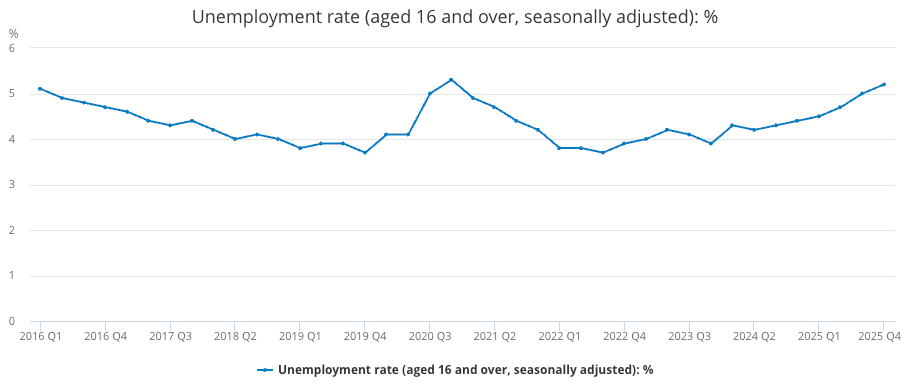

Unemployment in the United Kingdom has reached its highest rate in around five years at the end of 2025.

According to data from the Office for National Statistics, the unemployment rate rose to 5.2% in the three months to December from 5.1% in the three months to November.

Young people are bearing the brunt, with unemployment among those aged 16 to 24 rising to 16.1%, the highest in 10 years.

This comes as joblessness in the UK has steadily risen since 2022, and businesses have complained that tax rises by Rachel Reeves in her last two budgets have exacerbated this, with rises in national insurance contributions (NICs) and the minimum wage causing particular issues.

Martin Beck, the chief economist at WPI Strategy, said: “Higher labour costs, reflecting last year’s increase in employer NICs and rises in the adult minimum wage, appear to be weighing most heavily on entry-level hiring. At the same time, firms are likely reassessing junior roles in the face of rapid advances in AI.”

For those in work, wages have increased 4.2% in the three months to December. Despite this, the growth has slowed from 4.4% in the previous month.

In the private sector, pay increased by 3.2%, the lowest level in five years, while wages in the public sector rose 7.2%.

The number of people on company payrolls has fallen by 134,000 from a year ago and by 46,000 over the quarter. On a monthly basis, payrolls fell by 11,000 in January.

However, a sharp monthly decline reported in December compared with November was revised upwards by the ONS, from its original estimate of a fall of 43,000 to a fall of just 6,000.

These figures could mean that the Bank of England is likely to make another cut to interest rates by the spring, as inflationary pressures, such as higher wage growth, appear to be easing.

The Bank has forecast that the unemployment rate will rise to 5.3% this year and that wage growth will moderate from 3.4% last year to 3.25% by the end of the year as inflation falls. At its recent meeting earlier this month, the Bank kept rates on hold at 3.75%.