While there’s growing speculation that the Trump Administration may have to refund businesses' tariff monies already collected - throwing trade deals struck by the White House into question - the shipping industry is also sitting tight, awaiting an appeal to the United States Supreme Court and its final decision.

Last Friday, a federal appeals court concluded that most of Trump’s global tariffs – which are set to haul US$172.1 billion (A$262.7 billion) in 2025 - are illegal.

However, the duties remain in place until October 14, giving the Trump Administration time to appeal the decision in the highest court in the land.

Meanwhile, global shipping companies are fielding calls from customers looking for clarity on what happens if the Supreme Court uphold the ruling, and what the refund process could look like.

Mike Short, president of global forwarding at C.H. Robinson, says customers – especially those with drug-related tariffs affecting imports from Canada, Mexico, and China - are eager to know and plan for the ‘what ifs’ should tariff monies have to be returned.

Hold your nerve

Meanwhile, Josh Teitelbaum, senior counsel of Akin and a former U.S. Commerce official, is currently advising companies to stay the course.

Given the uncertainty of the tariff ruling, Teitelbaum is warning companies not to shift their sourcing based on what they think the Supreme Court might say.

While a Supreme Court ruling against tariffs could herald the ultimate humiliation for the Trump administration, Teitelbaum also reminded companies that it is likely to impose new tariffs under different authorities, with their own requirements, rates and time limitations.

While the U.S. President expects the Supreme Court to uphold its use of a 1977 emergency powers law to impose the tariffs on trading partners, Treasury Secretary Scott Bessent believes that the administration has a backup plan if it doesn’t.

Will new tariffs replace the old ones?

Alan Baer, CEO of OL USA, suspects that one of the tactics Bessent was alluding to is an appeal to the Senate, which could potentially provide Trump with special powers for the next 6 to 9 months to enact tariffs - with an end date prior to the 26 November mid-term elections.

Then there’s the possibility that the Trump administration could focus more on commodity-specific tariffs like steel and aluminium.

“I don’t see the White House giving up on collecting the $30 billion-plus in taxes,” said Baer, referring to how much the federal government has been collecting per month from the trade duties.

“Most companies will remain cautious with their forward ordering unless they see demand picking up,” Baer added.

According to the most recent Treasury Department data, the U.S. has generated $142 billion in tariff revenue so far this financial year.

How tariffs could be refunded

According to C.H. Robinson’s Mike Short, it’s unclear whether a decision by the Supreme Court to update the federal court’s decision will specify retroactive refunds of duties already paid or only prevent tariffs from being applied to future shipments.

But assuming the court ruling does address refunds, Short suspects they may occur in one of two ways: either Customs will process the refunds automatically, or brokers will need to undertake additional work to secure them.

“In the latter scenario, the workload for our customs teams would double overnight and be met with importers very eager to get those dollars back,” he said.

Dan Anthony, President of Trade Partnership Worldwide, believes the process of issuing refunds should only be as difficult as the Trump administration chooses to make it.

“Blanket refunds are fairly straightforward: all affected imports have an IEEPA-specific code and related tariff amount that should allow for automated refunds of payments,” Anthony said.

“But any sympathy should be for the importers forced to jump through hoops, not government agencies that created work for themselves in an effort to keep illegal tariffs paid by Americans.”

