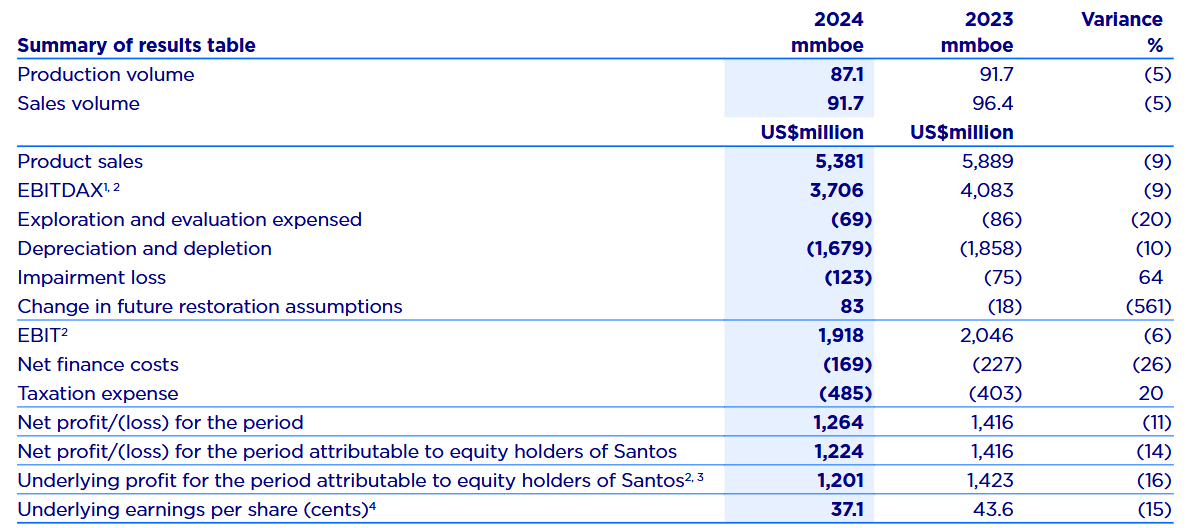

Energy company Santos has delivered a 14% downturn in net profit after tax (NPAT) to US$1.22 billion for the 2024 financial year (FY24).

The company, which produces and sells oil and gas in Australia and the Asia Pacific, said underlying profit fell 16% to $1.20 billion (A$1.89 billion) on revenue which dropped 9% to $5.38 billion as sales volumes fell 5% to 91.7 million barrels of oil equivalent.

Santos said earnings before interest, tax, depreciation, amortisation and exploration expenses (EBITDAX) decreased 9% to $3.706 billion and free cash flow from operations dived 13% to US$1.9 billion compared with FY23.

Directors declared an unfranked final dividend of US 10.3 cents per share to be paid on 26 March to shareholders registered on 26 February, which brings the total cash return to shareholders for 2024 to 23.3 cents per share, down from 26.2 cents in 2023.

Santos said FY25 guidance remained unchanged.

Managing Director and Chief Executive Officer Kevin Gallagher said the company’s strong free cash flow from operations reflected the cash generative nature of the business, which has been the target of ongoing protests by environmentalists.

He said a highlight of the year was the successful start-up of phase one of the Moomba carbon capture and storage (CCS) project in South Australia in September, which had an immediate and ongoing impact on the company’s emissions.

“Importantly, Moomba CCS phase one gives us confidence in the potential to build a commercial carbon management services business as customer demand for CCS grows in Australia and in Asia,” Gallagher said.

By 12.45pm AEDT (1.45am GMT) Santos (ASX:STO) shares were trading at A$6.70, down 19 cents (2.76%) after ranging between $6.66 and $6.90, and valuing the company at $21.81 billion.