Surging vehicle deliveries in Japan and North America couldn't shield Toyota from a US$6.1 billion tariff hit in the first half, dragging operating income down 19% year-on-year to ¥2 trillion (US$13.7 billion) despite hitting 105% of prior year sales volumes.

The automaker's full-year operating profit forecast of ¥3.4 trillion (US$23.3 billion) represents a 29% decline from fiscal 2025, with U.S. import duties alone slashing ¥1.45 trillion (US$9.9 billion) off the bottom line.

Net income for the six months to September fell 7% to ¥1.77 trillion (US$12.1 billion), while consolidated vehicle sales reached 4.78 million units - up from 4.56 million a year earlier as product competitiveness offset macro headwinds.

Electrified vehicles now comprise 46.9% of Toyota's mix - up from 44.4%, driven by hybrid sales in North America and China.

Profit collapse

The tariff blowout compounds a turbulent two years for Toyota, marked by certification scandals that forced production halts and triggered government correction orders.

Between June 2024 and August 2024, Japanese authorities uncovered improper testing on seven models, including the RAV4 and Camry, with issues ranging from falsified pedestrian protection data to modified steering tests.

Those scandals drove ¥230 billion (US$1.6 billion) in one-time expenses for fiscal 2025 and pushed break-even volume significantly higher as the company prioritised compliance remediation over production efficiency.

Combined with a strengthening yen that delivered ¥540 billion (US$3.7 billion) in transactional forex losses, Toyota faced structural headwinds even before the Trump administration's 25% vehicle tariffs took effect in April 2025.

Volume gains can't fix margin compression

Toyota's operating margin compressed to 8.1% in the first half from 10.6% a year ago, with management forecasting further erosion to 6.9% for the full year as structural headwinds persist.

The company squeezed out ¥910 billion (US$6.2 billion) in improvement efforts - including ¥310 billion (US$2.1 billion) from volume and model mix, ¥275 billion (US$1.9 billion) in cost reductions, and ¥195 billion (US$1.3 billion) from value chain expansion - yet tariff exposure and a ¥470 billion (US$3.2 billion) jump in expenses overwhelmed those gains.

Exchange rate fluctuations contributed ¥540 billion in transactional losses (US$3.7 billion) on imports and exports, with the yen strengthening to ¥146 against the dollar from ¥153 a year earlier.

Break-even volume has climbed significantly over the past two years following certification issues and capacity constraints, prompting a company-wide initiative to review allocation of people, materials and capital.

"We will turn the results of the reinforcement of our operational foundations activities efforts into earning power," management stated in the presentation, targeting waste elimination and productivity improvements.

Toyota lifted its interim dividend by ¥5 (US$0.03) to ¥45 (US$0.31) per share, with the full-year payout forecast rising to ¥95 (US$0.65) - marking continued "stable and continuous" increases for long-term shareholders.

The company passed a ¥3.2 trillion (US$21.9 billion) share repurchase resolution in June as part of taking Toyota private, though no new buyback programme will be established in the near term.

Total shareholder returns hit ¥586.5 billion (US$4 billion) for fiscal 2025.

