Accepting the United States’ investment demands without a currency swap could lead to a crisis for South Korea’s economy, South Korean President Lee Jae-myung has said.

Under a July trade agreement, South Korea would invest US$350 billion (A$530.9 billion) in the U.S. in exchange for a lower tariff rate. The two countries have not yet implemented the deal, and are continuing to negotiate.

“Without a currency swap, if we were to withdraw $350 billion in the manner that the U.S. is demanding and to invest this all in cash in the U.S., South Korea would face a situation as it had in the 1997 financial crisis,” Lee told Reuters.

South Korea has suggested a foreign exchange swap line to the U.S., though Lee did not say if the U.S. was likely to agree.

The $350 billion investment would include $150 billion in shipbuilding and $100 billion in liquefied natural gas. The deal would lower U.S. tariffs on South Korean goods from 25% to 15%.

U.S. Commerce Secretary Howard Lutnick has said that unless South Korea accepts the deal, including the investment package, its tariff rate will continue to be 25%. “Black and white, pay the tariffs or accept the deal,” he said.

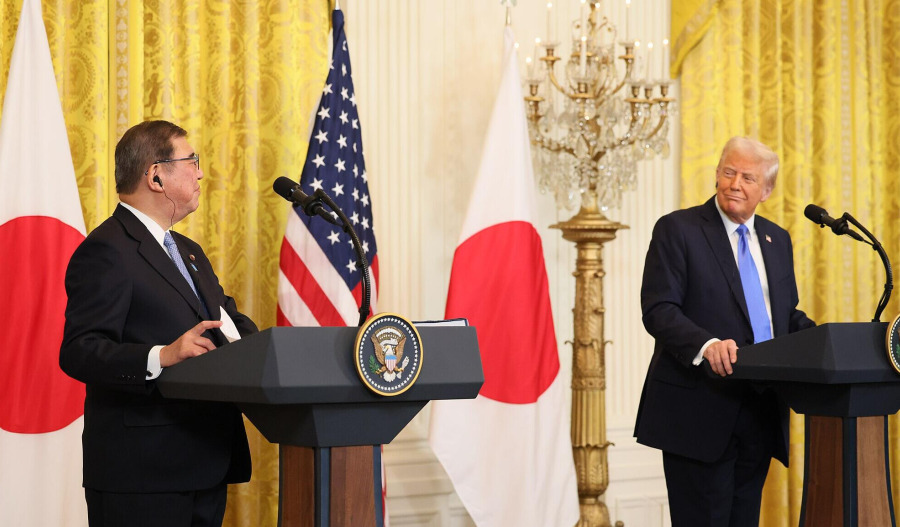

Japan agreed to a similar $550 billion investment under a trade agreement with the U.S. in July, though the countries have continued to dispute how the investment will be allocated even after the agreement was signed this month.

South Korea does not currently have an offshore market to trade its won. Its foreign reserves are around $410 billion, less than half of Japan’s.

Lee also said the raid by U.S. immigration authorities on a Georgia Hyundai plant earlier this month, which arrested more than 300 South Korean workers, would not undermine ties between the U.S. and South Korea. “I do not believe this was intentional, and the U.S. has apologised for this incident, and we have agreed to seek reasonable measures in this regard and we are working on them.”

Related content