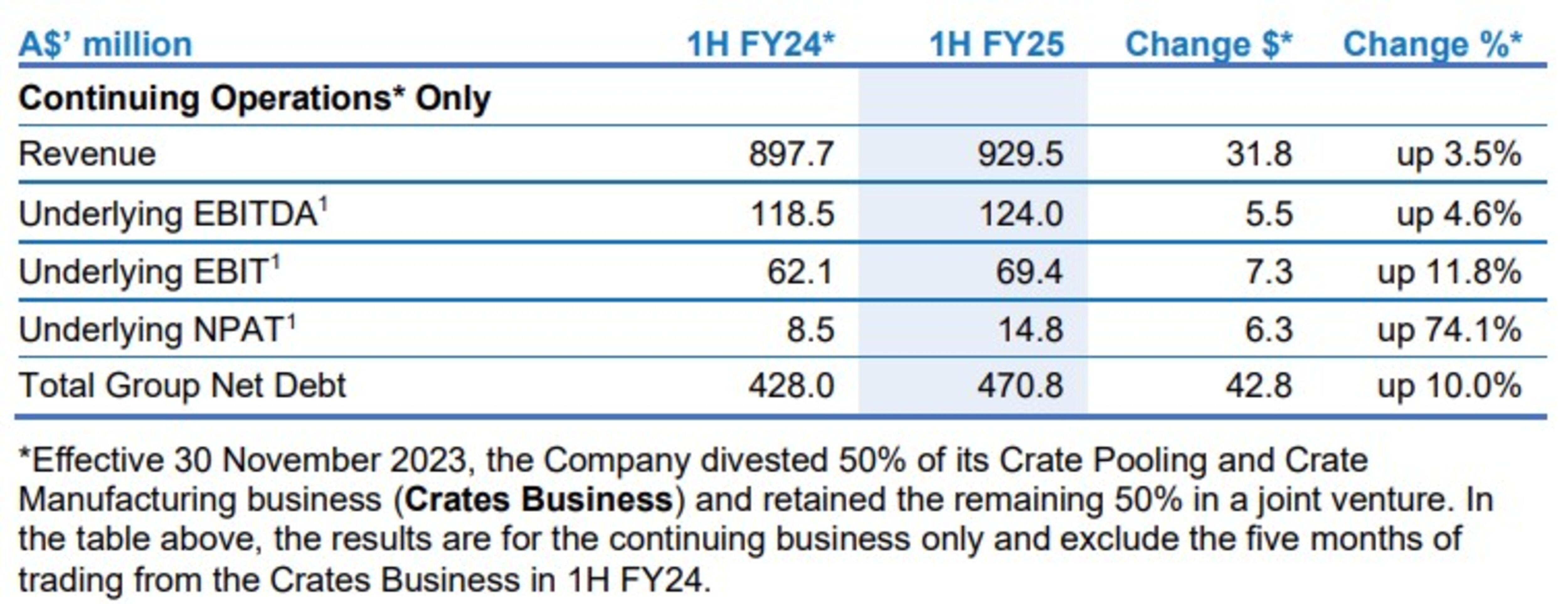

Packing company Pact Group Holdings has responded to an Australian Securities Exchange (ASX) query about a surge in its share price by revealing that half-year (H1) profit would be 74% higher than the previous corresponding period (pcp).

Pact Group said its results - to be issued on 28 February - would show underlying net profit was A$14.8 million in the six months to 31 December, compared with $8.5 million in the pcp.

The company said the results would show underlying earnings before interest, tax, depreciation and amortisation (EBITDA) rose 4.6% to $124 million and underlying EBIT increased 11.8% to $69.4 million on revenue which rose 3.5% to $929.5

million in H1.

Pact was responding to an ASX inquiry, colloquially known as a “speeding ticket”, about the 38% surge in its share price in just three days, from 76 cents on 4 February to a 52-week high of $1.05 today.

The ASX asked Pact Group (PGH) if it knew of any information not announced to the market that could explain recent trading in its securities, and if H1 earnings were likely to differ materially from earnings guidance or are otherwise be likely to surprise the market?

”No, PGH is not aware of any information concerning it or its earnings for the 6 month period ending 31 December 2024 that is likely to come as a surprise to the market,” the company said in ASX announcement.

But Pact said it was scheduled to release its half-year results on 28 February 2025 and, although they were subject to further review and Board approval, it expected the results to reflect the table above.