Over recent years, sport tourism has grown to be one of the most profitable and influential sectors within the travel industry.

According to UN Tourism, the sector accounts for around 10% of the total tourism market and is worth more than £500 billion, and is only on the rise.

Sports Tourism has an estimated growth rate of 17.5% between 2023 and 2030, and some projections suggest that it could quadruple by 2033 to £2.25 trillion.

What events are driving this?

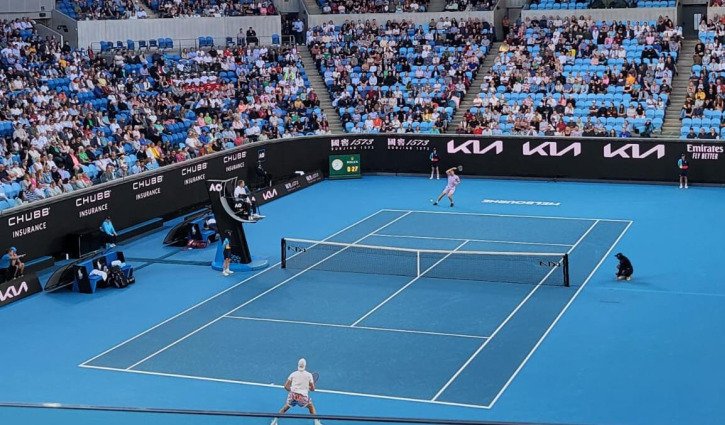

People will travel far and wide for any sport, and Australia alone already had two recent examples: the Australian Open and the Ashes Test.

Over the summer, it is estimated that over 35,000 British visitors made their way to Australia to watch the cricket, injecting what is projected to be hundreds of millions of dollars into the Australian economy over the summer.

In the 2024-25 season alone, UK travellers contributed US$2 billion to the Australian Open.

The Australian Open is also a huge tourism booster for Australia.

While the numbers for the 2026 Australian Open are yet to be released, 19% of the attendees to the 2025 grand slam were from interstate, and 8% were from overseas. The average daily spend per visitor in 2025 also reached A$243.92

As of 2025, the Australian Open has generated more than US$3.46 billion for the Victorian economy over the last 10 years.

According to RMIT professor of finance Angel Zhongs, tennis and cricket are sports that have large economic impacts.

“Cricket events, Formula One races, tennis grand slams, and major motorsport competitions also rank among the most lucrative in terms of visitor spending, driven by strong international audiences and loyal fan communities,” she tells Azzet.

However, the largest sports for tourism include the Olympics and the FIFA World Cup.

Zhong said soccer is particularly popular due to the international scale of the tournaments.

“Football is the single biggest driver of global sports tourism spending, not only because of its vast global fan base but also due to the scale of international tournaments that attract millions of travelling spectators,” she says.

FIFA estimates US$47 billion in economic output for the 2026 World Cup and the creation of 824,000 full-time jobs.

It is also estimated that 3.7 million local and international fans will flock to the tournaments' 11 host cities.

This year’s Milano Cortina Winter Olympic Games are also estimated to bring in €5.3 billion in economic benefits for Italy, according to a study by Italian bank Banca IFIS.

This includes an estimated €1.1 billion in spending from spectators, athletes, and staff at venues, €1.2 billion from future tourism, with visitors potentially choosing to stay longer or return to the country and €3 billion from the value of new and renovated infrastructure.

Events like the Olympics and FIFA can create a long-lasting legacy for the city, spanning up to a decade.

This is in part due to the extra investments that are injected into the cities to host such large-scale events.

“Major events typically lead to upgrades in infrastructure, such as stadiums, transport networks, and entertainment precincts that provide long‑term benefits for both residents and future tourism,” Zhong says.

“Furthermore, hosting high‑profile events elevates a city’s international profile, strengthening its brand, attracting future visitors, and sometimes unlocking new investment opportunities.”

Growth of the sector

SportsLink Travel founder and CEO, Paul Kelly, told Azzet the sports tourism sector has grown around 20% to 30%, with emerging sports, like UFC or Formula 1, having a potential 40% to 50% rise.

COVID had a particular impact on encouraging younger generations to travel for live sports, according to Kelly.

“Generally, it was always people in their 50s, 60s and 70s, people who were semi-retired or retired spending their money,” he says.

“Now you find that all of so many of these sports, it is people in their 20s or 30s that are going because they don’t want to wait until they’re 40 or 50.”

Zhong also says that social media has encouraged more fans to travel for sport.

“Digital media has played a major role too: fans who follow teams online are now far more likely to travel to see them in person,” she says.

A push in experiential travel has also boosted the sports tourism industry, according to Zhong.

“Over the past decade, it has grown from a niche category into a major economic force, driven by rising disposable incomes, increased global mobility, and the growing popularity of both elite sports and participation‑based activities,” she says.

Kelly says the sport also influences the demographic of travelling fans.

“You get people who go to UFC fights, who are generally obviously a much younger demographic, whereas a cricket or a golf fan would generally be older,” he says.

He also says that the rising price of tickets has pushed fans to travel now rather than wait, to the point where the industry is almost becoming a victim of its own success.

“The biggest issue at the moment is that pricing is getting out of control,” he says.

“You look at ticket pricing for the tennis this year, you know, has just jumped incredibly, and Super Bowl tickets in the U.S. have doubled in price.”