Texas Instruments Incorporated (TI) reported its Q4 2024 and full-year 2024 financial results on January 23, 2025.

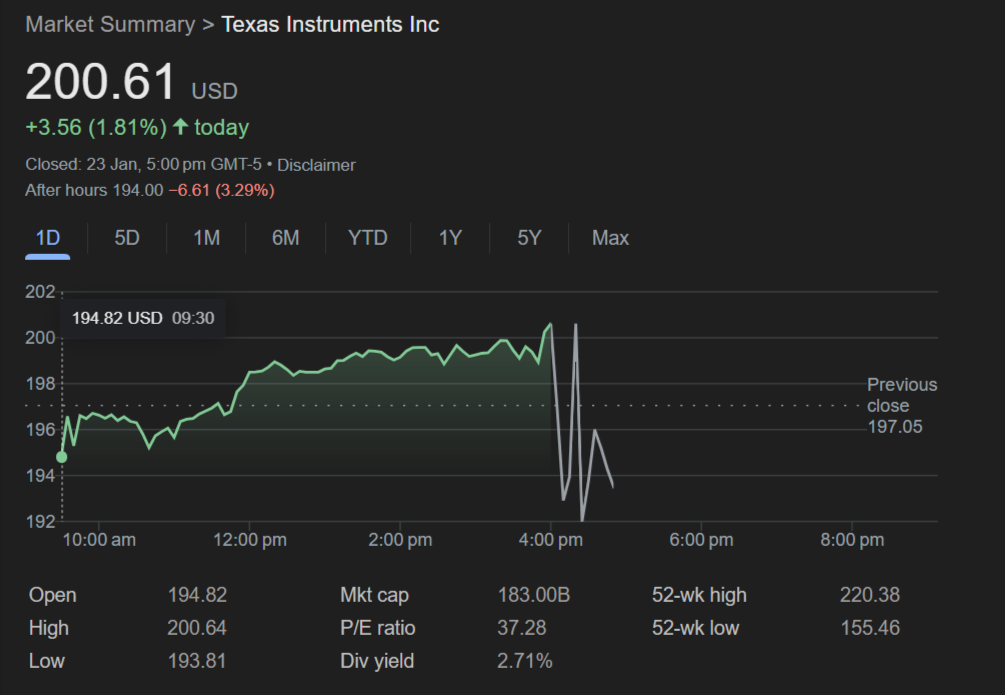

Following the release, shares fell close to 4% in extended trading on Thursday (Friday AEDT).

The company posted Q4 revenue of $4.01 billion (A$6.377 billion), a slight 2% decrease compared to the same quarter last year.

Net income for the quarter was $1.21 billion, with earnings per share (EPS) of $1.30, which included a 2-cent benefit not included in the company's original guidance. Despite these results, TI's performance fell short of analyst expectations, who expected higher revenue and EPS figures.

TI's CEO, Haviv Ilan, highlighted the company's strong cash flow from operations, which reached $6.3 billion in the trailing 12 months.

Ilan said: "Our cash flow... again underscored the strength of our business model, the quality of our product portfolio and the benefit of 300mm production. Free cash flow for the same period was $1.5 billion.

However, the company's revenue decreased 3% sequentially and 2% year-over-year, reflecting ongoing challenges in the semiconductor industry.

"Over the past 12 months we invested $3.8 billion in R&D and SG&A, invested $4.8 billion in capital expenditures and returned $5.7 billion to owners," Ilan said.

"TI's first quarter outlook is for revenue in the range of $3.74 billion to $4.06 billion and earnings per share between $0.94 and $1.16."

Looking ahead, TI remains cautiously optimistic about its economic outlook. The company expects its effective tax rate for 2025 to be around 12%, and it continues to invest heavily in research and development (R&D) and capital expenditures.

Analysts expected stronger performance, leading to mixed reactions from investors.

TI's commitment to innovation and maintaining a robust product portfolio is seen as a positive sign for its long-term growth prospects. However, the company acknowledges the potential impact of global economic uncertainties on its performance.

Key highlights from TI's Q4 2024 and 2024 financial results include:

- Q4 revenue came in at $4.01 billion, a 2% decrease year-over-year.

- Net income of $1.21 billion, with $1.30 EPS.

- Cash flow from operations of $6.3 billion for the trailing 12 months.

- First-quarter 2025 revenue outlook of $3.74 billion to $4.06 billion.

- The effective tax rate for 2025 is expected to be around 12%.

At the time of writing, Texas Instruments Inc's (NASDAQ: TXN) share price was US$200.61, with a market cap of around $183 billion.

Related content