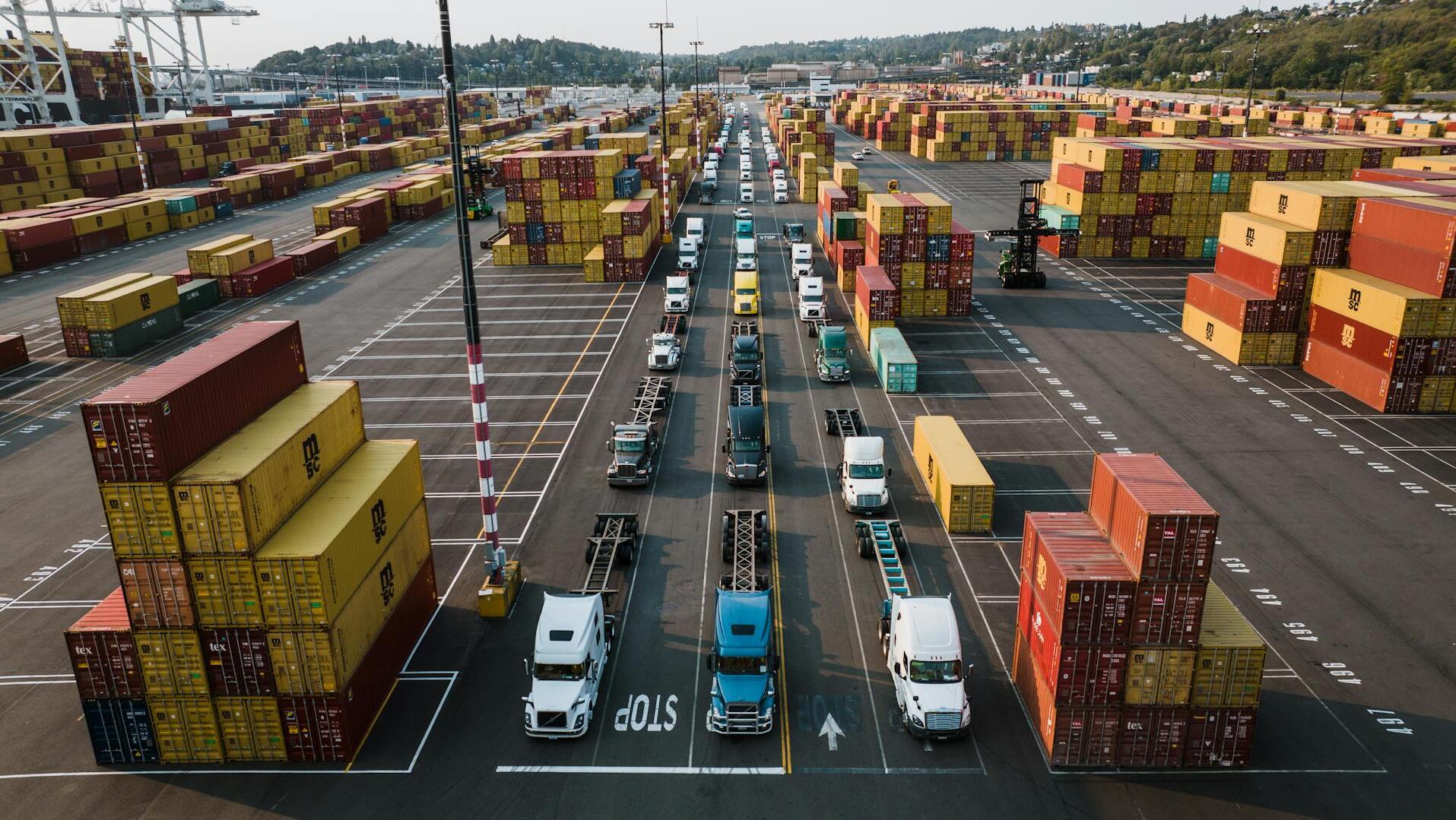

Nevertheless, the breadth of the global trade war is immense.

Tariffs on more than 90 countries and all of the products exported into the United States are in effect. The U.S. Customs Harmonized Tariff System (HTS) provides duty rates for virtually every existing product.

Challenging but doable

Given that there may be 800 or so codes targeted by the Section 232 tariffs alone, Felicia Pullam, former executive director of the Office of Trade Relations at U.S. Customs and Border Protection (CBP), suspects that in the short-term, refunding the tariffs would be an enormous challenge for the administration, yet doable.

“The funds that CBP collects from tariffs goes into the U.S. Treasury – they are not earmarked for anything,” she noted.

“If they had to be refunded, it would contribute to the U.S. budget deficit and overall debt, “just like most other kinds of federal spending.”

However, she reminds small businesses using a third party (e.g. UPS, FedEx, DHL, brokers) as the importer of record of additional challenges in seeking tariff refunds.

In these cases, the U.S. government would refund the third party, which in turn has to create a process for refunding their customers, according to Anthony.

“This can lead to significant delays for actual importers even if the government process goes off without a hitch,” he said.

According to tariff experts, shippers would have 314 days from the time their freight is processed through U.S. Customs to file an appeal for refunds.

However, with the frontloading of product ahead of the tariffs having started as early as February, the window for companies to appeal any tariffs is the end of December.

Existing trade deals

Given that they’re mostly frameworks as opposed to formalised treaties, Pullman doubts a loss in the Supreme Court would undo any of the trade deals recently reached between the U.S. and a myriad of countries globally.

“Negotiations are still ongoing… additionally, the administration has already prepared to roll out tariff alternatives quickly if IEEPA (International Emergency Economic Powers Act) tariffs are overturned,” she said.

“We would just lose federal revenue and move onto another stage of the negotiations.”

While repaying importers won’t undo other impacts of the tariffs, like lost business, Pullman is unperturbed by more extreme fears about the impact of court decisions on the broader economy.

“It will not sink the economy. Claims to the contrary sound more like desperation,” she said.

“The reality is tariff volatility has become the new normal… multiple Section 232 investigations are active — spanning sectors such as lumber, pharmaceuticals, furniture, aerospace, trucks and truck parts, seafood, and critical minerals.”