Unprecedented policy uncertainty from the Trump administration, coupled with the looming possibility that between US$133.5-$150 billion in illegal tariffs may have to be refunded to importers, is creating an overhang that capital markets are factoring into their playbook for an already turbulent 2026.

The United States Supreme Court (SCOTUS) is currently deliberating on the legality of emergency tariffs deployed by the Trump administration under the International Emergency Economic Powers Act of 1977 (IEEPA).

Most legal commentators believe SCOTUS will rule against Trump, given the line of questioning during oral arguments late last year.

Assuming the court rules in favour of refunds, they will be processed via a U.S. Customs & Border Protection (CBP) electronic refund system and potentially as early as 6 February.

Economic disaster

By his own admission, Trump recognises that the SCOTUS ruling on tariffs will be the most important decision the country’s highest court will ever make.

"If the Supreme Court rules against the United States of America on this National Security bonanza, WE’RE SCREWED!" Trump posted on 12 January Truth Social.

Trump also admitted that it would be an "economic disaster" if tariffs were overturned.

In addition to hundreds of “billions of dollars" in revenue collected from the tariffs, Trump also admitted that the U.S. would also be on the hook to pay back "Trillions" more in private investments.

In other words, the amount of 'payback’ by the U.S. government will also extend to the money that companies and other nations are spending to build factories and equipment in the U.S. to avoid paying the higher tariffs.

It’s understood that over 1,000 companies are currently suing the U.S. government to challenge trade tariffs and seek refunds.

Bond and US dollar impact

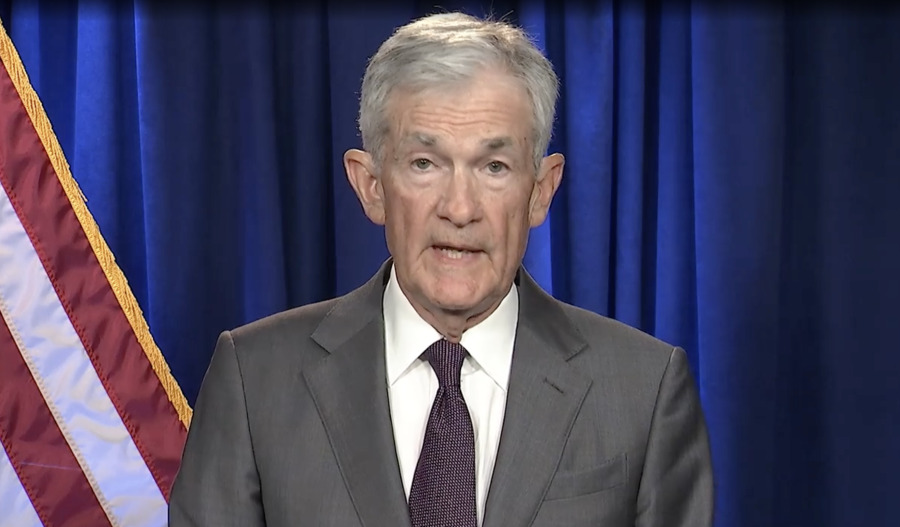

While tariff refunds are expected jolt financial markets, fear of a default blowout in U.S. debt - projected to exceed US$41 trillion – could also impact the U.S. dollar and put greater pressure on bond yields that have been moving higher despite the Federal Reserve's late-2025 interest rate cuts.

"We've never seen a ruling that has such an economic impact," noted Eddie Ghabour, CEO of KEY Advisors Wealth Management, who expects a tariff payout to be a major headwind for markets.

“This would be the equivalent of sucking liquidity out of the system."

When Trump announced tariffs last April, stocks fell by around 5% and Treasury yields initially tumbled as investors responded to the uncertainty by fleeing to safe-haven assets.

However, since then, stocks have recovered, rising more than 16% in 2025, hitting fresh record highs along the way.

Retailers, electronics, small caps to benefit

However, the fallout for equity markets may bring mixed blessings, with some investors expecting stocks to potentially bounce if the court rolls back existing tariffs, especially for companies that had to absorb high-import costs.

"Stocks would probably benefit in general," said John Velis, head of Americas macro strategy at BNY Markets.

"Sectors in particular would (include) retail as well as consumer goods. Electronics also would probably do well."

Some advisors are already putting money to work in small caps on expectations that the Federal Reserve's actions will keep a lid on the 10-year yield while injecting liquidity, and therefore, spur economic growth.

"That is as bullish as it gets," noted Key Advisors' Ghabour, who established a 4% stake in smaller stocks mid-December.

"If these small companies get tariff relief on top of that it will be like putting rocket fuel on a fire."

Interestingly, the Russell 2000 index, which tracks small-cap stocks, ended 2025 11.3% higher, and is up 4% so far this year.

Trump’s trick bag

However, given that any knee-jerk reaction in equities - following the decision - could be short-lived, some investors have warned the market that the administration would quickly use alternative provisions to reimpose the levies if the tariffs are struck down.

"In the short term, this will be noise," said John Pantakidis, a managing partner at Twin Focus Capital.

"The market is ignoring that the president keeps threatening more tariffs."

Meanwhile, in what could be described as a slap in the face to a pending court refund decision, Trump has doubled down on tariffs by threatening several European countries with more of them for opposing his plan to take control of Greenland.

The U.S. president has also threatened that any country doing business with the Islamic Republic of Iran will pay a Tariff of 25% on any and all business being done with America.

According to David Seif, chief economist for developed markets at Nomura, Trump could turn to five other legal routes to impose tariffs, some up to 15%.

"Certainly by the end of 2026, we would have a tariff regime that looks almost exactly the same as what is there," he added.