over 150,000 by 2040, a 117% surge that has utilities scrambling for long-term contracts.

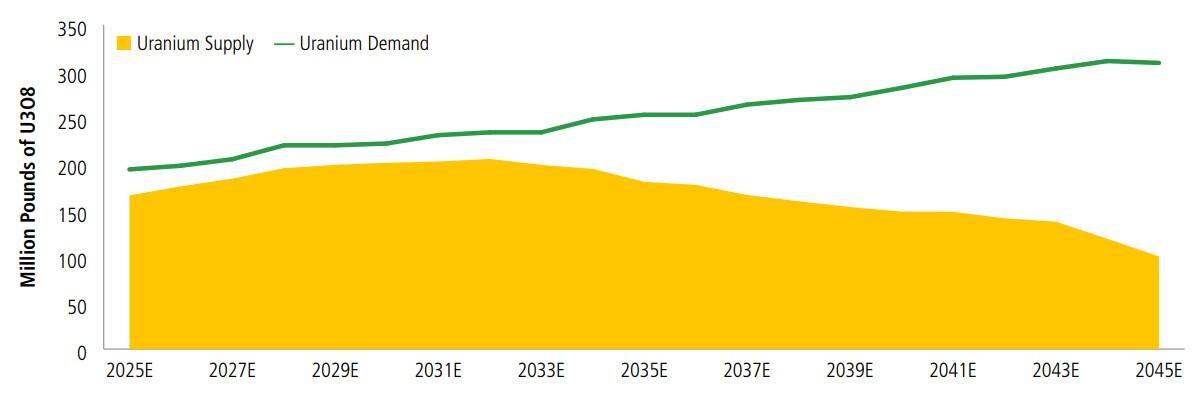

“Global uranium production in 2024 covered less than 80% of reactor demand,” says Oregon Group.

“The gap has been filled by drawdowns in inventories and spot purchases - but that buffer is shrinking.”

Big Tech goes nuclear

Microsoft has inked a 20-year power purchase agreement with Constellation Energy to restart Three Mile Island by 2028 - yes, that one - while Google committed early-stage capital to Elementl Power for 1.8GW across three U.S. sites and Amazon Web Services is deploying 5GW by 2040 through partnerships with X-energy and Dominion Energy.

Meta joined thje party in June 2025 with a 20-year deal for 1.1GW from Constellation's Clinton Clean Energy Center in Illinois, with the company's request for proposals attracting over 50 submissions for up to 4GW of new capacity.

Washington react(or)s

The real bee under the bonnet for uranium (U308) prices hit when the Trump administration signed four executive orders in May 2025 targeting a quadrupling of U.S. nuclear capacity to 400GW by 2050, which translates to building somewhere between a jaw-dropping 250 and 300 new reactors over the next quarter century.

The centrepiece is a US$80 billion partnership with Westinghouse to construct AP1000 reactors nationwide, announced in October, with the U.S. government arranging financing and permitting in exchange for a 20% share of profits once Westinghouse pays out $17.5 billion to owners Brookfield and Cameco.

Each two-unit project creates or sustains 45,000 jobs across 43 states, highlighting the scale of industrial mobilisation the administration is banking on.

"I think you've seen a sea change in the last 18 months," lobbyist Andrew Shaw of Bracewell LLP told E&E News.

"Everybody was talking about SMRs, but now there's a lot of new interest in AP1000s."

That interest extends to deals for Westinghouse's reactors across Canada, Hungary and six UK-based companies that support projects across the world.

The Department of Energy (DoE) is also releasing 20 metric tonnes of high-assay low-enriched uranium (HALEU) for private projects, while Congress designated uranium a critical mineral - opening the door to FAST-41 permitting and federal support for domestic producers.

U.S. Energy Secretary Chris Wright has emphasised the need for larger strategic reserves, pointing out that U.S. operators hold just 14 months of inventory compared to the EU's 2.5 years and China's 12-year stockpile - a gap that leaves American nuclear operators exposed to supply disruptions.

Industry leaders at the recent World Nuclear Fuel Cycle conference in Montreal echoed the urgency.

"The fuel cycle is at a pivotal moment - without fuel you can't run a reactor," Ontario Power Generation CEO Nicolle Butcher told attendees.

Supply hierarchy

Kazatomprom controls roughly 40% of global production, operating 26 deposits across Kazakhstan using low-cost in-situ recovery, though the state-owned and Russian-linked producer announced a 10% output cut for 2026 that will add further pressure to an already tight market.

Cameco runs Cigar Lake and McArthur River in Canada's Athabasca Basin - the highest-grade operations globally - but cut its 2025 production guidance by 19% due to expansion delays at McArthur River, while its 40% stake in Kazatomprom's Inkai joint venture experienced a temporary suspension in January over permit approvals.

Orano (formerly Areva) provides vertically integrated services from mining through enrichment, while Paladin Energy's (ASX:PDN) C$1.14 billion acquisition of Fission Uranium expanded its footprint in Saskatchewan's premier uranium province.

Supply chain crunch

Mining is just the start - the real bottlenecks sit in conversion and enrichment, where decades of underinvestment have left the industry scrambling to catch up with surging demand.

Only four commercial conversion facilities exist globally - in the U.S., Canada, France, and Russia - with a combined capacity of around 62,000t of uranium per year, and as conversion prices have surged from under $10/kg to around $50/kg - ageing infrastructure struggles to keep pace.

New capacity requires well over $1 billion and at least five years to develop, which means any relief is a long way off.

Enrichment presents an even thornier challenge, with Russia controlling 46% of global capacity alongside 14% of conversion services - a concentration that has Western utilities increasingly nervous about supply security.

U.S. enrichment capacity itself sits at 4.3 million separative work units (SWU) against domestic demand exceeding 15 million SWU, and while Urenco is adding 700,000 SWU annually at its U.S. plant by 2025 and 750,000 SWU at Almelo by 2027, the deficit remains structural.

Domestic U.S. production covered just 5% of fuel used in American reactors last year, underscoring the immense scale of the challenge ahead.

"The DoE's money is like a sourdough bread starter - we can't stand up a market without it, really," Curtis Roberts II of Orano USA told E&E News, highlighting the industry's dependence on federal support to get new capacity off the ground.

Price outlook

Analysts expect prices to stabilise between $90 and $100 per pound by mid-2026, with some forecasting triple digits as the supply deficit deepens, though sustained prices above $75-80 are required to incentivise production expansions and greenfield projects need $90-100 to pencil out.

Physical holding funds like Sprott Physical Uranium Trust now control roughly 100 million pounds - about 18 months of global reactor consumption - removing material from circulation and amplifying price movements in the relatively thin spot market.

And BMO Capital Markets has raised its uranium demand growth forecast to a 5.3% CAGR through 2040 - well above its previous 3.6% estimate.

There's "momentum in the industry which we have not seen for decades," Urenco CEO Boris Schucht told CNBC, though warned that the industry is now "way beyond the forecasts and the spreadsheets and the blue sky" - and it has to deliver.