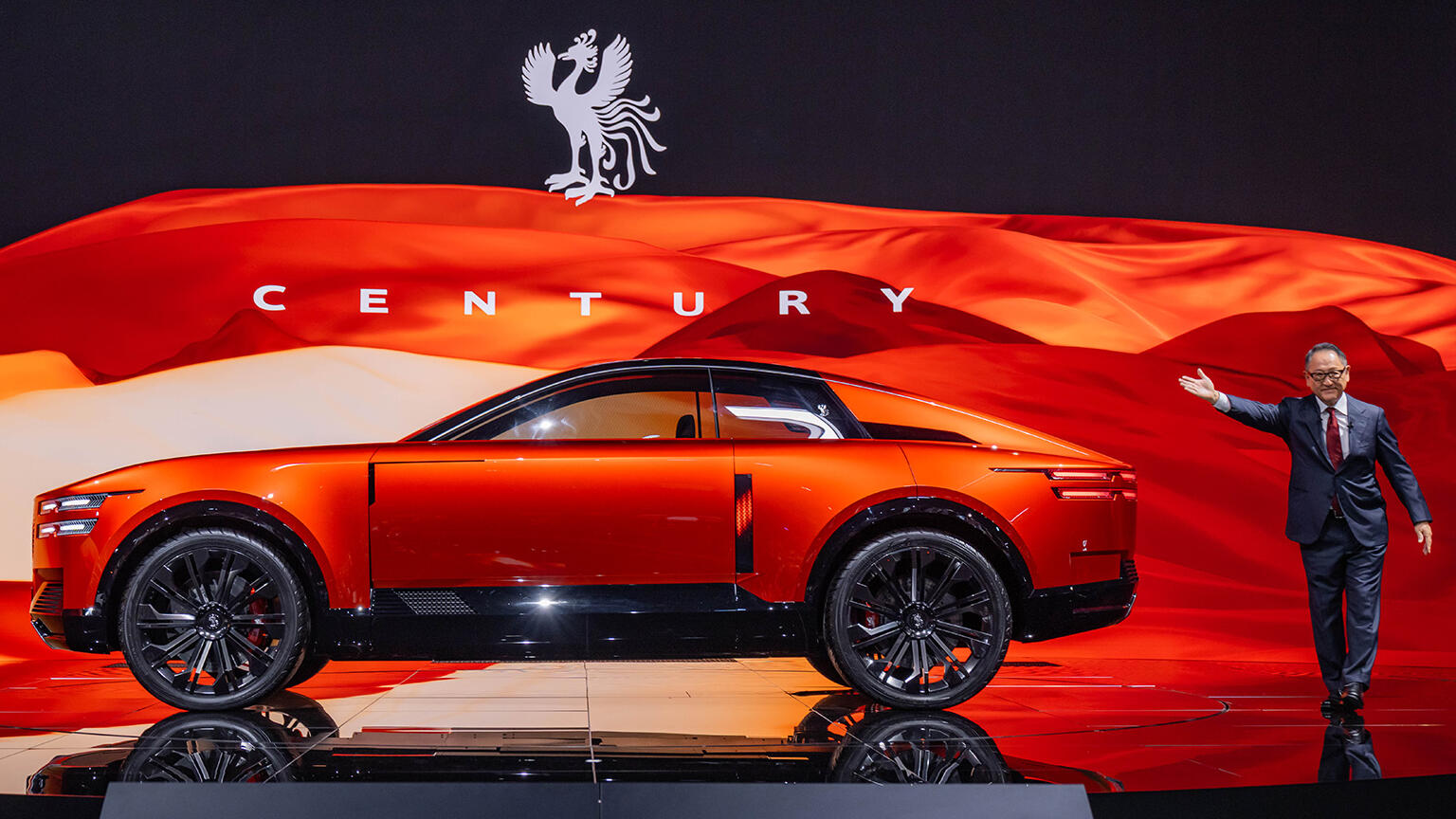

Meanwhile, management used the Japan Mobility Show to unveil a five-brand strategy encompassing Toyota, Lexus, Daihatsu, GR and the newly introduced Century marque.

The RAV4 will debut Toyota's Arene software development platform - a calculated risk given the model's 1 million annual unit sales.

Value chain businesses, including parts, accessories, sales finance and used vehicles, now generate approximately ¥2 trillion in operating income (US$13.7 billion), supported by 150 million vehicles in the global installed base.

Toyota expects consolidated vehicle sales of 9.8 million units for fiscal 2026, unchanged from prior guidance, with retail sales forecast at 11.3 million units.

Toyota (TYO: 7203) stock closed at ¥3,040 on Wednesday, down 3.7% from Tuesday's close of ¥3,120. Toyota's market cap stands at ¥41.12 trillion (US$267.5 billion).