Volkswagen has lowered its full-year outlook and reported a steep drop in second-quarter profit after taking a €1.3 billion (A$2.32 billion) hit from United States import tariffs in the first half of 2025.

The German auto giant continues to wrestle with global trade pressures, restructuring costs, and increased competition in key markets.

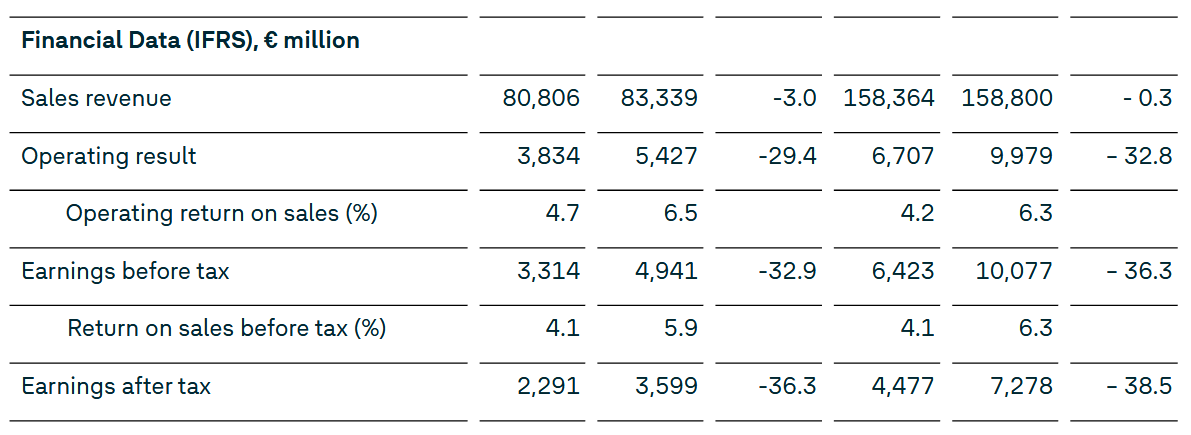

Operating profit for the three months to June came in at €3.83 billion (A$6.84 billion), a 29.4% decline from €5.4 billion a year earlier.

Markets had anticipated a slightly higher figure of €3.94 billion, according to a FactSet consensus. Quarterly revenue also missed expectations, coming in at €80.81 billion versus a forecast €82.16 billion.

Volkswagen said restructuring provisions amounted to €700 million for the first half, compounding the drag from trade policy uncertainty.

Looking ahead, the company now expects an operating return on sales between 4% and 5% for 2025 - down from an earlier forecast of 5.5% to 6.5%.

Full-year sales are now projected to match 2024 levels, compared with a previous estimate of up to 5% growth.

Despite the headwinds, Volkswagen’s shares rose 3.9% on the day, rebounding from earlier losses.

Volkswagen posted notable growth in electric vehicle orders, with first-half intake for all-electric models rising by 62%.

In terms of regional performance, vehicle sales grew 19% in South America, 2% in Western Europe, and 5% in Central and Eastern Europe. Sales fell 3% in China and dropped 16% in North America, largely due to tariff impacts.

Škoda

Škoda Auto, a subsidiary of Volkswagen, emerged as a bright spot, becoming Europe’s third best-selling brand.

The Czech automaker delivered 509,400 vehicles globally in the first half, up 13.6%. Revenue rose 10.4% to €15.07 billion, and operating profit climbed 11.8% to €1.285 billion. Plug-in hybrid and fully electric models made up 22.8% of European deliveries.

CEO Klaus Zellmer said: “It is notable that our success in the first six months has been spread across powertrains, confirming we are on the right course by offering freedom of choice in this era of transition.

"And our order numbers prove, that our EV strategy is also on track: More than 120,000 orders for our all-electric new Enyaq and Elroq models were made by end of June.”

Audi

Audi, another key brand within the group, faced a tougher half. Revenue reached €32.6 billion, with operating profit down to €1.1 billion and net cash flow at €0.9 billion.

CFO Jürgen Rittersberger acknowledged: “Tariffs and expenses for Audi restructuring measures have impacted financial performance in the first half of the year. The figures once again underscore the necessity of the transformation that has been started.”

CEO Gernot Döllner added: “Renewing our portfolio is a key part of the fundamental realignment of Audi.”

Brand Group Core

Despite market pressures, the Brand Group Core - which includes Volkswagen, Škoda, SEAT/Cupra and Volkswagen Commercial Vehicles - saw sales revenue rise 5% to €72.5 billion.

Operating profit increased to €3.46 billion, supported by improved capacity utilisation, cost reductions, and refreshed product lines.

Within the Brand Group Progressive, Bentley, Lamborghini and Ducati all contributed positively but showed signs of strain.

Bentley delivered 4,876 vehicles, down 11%, with profit falling to €81 million. Lamborghini held steady with 5,681 deliveries and €431 million profit, while Ducati saw a 5.7% drop in sales and a fall in operating profit to €53 million.