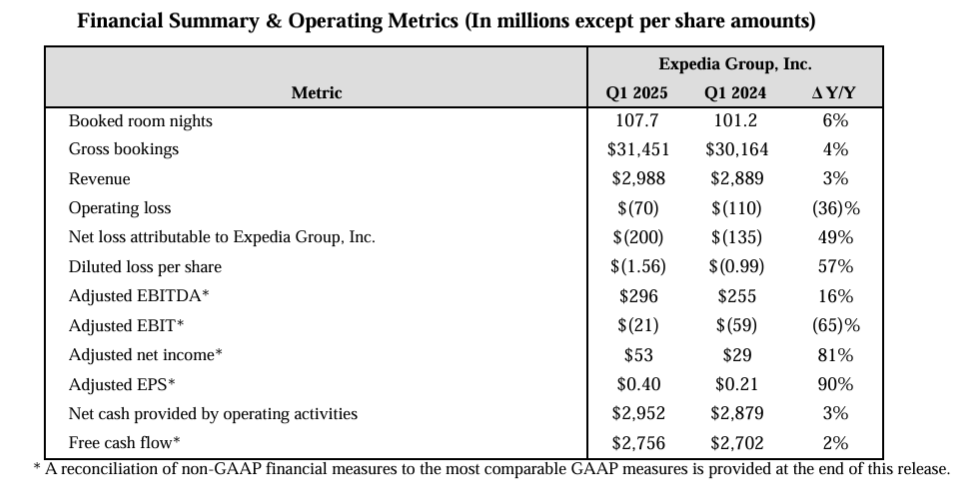

Expedia Group posted solid Q1 2025 results, navigating softened United States travel demand while delivering 4% bookings growth and 3% revenue growth.

The company beat bottom-line guidance, expanding EBITDA margins and repurchasing $330 million in shares. Despite a 49% rise in net loss, adjusted net income jumped 81%, signaling strong operational efficiency.

A Street consensus estimate of US$3.01 billion was missed, according to Benzinga Pro data.

The B2B segment drove growth, with bookings up 14%, while B2C bookings edged up 1%. Lodging bookings climbed 5%, and advertising revenue surged 20%, reinforcing Expedia’s diversified revenue streams. Adjusted EBITDA rose 16%, with a 105 basis-point margin expansion, underscoring cost discipline.

Shareholder returns remained a priority, with 1.7 million shares repurchased and a $0.40 quarterly dividend paid. Stockholders’ equity declined to $2.136 billion, reflecting capital allocation strategies. CEO Ariane Gorin reaffirmed the company’s commitment to margin expansion and top-line growth.

“We posted first quarter bookings and revenue within our guidance range despite weaker than expected demand in the U.S., drove bottom-line meaningfully above our guidance, and made significant progress against our strategic priorities. Looking ahead, we are committed to continuing to deliver margin expansion while growing our top-line," said Gorin.

Looking ahead, Expedia plans to leverage AI-driven solutions to enhance partner success and B2B expansion. The company will host a conference call to discuss strategic priorities and its financial outlook. Investors will watch for continued execution amid macroeconomic uncertainties.

Expedia’s non-GAAP financial measures, including Adjusted EBITDA and EPS, provide insights into cash earnings and operational efficiency. Free cash flow hit $2.756 billion, reinforcing financial flexibility. The company remains focused on scalability and profitability, despite the challenges facing the travel sector.

First Quarter Highlights

- Booked room nights grew 6% in the first quarter year-over-year amid softened travel demand within and into the U.S.

- Total gross bookings grew 4% in the first quarter. B2C gross bookings grew 1% and B2B gross bookings grew 14% given the segment’s greater international exposure.

- Lodging gross bookings grew 5% year-over-year in the first quarter; hotel bookings were up 6%, driven by resilience at B2B and Brand Expedia.

- Revenue grew 3% in the quarter, led by our B2B and Advertising businesses, which grew 14% and 20%, respectively.

- First quarter net loss increased 49% while adjusted net income grew 81%, year-over-year. Adjusted EBITDA increased 16% with 105 basis points of margin expansion, and adjusted EBIT loss decreased 65% with 136 bps of margin expansion.

- Diluted loss per share was ($1.56) in the quarter while Adjusted EPS was $0.40 and grew 90% versus the prior year.

- Repurchased approximately 1.7 million shares for $330 million in the first quarter.

- Paid quarterly dividend of $0.40 per share on 27 March, 2025.

At the time of writing, Expedia Group Inc's (NASDAQ: EXPE) stock price was US$168.99 +$2.43 (1.46%) today, but down $13.59 (8.04%) to $155.40 in after-hours trading. The company's market cap was approximately $21.56 billion.

Related content