In the latest salvo from China in the battle for artificial intelligence superiority, the release of DeepSeek’s R1 generative AI model has rocked global tech stocks in a sell-off worth more than US$1 trillion, with questions over American tech spending in the sector mounting.

The public release of Chinese-based DeepSeek’s cheaper and less energy-intensive R1 generative AI model blows OpenAI’s o1 out of the water in terms of energy use, affordability and performance.

By the close of trade on Monday the tech-heavy NASDAQ had sunk 3.1%, while the S&P 500 fell 1.5% as investors fled NVIDIA - which had US$600 billion wiped off its market value, adding to a more than US$1 trillion loss across U.S markets.

While semiconductor companies such as Micron and ARM fell 10% and ASML 6% at the end of daily trade, mega tech stocks Microsoft and Google’s parent company Alphabet fell 2% and 4% respectively.

The tech bloodbath on Wall Street is expected to continue. Ahead of open, U.S futures on the NASDAQ 100 have fallen 3.9% and chipmaker ASML is expected to fall a further 10%.

The reverberations were felt on the ASX today too, with semiconductor tech business Weebit Nano (ASX : WBT) sustaining a >10% loss on open.

Low-cost and open source

The DeepSeek AI assistant app rocketed to #1 on the U.S. Apple App Store yesterday after showing capabilities competitive with OpenAI and Meta’s own AI tech.

Bloomberg Global Business Editor Samson Ellis says the worrying part for DeepSeek's US rivals is it claims to have done so without having spent billions on cutting-edge chips.

“The revelation is prompting a major rethink about the big boys in AI’s massive spending needs, triggering doubts about the sky-high valuations for companies like Nvidia. More broadly, it has called into question the widely assumed lead the US has in AI,” Ellis wrote in a note.

DeepSeek’s R1 training budget, which was around $5 million, is a drop in the ocean compared to the $7 billion spent by OpenAI to train ChatGPT.

Reports show R1 typically requires about 10,000 GPU hours on high-performance GPUs such as NVIDIA A100s for $25,000. At the same time, estimates suggest training ChatGPT 4 requires GPU hours into the millions - with potential costs exceeding US$10 million.

For developers, API access for R1 starts at $0.14 per one million tokens - about 750,000 words, while - OpenAI's o1 model comes at a cost of $7.50 per one million tokens.

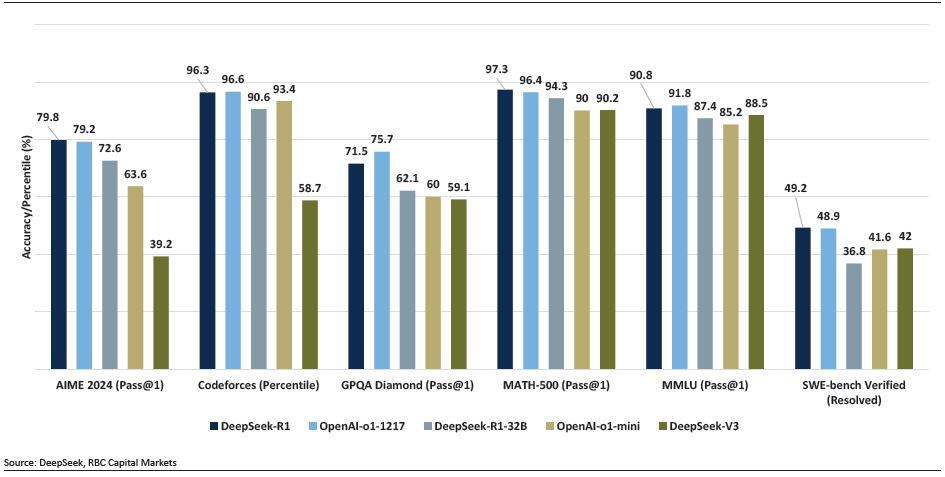

Yet performance metrics are on par with OpenAI's 1o model across the board.

And while ChatGPT Pro costs users US$200/month, with OpenAI still running at a loss, DeepSeek is free and open source for its base model.

Showing that effective generative AI modelling can be achieved without overwhelming costs, DeepSeek’s release has sent shockwaves through the tech sector and has called into question the multiple billions of dollars purported to be required for the US to remain at the cutting edge of artificial intelligence innovation.

Knocking the wind out of America’s AI push

R1's release during President Trump’s inauguration last week was no coincidence when overlaying the machinations of the US-China tech war and has spooked investor confidence in the United States’ AI leadership which recently announced a US$500 billion investment commitment into AI, driven by funding from Softbank, OpenAI and Oracle.

A large portion of that investment is pegged to go towards the high energy costs involved in data centres and high bandwidth memory (HBM) chips used for GPU processing.

The fallout from the news has also hit uranium stocks, with mining majors Cameco and Denison Mines both sinking 15% to US$47.51/sh and US$1.73/sh by Monday's close on Wall Street.

That's because tech giants have been pouring into nuclear energy supply chains, with millions of dollars being invested by Google, Amazon, Microsoft and Meta to feed into their power-hungry data centre developments.

Since their recent high in February last year, U3O8 prices have fallen 34% to just under $70/lb this month and the potential of lower energy costs for the AI sector could drive prices yellowcake even lower.