The United States and China have struck a tentative trade agreement that would see Beijing resume rare earth and magnet exports while Washington maintains a 55% tariff on Chinese goods.

The deal, reached after two days of negotiations in London, also restores access for Chinese students to American universities — a concession that could signal a broader diplomatic thawing.

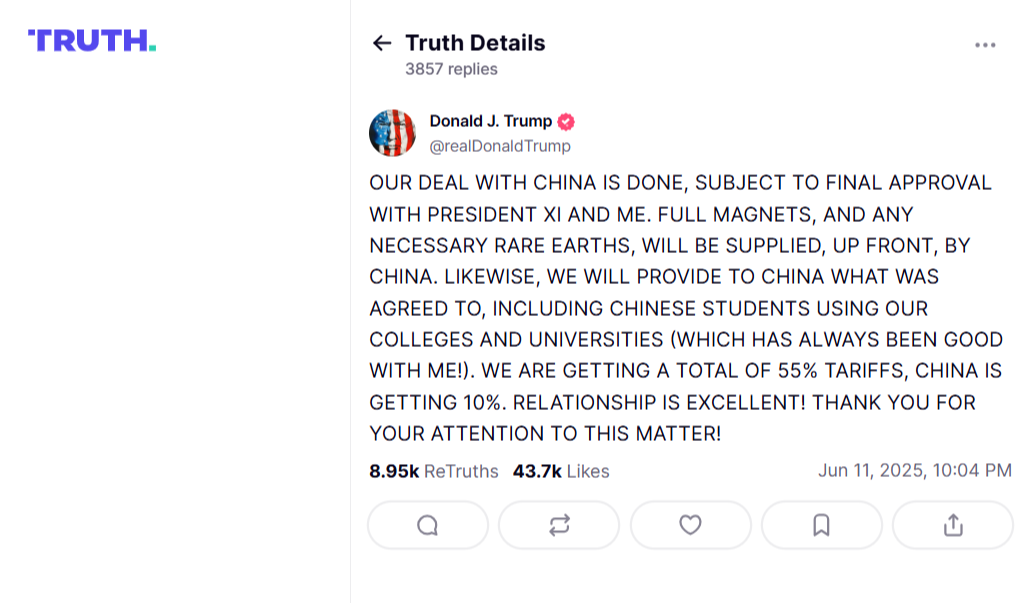

However, the agreement remains subject to final approval by President Donald Trump and Chinese President Xi Jinping.

While the deal removes China's restrictions on rare earth exports, it does little to resolve deep trade tensions.

The U.S. tariff structure includes a 10% baseline reciprocal tariff, a 20% levy tied to fentanyl trafficking, and a 25% continuation of pre-existing tariffs.

China, in response, will impose a 10% tariff on U.S. imports.

The framework builds on last month's Geneva negotiations, which stalled over China's mineral export curbs and U.S. semiconductor restrictions.

The agreement presents both risks and opportunities for Australia.

As a major rare earth producer, Australia could see increased competition from Chinese suppliers re-entering the market.

However, the deal also underscores the strategic importance of Australian rare earths, particularly for U.S. and European buyers seeking to diversify their supply chain away from China.

Australian mining firms, including Lynas Rare Earths, may benefit from heightened demand for non-Chinese sources.

Despite the breakthrough, China retains its dominance in rare earth refining, controlling 90% of global capacity.

This chokehold on supply chains remains a critical vulnerability for industries reliant on these materials, including defence contractors, EV manufacturers, and tech giants like Tesla and Apple.

Investors should watch for further developments, as the deal’s implementation — and potential disruptions — could reshape global trade flows.