Enterprise software stocks have shed roughly US$1 trillion in market capitalisation in a fortnight as the S&P 500 Software Index officially enters a bear market with its relative strength index at 18 - its lowest reading since 1990.

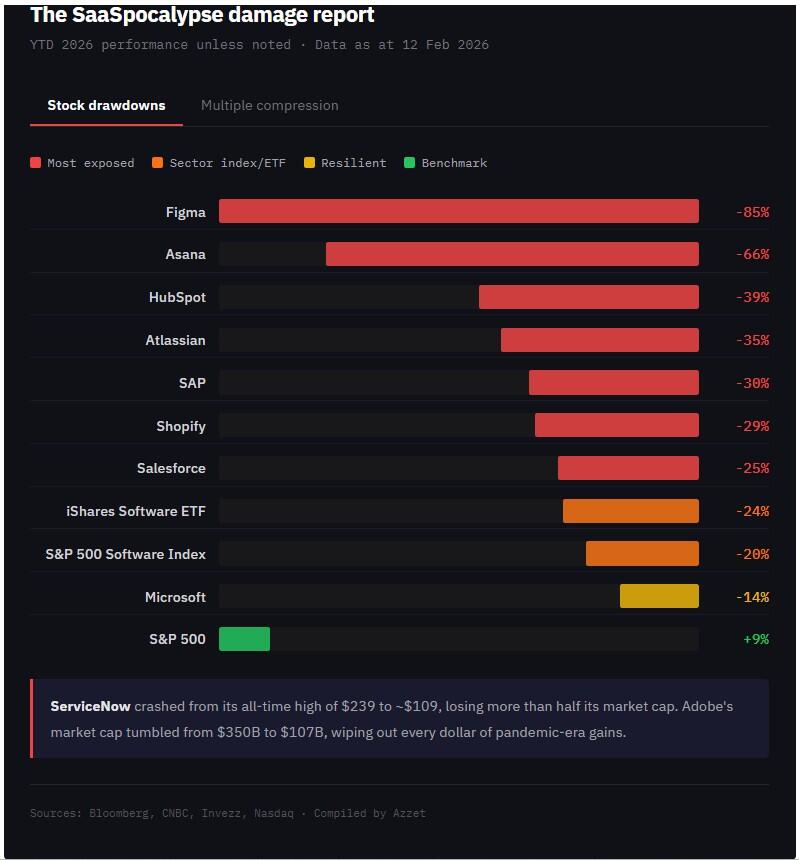

The S&P 500 Software & Services Index is off about 20% year to date, while the broader index is up 9% across the same stretch.

Adobe's market cap has fallen from $350 billion to $107 billion, erasing its pandemic-era gains, and the WisdomTree Cloud Computing Fund is down roughly 20% in 2026.

How we got here

The selloff began on 29 January when SAP's cloud backlog and 2026 revenue outlook fell short of projections, sending the stock down more than 16% and dragging ServiceNow (-11%), Atlassian (-12.6%) and HubSpot (-11.5%) with it.

The S&P 500 Software and Services Index slid 8.7% in that single session to a nine-month low, and Microsoft's earnings the following week added pressure with capex ballooning while cloud growth underwhelmed.

On 31 January, Anthropic released new plugins for its Claude Cowork productivity tool, bolting on legal, finance and product marketing capabilities under an open-source licence targeting contract review, CRM and analytics - workflows that overlap with enterprise software products.

The release triggered a $285 billion rout across software, financial services and asset management stocks in a single session.

"We call it the 'SaaSpocalypse,' an apocalypse for software-as-a-service stocks. Trading is very much 'get me out' style selling," Jefferies equity trader Jeffrey Favuzza said.

Thomson Reuters and LegalZoom each fell more than 15%, RELX and FactSet dropped by double digits, and the selling spread to Asian IT firms, including Tata Consultancy Services and Infosys.

By 5 February, software stocks tracked by an iShares ETF had lost close to $1 trillion in seven days, with hedge funds adding roughly $24 billion in short positions against the sector.

A case for disruption

The bear thesis centres on pricing: if AI agents can handle the workflows that enterprise software automates at lower cost, the per-seat SaaS model faces a structural mismatch.

The concern runs on two tracks: SaaS customers could build their own tools using AI coding platforms, reducing dependence on third-party vendors; or AI agents could bypass the user interface layer, reducing demand for dedicated application software.

Goldman Sachs flagged "existential" risks tied to this pricing mismatch, and KeyBanc singled out seat-based outfits like Monday.com, Asana and Sprout Social as among those at risk - companies lacking an anchor system of record or multi-product platform.

Revenue growth has slowed across the sector, with Adobe's expanding 9.52% in 2025 and tipped to decelerate, while ServiceNow, Salesforce and Atlassian face similar trajectories.

Several have turned to acquisitions - Adobe bought Semrush, ServiceNow bought Moveworks, Salesforce acquired Informatica for $8 billion - without arresting the decline.

No need for panic?

"Is AI a headwind in the near-term for software? YES! However, the magnitude of this software sell-off is a major head scratcher and is factoring in an Armageddon scenario for the sector that is far from reality in our view," Wedbush Securities analyst Dan Ives wrote in a note.

"Enterprises won't completely overhaul tens of billions of dollars of prior software infrastructure investments to migrate over to Anthropic, OpenAI, and others."

JPMorgan called the rout an "overly bearish outlook on AI disruption" and noted short interest sits at record levels - a positioning imbalance that has preceded rebounds in past selloffs.

Goldman Sachs CEO David Solomon told a UBS conference the selloff was "too broad", and J.P. Morgan Private Bank noted that companies deploying AI are posting higher margins, with firms in the S&P 500 AI Usage basket running net margins of 16.4% versus 13% for those without exposure.

Stifel noted in a recent HubSpot channel check that no partner cited near-term headcount reductions or seat disruption tied to AI.

And as Bank of America noted, the selloff relies on two mutually exclusive scenarios: “AI capex deteriorating to the point of weak ROI and unsustainable growth, while simultaneously AI adoption will be so pervasive and productivity-enhancing that long-standing software workflows and business models become obsolete. Both outcomes cannot occur at once.”

YTD 2026 drawdowns (as at 12 Feb):

- Figma - down ~85% from highs after Google's Project Genie fuelled design tool obsolescence concerns

- Asana - down ~66% from peak

- HubSpot - down 39% in 2026 following a 42% decline in 2025

- Atlassian - down 35% YTD

- SAP - down 30% over six months

- Shopify - down 29% YTD

- Salesforce - down ~25% YTD

- ServiceNow - fell from $239 to ~$109, losing more than half its market cap

- iShares Expanded Tech Software ETF - off more than 24%

Forward PE compression:

- Atlassian - from 111X (five-year average) to 23X

- ServiceNow - from 67X to 28X

- Adobe - from 30X to 12X

The common factor across these names: per-seat pricing, narrow product lines and functions that AI agents could replicate.

Who weathers the storm

However, some industries within the sector are buoyant. Cybersecurity has outperformed, and JPMorgan urged investors to buy AI-resilient software companies with cyber at the top of the list - on the basis that AI expands the attack surface rather than shrinking it.

CrowdStrike and Palo Alto Networks are the Wall Street consensus picks, with Ives writing that CrowdStrike remains the "gold standard of cybersecurity" and setting a $600 price target.

Palantir reported 137% year-over-year U.S. commercial revenue growth in Q4 with 57% adjusted operating margins, while Microsoft remains JPMorgan's top pick despite being off 14% and trading at less than 23X estimated earnings.