Gap Inc.'s financial results for the first quarter of fiscal 2025, highlight sales growth, market share gains, and an outlook amid challenges such as tariffs.

“Gap Inc. delivered strong first quarter results, exceeding financial expectations and gaining market share for the ninth consecutive quarter,” said President and Chief Executive Officer, Richard Dickson.

“We had positive comp sales for the 5th consecutive quarter, with our two largest brands, Gap and Old Navy, winning in the marketplace, demonstrating the power of our brand reinvigoration playbook. The rigor we’ve embedded across the organisation continued to serve us well, driving gross margin and operating margin expansion in the quarter. These results are yet another proof point that our strategy is working. In this highly dynamic environment, we are optimistic yet realistic and remain focused on controlling the controllables as we build our company for long term growth.”

Gap Inc. is the largest specialty apparel company in the United States with a portfolio of brands including Old Navy, Gap, Banana Republic, and Athleta.

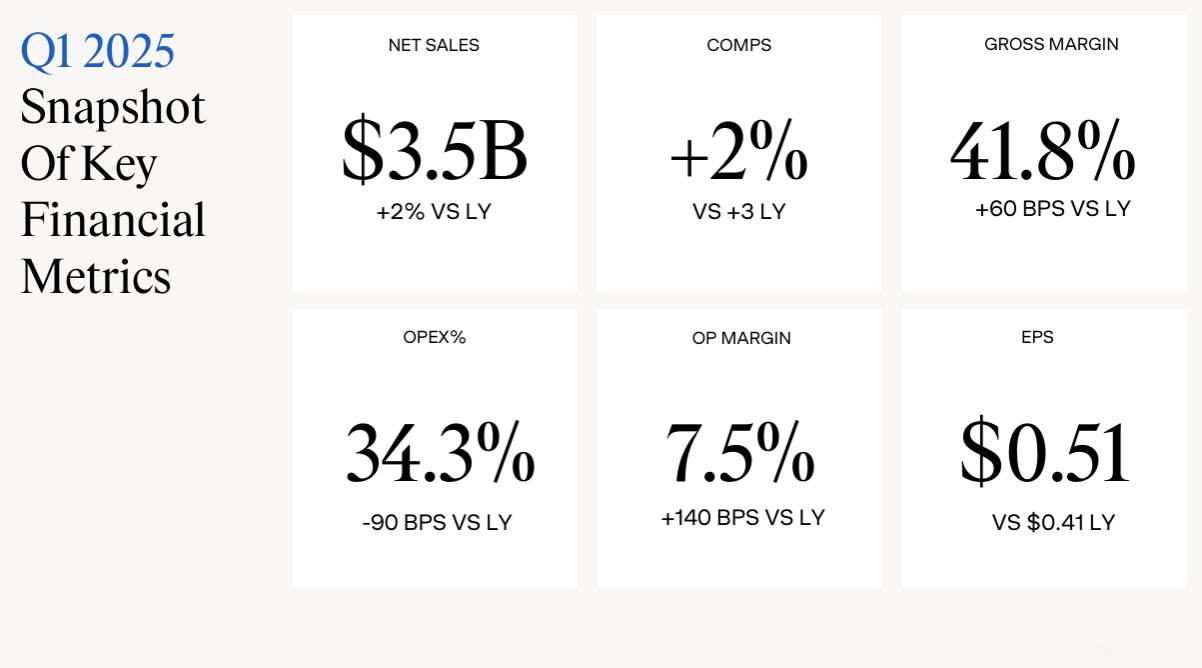

Financial Performance Overview for Q1 Fiscal 2025

Gap Inc. reported a modest increase in net sales and online sales, while facing challenges in store sales.

The company achieved gross margin improvement and positive operating income, despite negative cash flow from operating activities due to seasonality.

- Net sales reached $3.5 billion, up 2% year-over-year.

- Comparable sales also increased by 2% year-over-year.

- Store sales remain flat compared to last year.

- Online sales grew by 6%, accounting for 39% of total net sales.

- Gross margin improved to 41.8%, up 60 basis points from last year.

- Operating income was $260 million, with an operating margin of 7.5%.

- Net income totaled $193 million, resulting in diluted earnings per share of $0.51.

Balance Sheet and Cash Flow Highlights

The company ended the quarter with a significant increase in cash reserves, but faced challenges in cash flow due to seasonal factors. Inventory levels rose, and capital expenditures were made to support ongoing operations.

- Cash, cash equivalents, and short-term investments totalled $2.2 billion, up 28% from the prior year.

- Net cash from operating activities was negative $140 million, primarily due to seasonality.

- Free cash flow was negative $223 million after capital expenditures of $83 million.

- Ending inventory increased by 7% to $2.1 billion, attributed to the earlier timing of receipts.

- Shareholder returns included $131 million in dividends and share repurchases.

Brand Performance in Q1 Fiscal 2025

Gap Inc.'s brands show varied performance, with Old Navy and Gap achieving growth, while Banana Republic and Athleta facing declines.

- The overall brand strategy appears to resonate well with customers, particularly Old Navy and Gap.

- Old Navy's net sales were $2.0 billion, up 3%, marking nine consecutive market share gains quarters.

- Gap's net sales reached $724 million, up 5%, achieving positive comparable sales for the sixth consecutive quarter.

- Banana Republic's net sales declined 3% to $428 million, with flat comparable sales.

- Athleta's net sales fell 6% to $308 million, with comparable sales down 8%.

Fiscal 2025 Outlook and Tariff Impact

- The company provided guidance for fiscal 2025, anticipating modest growth in net sales and operating income, while highlighting potential tariff impacts.

- Strategies are in place to mitigate some tariff costs.

- Expected net sales growth for FY 2025 is projected at 1-2%.

- Operating income is anticipated to grow from 8% to 10%.

- Estimated net interest income is approximately $15 million.

- Potential tariff impacts could add $100 million to $150 million in costs, primarily affecting the second half of the year.

- The company plans to close approximately 35 stores during FY 2025.

Second Quarter Fiscal 2025 Expectations

The company anticipates flat net sales year-over-year for the second quarter, with expectations for gross margin and operating expenses remaining stable. This outlook reflects the ongoing challenges of retail.

Net sales are expected to be approximately flat compared to the previous year.

Gross margin is projected to be similar to Q1 fiscal 2025 levels.

Operating expenses as a percentage of net sales are expected to leverage slightly year-over-year.

At the time of writing, the share price of Gap Inc (NYSE: GAP) was US$27.95, down 29 cents (1.03%) today, and in after-hours trading was $23.76, down $4.19 (14.99%). It has a market cap of around $10.53 billion.