Superannuation funds have provided a third successive year of strong returns after a rally in share prices in the final quarter of the 2025 financial year (FY25), according to new data.

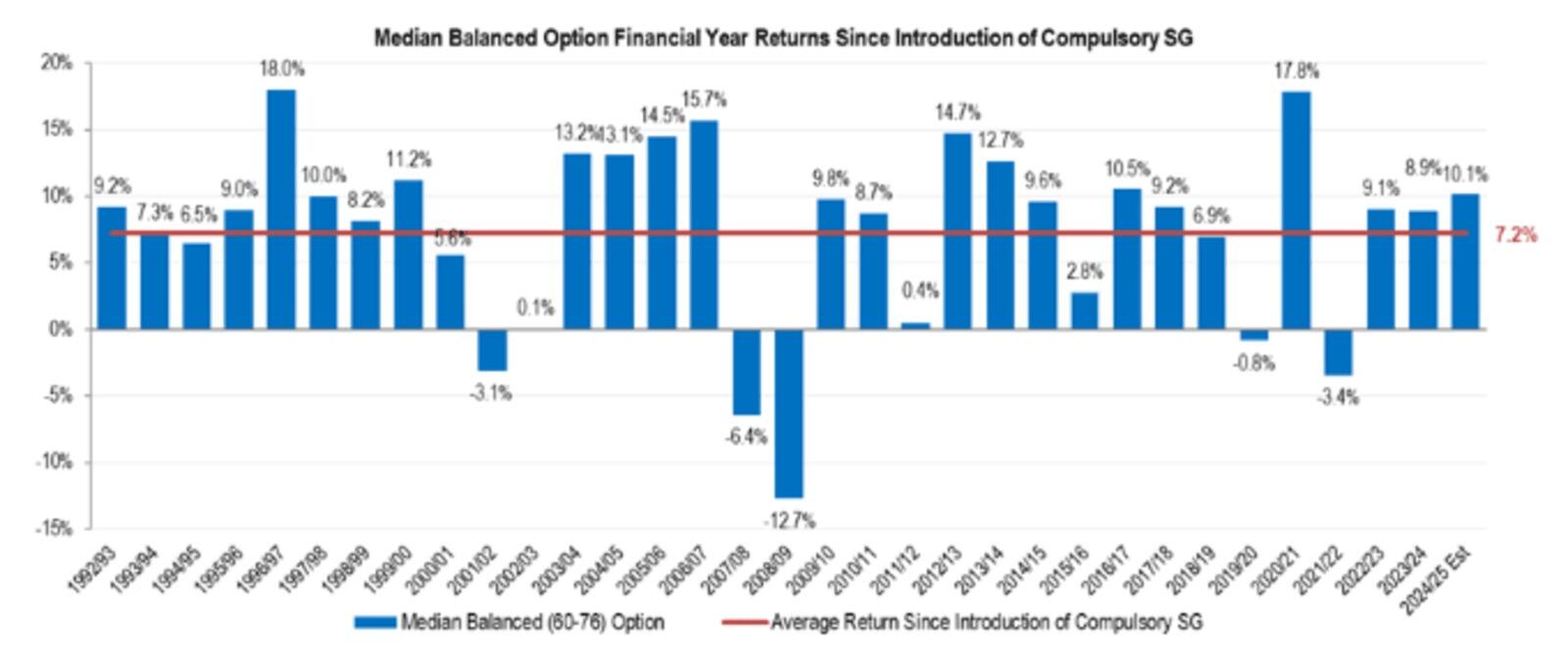

SuperRatings estimated the median balanced option returned 10.1% in the 12 months ending 30 June, compared with 8.8% in FY24 and 8.5% in FY23.

The research firm said the median growth option grew by an estimated 11.3% and the median capital stable option, which has more defensive assets like cash and bonds, rose by 7.3% in the last financial year.

SuperRatings said funds had delivered positive returns in 14 out of the last 16 years since the bottom of the global financial crisis in FY09.

