Donald Trump tried his best with the trade war he launched on the rest of the world, but he could not keep Australia’s A$4.1 trillion (US$2.6 trillion) superannuation industry down.

Super (pensions) funds produced small positive returns in April despite the impact of tariffs introduced by the United States President, new data shows, but the outlook remains volatile.

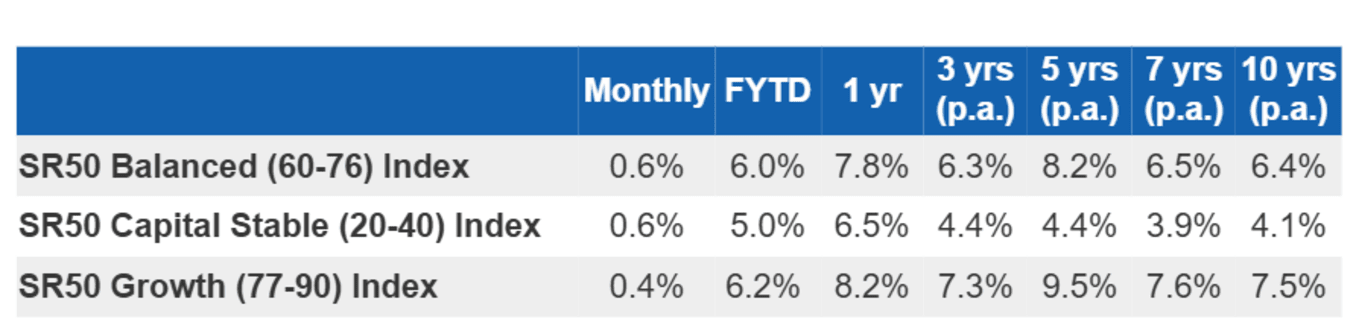

Super research firm SuperRatings estimated the median balanced option returned 0.6%, the median growth option 0.4% and the median capital stable 0.6% in April, bringing one year accumulation returns to 7.8%, 6.5% and 8.2% respectively.

SuperRatings Executive Director Kirby Rappell said returns have bounced around more than usual as markets responded strongly to the tariff announcement early in the month.

“Importantly, the large declines seen at the beginning of the month were quickly regained as tariffs were paused, reinforcing the difficulty of timing the market,” Rappell said.

He said members who panicked and switched options or withdrew funds may have missed this rebound, but they would have to learn to live with volatility for the next period.

Pension returns were also subdued in April with the median balanced option returning an estimated 0.7%, the median capital stable option 0.8% and the median growth option 0.7%; bringing one year returns to 8.6%, 7.1% and 9.3% respectively.

The returns highlighted the value of super investment diversification with the average balanced option including about 45% of non-shared assets, which allowed funds to reduce losses or grow balances even when share markets are down.

“Returns are now back to where they were at the start of January, so after four months of ups and downs most members are still looking at a 6% return for the financial year to date,” Rappell said.

“Despite the pause on tariffs, we continue to believe there will be ups and downs over the coming months, however funds have consistently demonstrated their ability to navigate changing markets and provide strong long-term outcomes for members.”