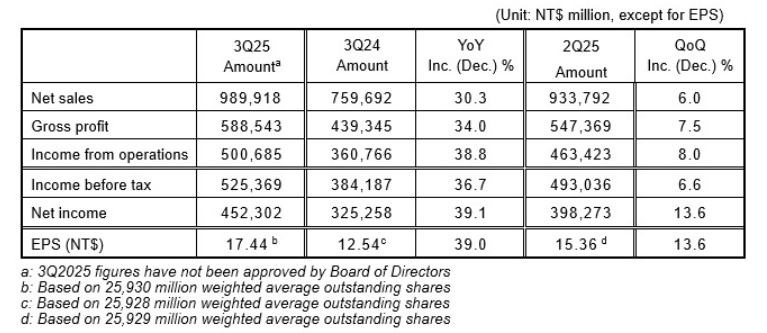

Taiwan Semiconductor Manufacturing Co. (TSMC) has reported record earnings for the third quarter of 2025 (Q3 FY25) and upgraded its full-year revenue forecast on the back of surging demand for computer chips powering the artificial intelligence (AI) revolution.

The world’s largest contract chipmaker said net income jumped 39.1% to NT$452.30 billion (US$14.75 billion) on revenue which climbed 30.3% to NT$989.92 billion (US$33.10 billion) in the quarter ending 30 September.

“Our business in the third quarter was supported by strong demand for our leading-edge process technologies,” TSMC’s Chief Financial Officer Wendell Huang said in a media release.

“Moving into fourth quarter 2025, we expect our business to be supported by continued strong demand for our leading-edge process technologies.”

TSMC raised its 2025 revenue growth forecast in U.S. dollar terms to the mid-30% range due to stronger-than-expected AI demand.

“AI demand actually continues to be very strong — more strong than we thought three months ago,” CEO C.C. Wei told analysts on the earnings call.

In Q4 the company expected revenue to be between US$32.2 billion and US$33.4 billion, the gross profit margin to be between 59% and 61% and the operating profit margin to be between 49% and 51%.

TMSC’s customers include iPhone maker Apple (AAPL.O).

Net income was well ahead of the NT$417.7 billion average forecast from LSEG SmartEstimates.

TMSC (TPE: 2330) shares had closed on Thursday 1.37% higher at NT$1,485.00, capitalising the company at NT$38.51 trillion (US$1.26 trillion).