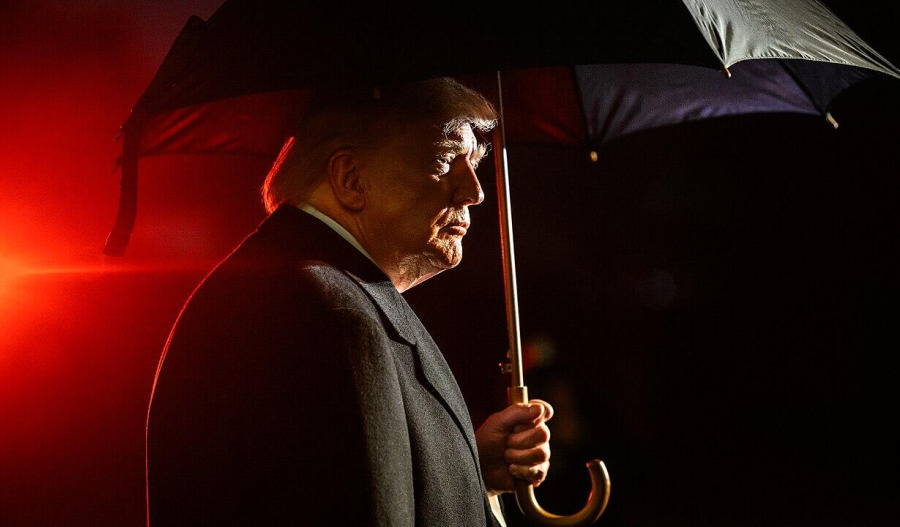

United States President Donald Trump purchased up to US$100 million (A$149.3 million) in municipal and corporate bonds between mid-November and late December, according to newly released financial disclosures.

Disclosures posted on Thursday and Friday show Trump bought a broad mix of municipal bonds issued by cities, school districts, utilities and hospitals, alongside corporate debt from companies including Boeing, Occidental Petroleum and General Motors.

The filings also reveal purchases of up to $2 million in bonds issued by Netflix and Warner Bros Discovery, just weeks after the companies announced plans for a merger.

The disclosure, filed with the Office of Government Ethics and initially submitted on Wednesday, lists 191 financial transactions.

These include two sales worth at least $1.25 million and between $1 million and $51 million in purchases of corporate and municipal bonds. The exact size of the transactions remains unclear, as the report lists amounts in broad ranges, in some cases between $1 million and $5 million.

All of the reported investments were made between 14 November and 19 December.

A White House official told CNN that Trump’s stock and bond holdings are managed independently by third-party financial institutions.

“All holdings are maintained in discretionary accounts and invested through computer-based model portfolios that automatically replicate recognised indexes, such as the Schwab 1000,” the White House said.

“Neither President Trump nor any member of his family has any ability to direct, influence, or provide input regarding how the portfolio is invested or when investments are bought or sold. All investment decisions are made entirely by independent managers.”

At the start of Trump’s term, the Trump Organization outlined an ethics plan stating that the president would “have no involvement” in the management of his business empire. However, the plan did not require him to divest assets or recuse himself from matters that could affect his financial interests.

Among the most notable transactions were two purchases of Netflix bonds and two purchases of Discovery Communications bonds, each valued between $250,001 and $500,000. These transactions took place on 12 December and 16 December.

Discovery Communications operates under the Warner Bros. Discovery banner. On 5 December, Netflix announced plans to acquire Warner Bros. Discovery for $72 billion plus debt, a deal that would include the company’s film and television studios as well as assets such as the HBO streaming service.

Warner Bros. Discovery, which is the parent company of CNN, has said CNN would not be included in the Netflix acquisition.

The group plans to split into two publicly listed entities in 2026, with Netflix expected to acquire the Warner business.

The remaining entity, Discovery Global, would retain CNN and other cable networks.

On 8 December, Paramount launched a hostile takeover bid for Warner Bros. Discovery in an effort to block the Netflix deal. Warner Bros. Discovery has since indicated that Netflix remains its preferred buyer, with its board rejecting Paramount’s offer on 7 January.

Paramount chief executive David Ellison and his father, Oracle co-founder Larry Ellison, have longstanding ties to Trump. While Larry Ellison did not publicly endorse or donate to Trump’s 2024 campaign, he hosted a fundraiser for Trump in 2020 and is leading an investor group seeking to acquire and oversee most of TikTok’s US assets.

One day before Paramount announced its hostile bid, Trump said he would be “involved” in regulatory decisions related to whether the proposed sale of Warner Bros. to Netflix should be approved.

Trump’s ethics disclosure also showed purchases of corporate debt issued by aircraft maker Boeing, retailers Macy’s and Victoria’s Secret, and automaker General Motors.