It said the second half of the year had been a rollercoaster for returns which plunged from 8.0% in the seven months to 31 January to 0.8% after the United States ‘Liberation Day’ tariffs announcement in April before rebounding.

“We saw exceptional volatility in returns over the year, particularly following the announcement of US tariffs in early 2025, however the benefit of staying the course was once again proven as a quick rebound has resulted in the third double digit return year over the past decade,” Executive Director Kirby Rappell said.

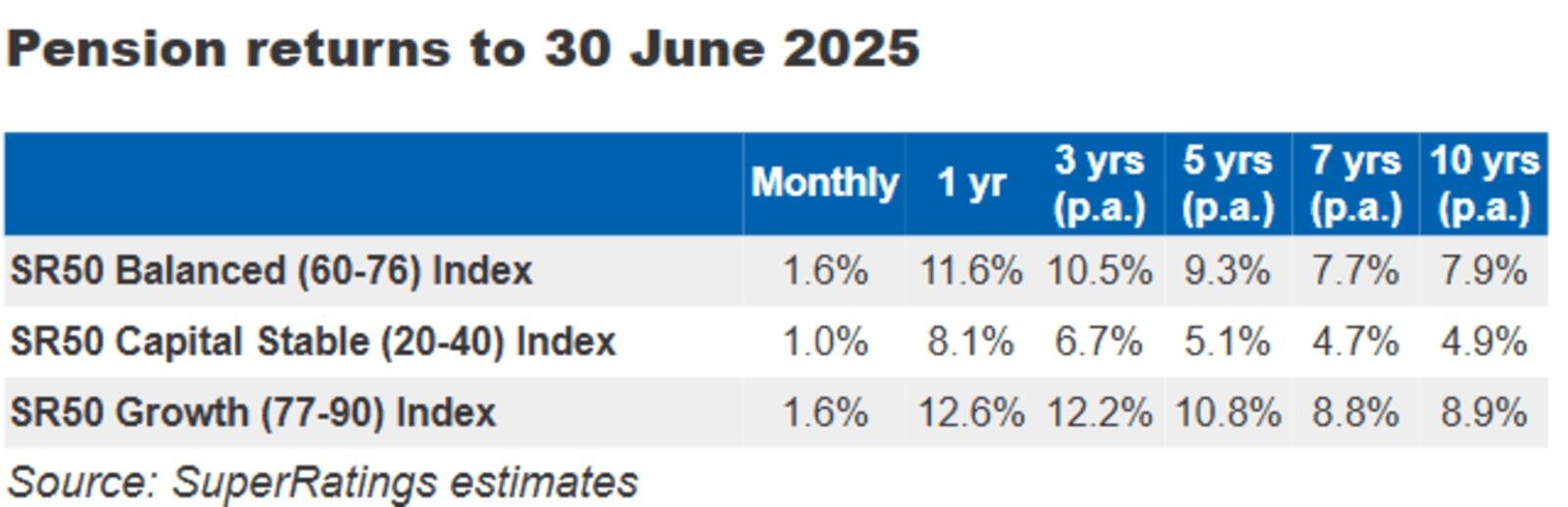

Pension returns were also strong in FY25 with the median balanced option returning an estimated 11.6%, the median growth option 12.6% and the median capital stable option 8.1%.

SuperRatings also said the average annual return since the inception of the superannuation guarantee (SG) in 1992 was 7.2%, with the typical balanced fund exceeding its long-term return objective of 3.0% over the inflation rate.

The firm said shares delivered strong returns for the third consecutive year, shrugging off disruptions like the tariff announcements, Middle East tensions, China’s rising artificial intelligence (AI) capabilities and worries about inflation.

Technology stocks continued to deliver in global markets but returns were less concentrated in the Magnificent Seven stocks than in previous years and were driven by investment in AI and a positive outlook for cryptocurrency.

In Australia the financial sector continued to outperform, driven by bank shares with Commonwealth Bank of Australia (ASX: CBA) in particular driving growth.