Target Corporation has announced a fall in earnings for the third quarter (Q3) of 2025 and forecast a continued drop in the final quarter of the calendar year.

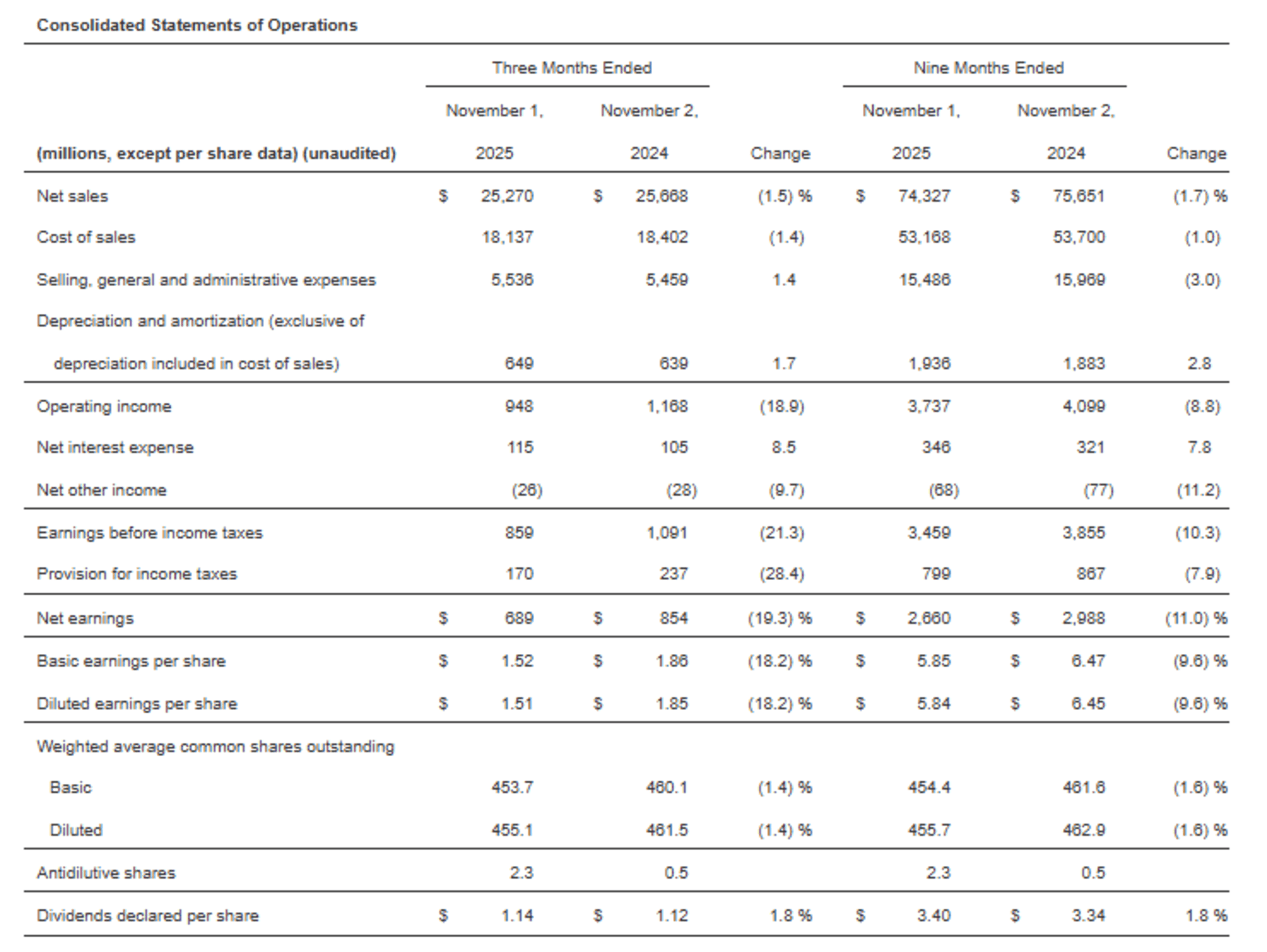

The American big-box retailer said net earnings dropped 19.3% to US$689 million (A$1.05 billion) and diluted earnings per share (EPS) fell 18.2% to $1.51 as net sales eased 1.5% to $25.27 billion in the three months ended 1 November 2025.

Adjusted EPS, which excludes non-recurring severance and asset-related charges, was $1.78 compared with $1.85 in Q3 2024.

In the first nine months of the year net earnings dropped 11% to US$2.66 billion and diluted EPS eased 1.6% to $5.85 as net sales edged down 1.7% to $74.3 billion.

"Thanks to the incredible work and dedication of the Target team, our third quarter performance was in line with our expectations, despite multiple challenges continuing to face our business," incoming Chief Executive Officer (CEO) Michael Fiddelke said in a press release.

Fiddelke, who is replacing Brian Cornell as Chairman and CEO, last month announced the company was cutting 1,800 jobs, or 8% of the head office staff.

The drop in net sales reflected a 1.9% drop in merchandise sales which was partially offset by a 17.7% increase in non-merchandise sales.

Fiddelke said Target continued to focus on solidifying its merchandising authority, elevating the “shopping experience”, and harnessing technology to move fast and more consistently in support of a return to sustainable growth.

Target maintained its expectation of a low-single digit percentage decline in sales in Q4 with full-year adjusted EPS, which excludes litigation settlements gains and severance and asset-related charges, expected to be about $7.00 to $8.00.

“I'm confident that we're rapidly moving in the right direction and position our business to get back to sustainable profitable growth in years ahead,” Chief Financial Officer Jim Lee said on an earnings call.

Adjusted Q3 EPS of $1.78 exceeded analysts' estimates of $1.72 while revenue was just below expectations.

Target shares (NYSE: TGT) closed $2.47 (2.79%) lower at $86.08, capitalising the company at $38.92 billion.

The share price has fallen 45% over the last year.